Question

SFM, Corp. is considering replacing a key component of its production technology. The new technology is expected to be employed for 12 years and has

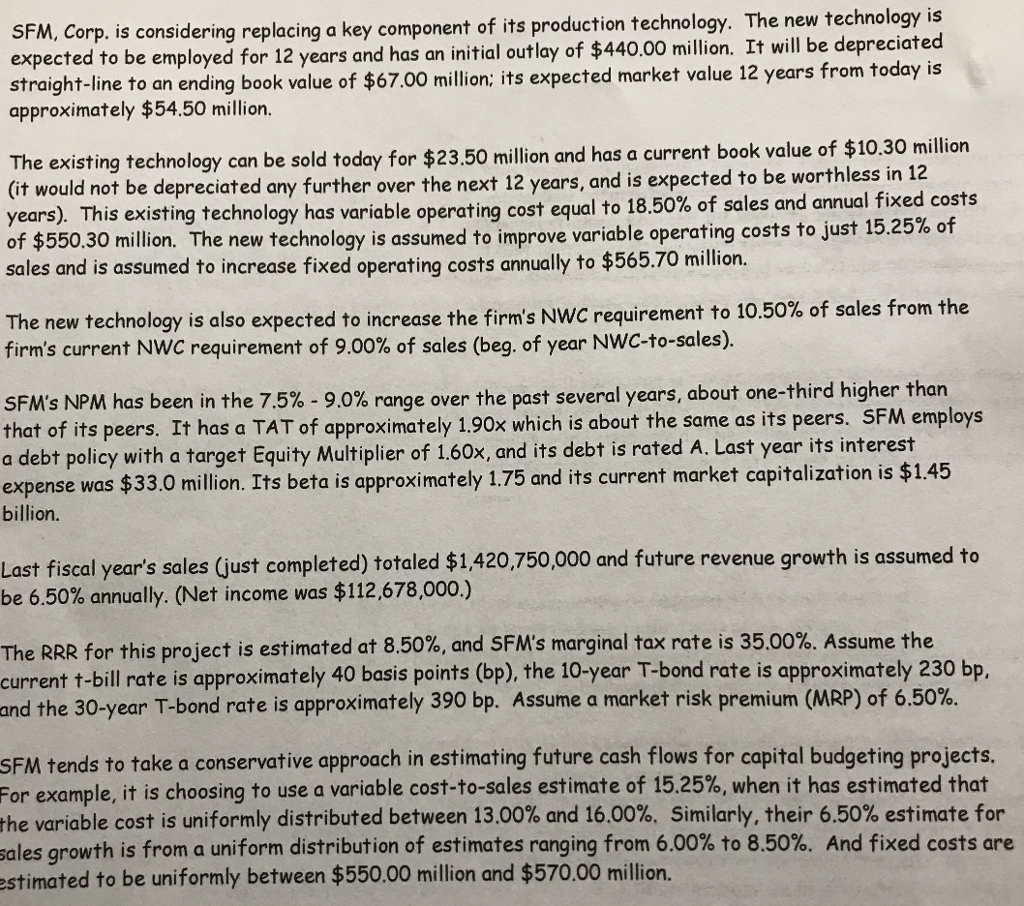

SFM, Corp. is considering replacing a key component of its production technology. The new technology is expected to be employed for 12 years and has an initial outlay of $440.00 million. It will be depreciated straight-line to an ending book value of $67.00 million: its expected market value 12 years from today is approximately $54.50 million.

The existing technology can be sold today for $23.50 million and has a current book value of $10.30 million (it would not be depreciated any further over the next 12 years, and is expected to be worthless in 1 years). This existing technology has variable operating cost equal to 18.50% of sales and annual fixed costs of $550.30 million. The new technology is assumed to improve variable operating costs to just 15.25% of sales and is assumed to increase fixed operating costs annually to $565.70 million. The new technology is also expected to increase the firm's NWC requirement to 10.50% of sales from the firm's current NWC requirement of 9.00% of sales (beg. of year NWC-to-sales) SFM's NPM has been in the 7.50%-9.00% range over the past several years, about one-third higher than that of its peers. It has a TAT of approximately 1.90x which is about the same as its peers. SFM employs a debt policy with a target Equity Multiplier of 1.60x, and its debt is rated A. Last year its interest expense was $33.0 million. Its beta is approximately 1.75 and its current market capitalization is $1.45 billion.

Last fiscal year's sales (just completed) totaled $1,420,750,000 and future revenue growth is assumed to be 6.50% annually. (Net income was $112,678,000.) The RRR for this project is estimated at 8.50%, and SFM's marginal tax rate is 35.00%. Assume the current t-bill rate is approximately 40 basis points (bp), the 10-year T-bond rate is approximately 230 bp, and the 30-year T-bond rate is approximately 390 bp. Assume a market risk premium (MRP) of 6.50%.

SFM tends to take a conservative approach in estimating future cash flows for capital budgeting projects. For example, it is choosing to use a variable cost-to-sales estimate of 15.25%, when it has estimated that the variable cost is uniformly distributed between 13.00% and 16.00%. Similarly, their 6.50% estimate for sales growth is from a uniform distribution of estimates ranging from 6.00% to 8.50%. And fixed costs are estimated to be uniformly between $550.00 million and $570.00 million

SFM, Corp. is considering replacing a key component of its production technology. The new technology is expected to straight-line to an ending book value of $67.00 million: its expected market value 12 years from today is approximately $54.50 million be employed for 12 years and has an initial outlay of $440.00 million. It will be depreciated The existing technology can be sold today for $23.50 million and has a current book value of $10.30 million (it would not be depreciated any further over the next 12 years, and is expected to be worthless in 1 years). This existing technology has variable oper of $550.30 million. The new technology is assumed to improve variable operating costs to just 15.25% of sales and is assumed to increase fixed operating costs annually to $565.70 million ating cost equal to 18.50% of sales and annual fixed costs 0.50% of sales from the The new technology is also expected to increase the firm's NWC requirement to 1 firm's current NWC requirement of 9.00% of sales (beg. of year NWC-to-sales) SFM's NPM has been in the 75%-90% range over the past several years, about one-third higher than that of its peers. It has a TAT of approximately 1.90x which is about the same as its peers. SFM employs a debt policy with a target Equity Multiplier of 1.60x, and its debt is rated A. Last year its interest expense was $33.0 million. Its beta is approximately 1.75 and its current market capitalization is billion Last fiscal year's sales (just completed) totaled $1,420,750,000 and future revenue growth is assumed to be 6.50% annually. (Net income was $112,678,000.) The RRR for this project is estimated at 8.50%, and SFM's marginal tax rate is 35.00%. Assume the current t-bill rate is approximately 40 basis points (bp), the 10-year T-bond rate is approximately 230 bp, and the 30-year T-bond rate is approximately 390 bp. Assume a market risk premium (MRP) of 6.50% SFM tends to take a conservative approach in estimating future cash flows for capital budgeting projects For example, it is choosing to use a variable cost-to-sales estimate of 15.25%, when it has estimated that the variable cost is uniformly distributed between 13.00% and 16.00%. Similarly, their 6.50% estimate for sales growth is from a uniform distribution of estimates ranging from 6.00% to 8.50%. And fixed costs are estimated to be uniformly between $550.00 million and $570.00 millionStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started