Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Sew-Textile Ltd. manufactures and distributes textiles. The company is currently unlevered, and has ( beta_{U}=0.80 ), in line with mature companies in the apparel industry.

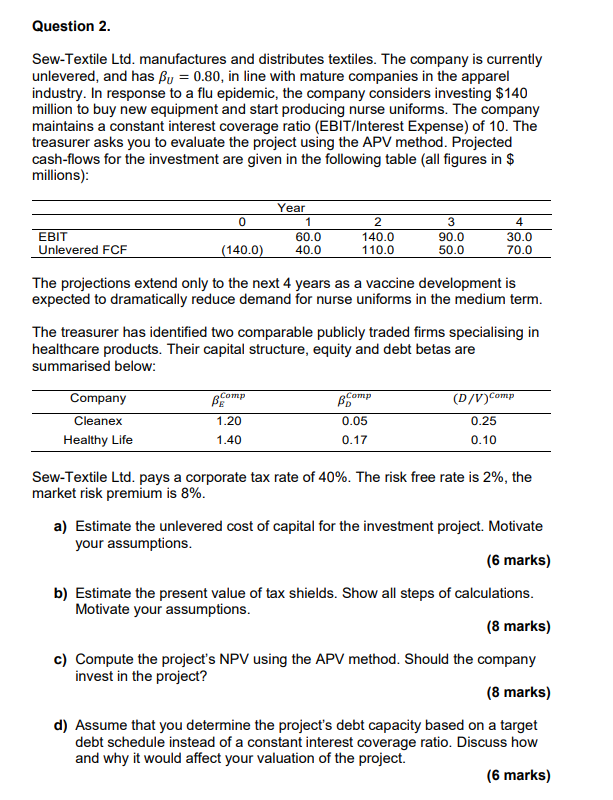

Sew-Textile Ltd. manufactures and distributes textiles. The company is currently unlevered, and has \\( \\beta_{U}=0.80 \\), in line with mature companies in the apparel industry. In response to a flu epidemic, the company considers investing \\( \\$ 140 \\) million to buy new equipment and start producing nurse uniforms. The company maintains a constant interest coverage ratio (EBIT/Interest Expense) of 10 . The treasurer asks you to evaluate the project using the APV method. Projected cash-flows for the investment are given in the following table (all figures in \\( \\$ \\) millions): The projections extend only to the next 4 years as a vaccine development is expected to dramatically reduce demand for nurse uniforms in the medium term. The treasurer has identified two comparable publicly traded firms specialising in healthcare products. Their capital structure, equity and debt betas are summarised below: Sew-Textile Ltd. pays a corporate tax rate of \40. The risk free rate is \2, the market risk premium is \8. a) Estimate the unlevered cost of capital for the investment project. Motivate your assumptions. (6 marks) b) Estimate the present value of tax shields. Show all steps of calculations. Motivate your assumptions. (8 marks) c) Compute the project's NPV using the APV method. Should the company invest in the project? (8 marks) d) Assume that you determine the project's debt capacity based on a target debt schedule instead of a constant interest coverage ratio. Discuss how and why it would affect your valuation of the project. (6 marks)

Sew-Textile Ltd. manufactures and distributes textiles. The company is currently unlevered, and has \\( \\beta_{U}=0.80 \\), in line with mature companies in the apparel industry. In response to a flu epidemic, the company considers investing \\( \\$ 140 \\) million to buy new equipment and start producing nurse uniforms. The company maintains a constant interest coverage ratio (EBIT/Interest Expense) of 10 . The treasurer asks you to evaluate the project using the APV method. Projected cash-flows for the investment are given in the following table (all figures in \\( \\$ \\) millions): The projections extend only to the next 4 years as a vaccine development is expected to dramatically reduce demand for nurse uniforms in the medium term. The treasurer has identified two comparable publicly traded firms specialising in healthcare products. Their capital structure, equity and debt betas are summarised below: Sew-Textile Ltd. pays a corporate tax rate of \40. The risk free rate is \2, the market risk premium is \8. a) Estimate the unlevered cost of capital for the investment project. Motivate your assumptions. (6 marks) b) Estimate the present value of tax shields. Show all steps of calculations. Motivate your assumptions. (8 marks) c) Compute the project's NPV using the APV method. Should the company invest in the project? (8 marks) d) Assume that you determine the project's debt capacity based on a target debt schedule instead of a constant interest coverage ratio. Discuss how and why it would affect your valuation of the project. (6 marks) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started