Answered step by step

Verified Expert Solution

Question

1 Approved Answer

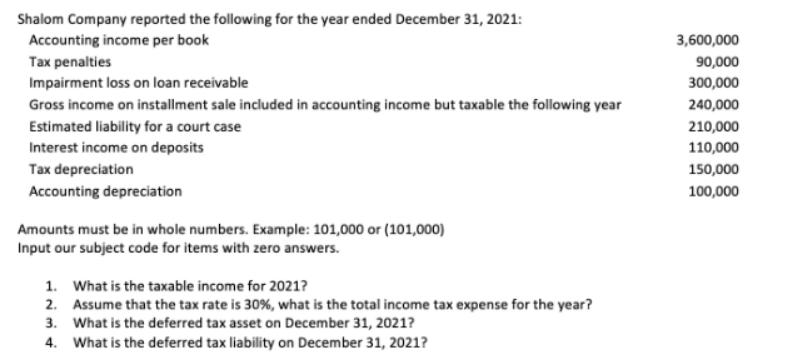

Shalom Company reported the following for the year ended December 31, 2021: Accounting income per book Tax penalties Impairment loss on loan receivable Gross

Shalom Company reported the following for the year ended December 31, 2021: Accounting income per book Tax penalties Impairment loss on loan receivable Gross income on installment sale included in accounting income but taxable the following year Estimated liability for a court case Interest income on deposits Tax depreciation Accounting depreciation Amounts must be in whole numbers. Example: 101,000 or (101,000) Input our subject code for items with zero answers. 1. What is the taxable income for 2021? 2. Assume that the tax rate is 30%, what is the total income tax expense for the year? 3. What is the deferred tax asset on December 31, 2021? 4. What is the deferred tax liability on December 31, 2021? 3,600,000 90,000 300,000 240,000 210,000 110,000 150,000 100,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 Taxable income for 2021 is 3450000 2 Income tax expense for the year is 1035000 3450000 x 30 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started