Answered step by step

Verified Expert Solution

Question

1 Approved Answer

SFS Corporation is considering opening fast food outlets in major metropolitan areas. The target leverage ratio (D/V) for this enterprise is 0.23. SFS has

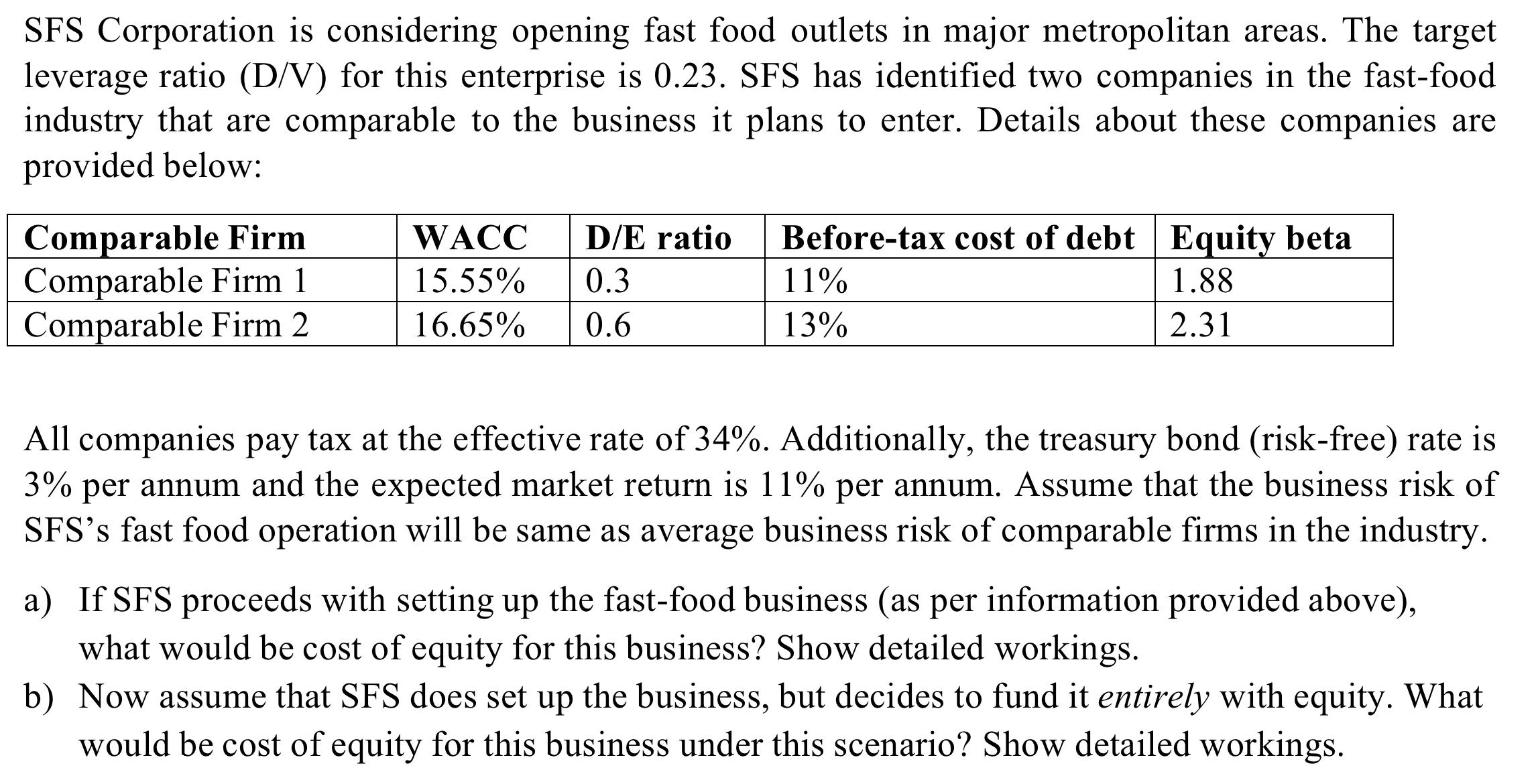

SFS Corporation is considering opening fast food outlets in major metropolitan areas. The target leverage ratio (D/V) for this enterprise is 0.23. SFS has identified two companies in the fast-food industry that are comparable to the business it plans to enter. Details about these companies are provided below: Comparable Firm WACC D/E ratio Before-tax cost of debt Equity beta Comparable Firm 1 Comparable Firm 2 15.55% 16.65% 0.3 0.6 11% 13% 1.88 2.31 All companies pay tax at the effective rate of 34%. Additionally, the treasury bond (risk-free) rate is 3% per annum and the expected market return is 11% per annum. Assume that the business risk of SFS's fast food operation will be same as average business risk of comparable firms in the industry. a) If SFS proceeds with setting up the fast-food business (as per information provided above), what would be cost of equity for this business? Show detailed workings. b) Now assume that SFS does set up the business, but decides to fund it entirely with equity. What would be cost of equity for this business under this scenario? Show detailed workings.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started