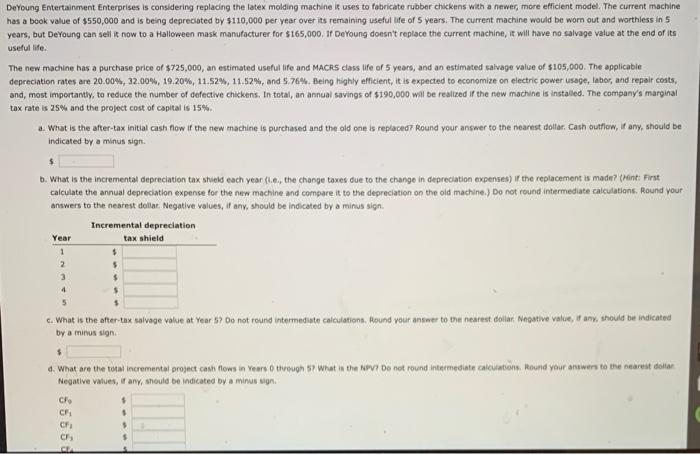

Seyoung Entertainment Enterprises is considering replacing the latex molding machine is uses to fabricate rubber chickens with a newer, more efficient model. The current machine nas a book value of $550,000 and is being depreciated by $110,000 per year over its remaining useful life of 5 years. The current machine would be worn out and worthless in 5 years, but DeYoung can seili is now to a Halloween mask manufacturer for $165,000. If DeYoung doesn't replace the current machine, it will have no salvage value at the end of its useful life. The new machine has a purchase price of $725,000, an estimated useful life and MACRS class life of 5 years, and an estimated salvage value of $105,000. The applicabie depreciation rates are 20.00%,32.00%,19.20%,11.52%,11.52%, and 5.76%. Being highly efficient, it is expected to economize on electric power usege, labor, and repair costs, and, most importantly, to reduce the number of defective chickens. In total, an annual savings of $190,000 will be realized if the new machine is instalied. The company's marginal tax rate is 25% and the project cost of capital is 15% a. What is the after-tax initial cast flow if the new machine is purchased and the old one is replaced Round your answer to the nearest dollar, Cash outflow, if any, should be indicated by a minus sign. 5 b. What is the incremental depreciation tax shield each year (l.e., the change taxes due to the change in depreciation expenses) if the repiacement is made? (hint: First calculate the annual depreciation expense for the new machine and compare it to the depreciation on the oid machine.) Do not round intermediate calculatians. Round your answers to the nearest deiliar. Negative values, if any, should be indicated by a minus sign. c. What is the after-tax salvage value at Year 5 ? Do not round intermed ste calculstions, found your ansaer to the nearest dollar. Negative value, if any, should be indicated by a mimus sign. 4 4. What are the total incremental project cash flews in veers 0 throvgh 5) What is the Nov? Do not round intermediate calcuations. Round your answers to the nearest dollar Negative values, if any, should be indicated by a minus sign