Answered step by step

Verified Expert Solution

Question

1 Approved Answer

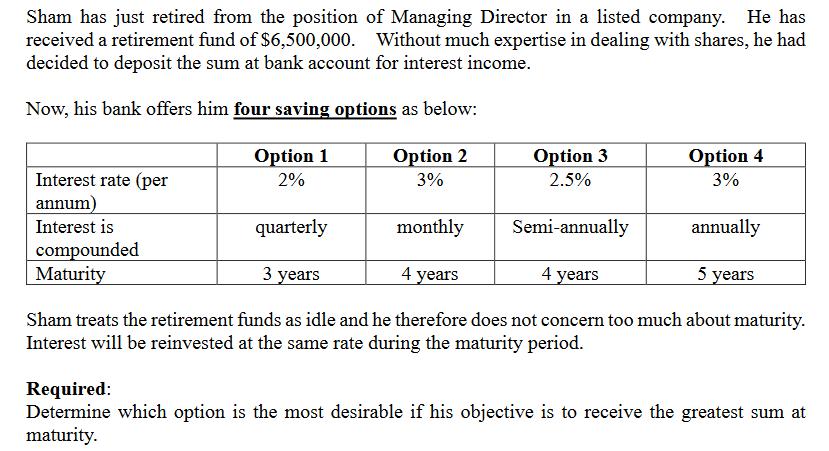

Sham has just retired from the position of Managing Director in a listed company. He has received a retirement fund of $6,500,000. Without much

Sham has just retired from the position of Managing Director in a listed company. He has received a retirement fund of $6,500,000. Without much expertise in dealing with shares, he had decided to deposit the sum at bank account for interest income. Now, his bank offers him four saving options as below: Interest rate (per Option 1 2% annum) Interest is quarterly compounded Maturity 3 years Option 2 3% Option 3 2.5% Option 4 3% monthly Semi-annually annually 4 years 4 years 5 years Sham treats the retirement funds as idle and he therefore does not concern too much about maturity. Interest will be reinvested at the same rate during the maturity period. Required: Determine which option is the most desirable if his objective is to receive the greatest sum at maturity.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started