Answered step by step

Verified Expert Solution

Question

1 Approved Answer

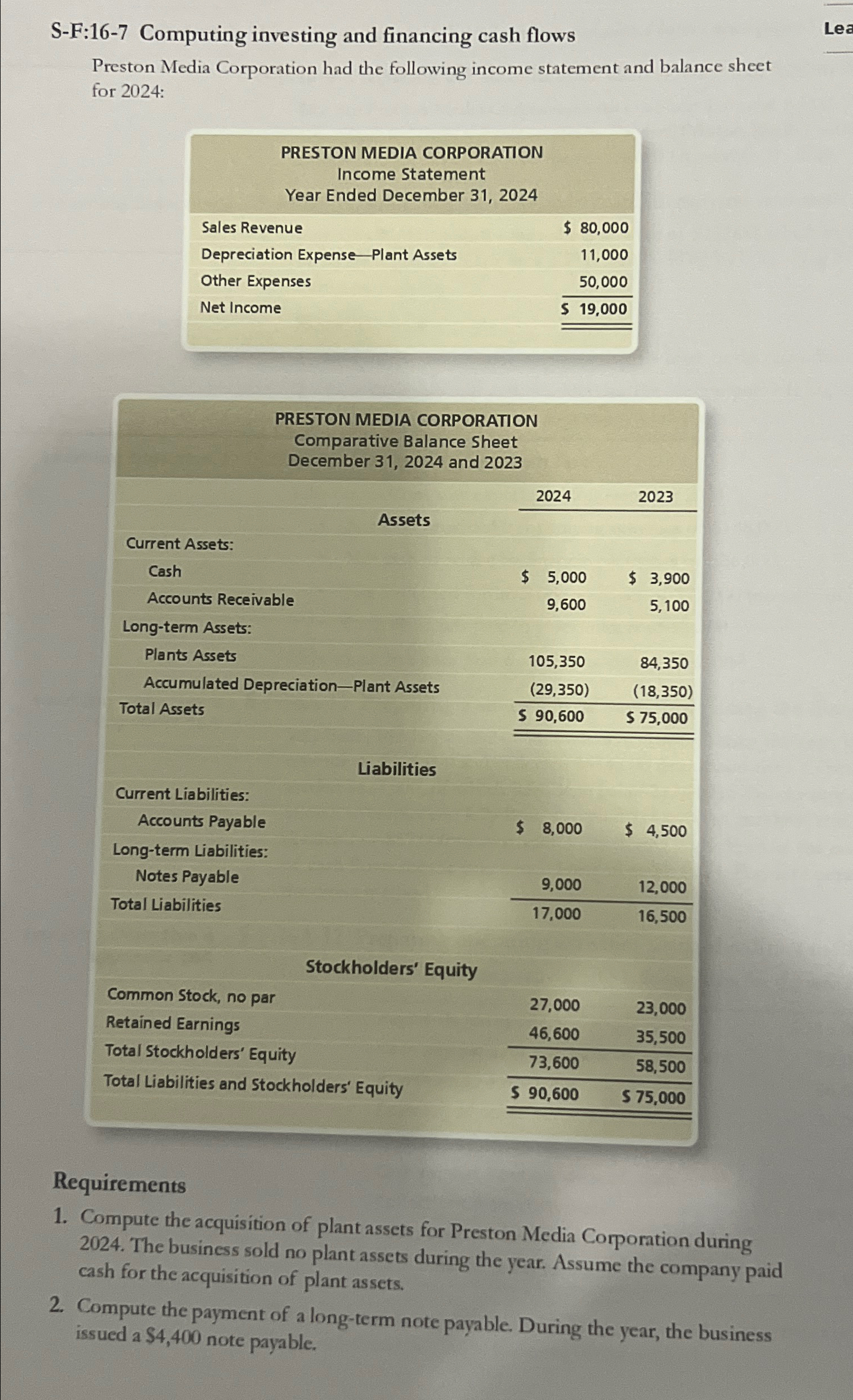

S-F:16-7 Computing investing and financing cash flows Preston Media Corporation had the following income statement and balance sheet for 2024: Lea PRESTON MEDIA CORPORATION

S-F:16-7 Computing investing and financing cash flows Preston Media Corporation had the following income statement and balance sheet for 2024: Lea PRESTON MEDIA CORPORATION Income Statement Year Ended December 31, 2024 Sales Revenue $ 80,000 Depreciation Expense Plant Assets 11,000 Other Expenses 50,000 Net Income $ 19,000 PRESTON MEDIA CORPORATION Comparative Balance Sheet December 31, 2024 and 2023 Current Assets: Cash Accounts Receivable Assets Long-term Assets: Plants Assets Accumulated Depreciation-Plant Assets Total Assets Current Liabilities: Accounts Payable Long-term Liabilities: Notes Payable Total Liabilities Liabilities 2024 2023 $ 5,000 $ 3,900 9,600 5,100 105,350 (29,350) 84,350 (18,350) $ 90,600 $ 75,000 $ 8,000 $ 4,500 9,000 12,000 17,000 16,500 Stockholders' Equity Common Stock, no par 27,000 23,000 Retained Earnings 46,600 35,500 Total Stockholders' Equity 73,600 58,500 Total Liabilities and Stockholders' Equity $ 90,600 $ 75,000 Requirements 1. Compute the acquisition of plant assets for Preston Media Corporation during 2024. The business sold no plant assets during the year. Assume the company paid cash for the acquisition of plant assets. 2. Compute the payment of a long-term note payable. During the year, the business issued a $4,400 note payable.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started