Question

Shaan Company will either payout $4,000 extra dividend or do a $4,000 share repurchase. Its current EPS are $.90 and its stock is currently

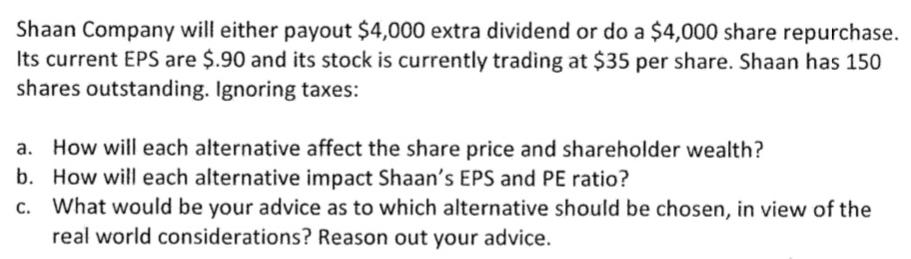

Shaan Company will either payout $4,000 extra dividend or do a $4,000 share repurchase. Its current EPS are $.90 and its stock is currently trading at $35 per share. Shaan has 150 shares outstanding. Ignoring taxes: a. How will each alternative affect the share price and shareholder wealth? b. How will each alternative impact Shaan's EPS and PE ratio? c. What would be your advice as to which alternative should be chosen, in view of the real world considerations? Reason out your advice.

Step by Step Solution

3.33 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

a Evaluation of Alternative Dividend Payment Dividend per share 4000 150 2667 Price per share before ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Corporate Finance

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe

10th edition

978-0077511388, 78034779, 9780077511340, 77511387, 9780078034770, 77511344, 978-0077861759

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App