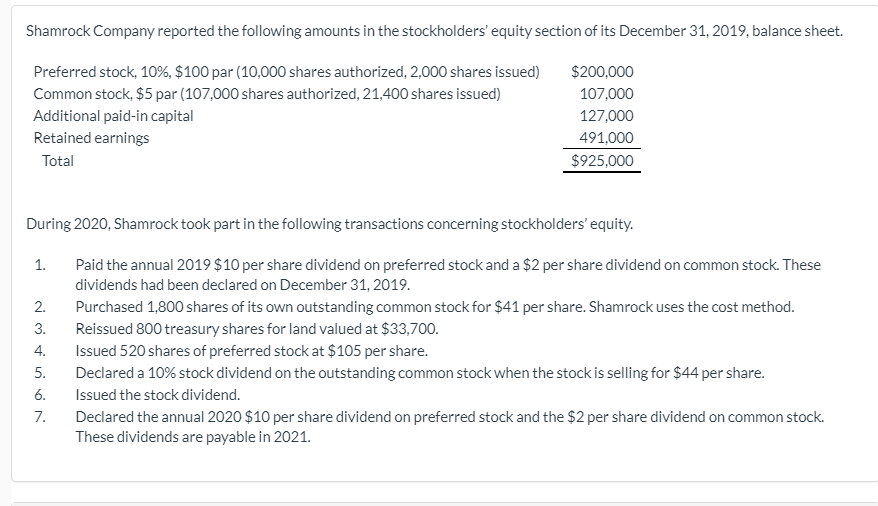

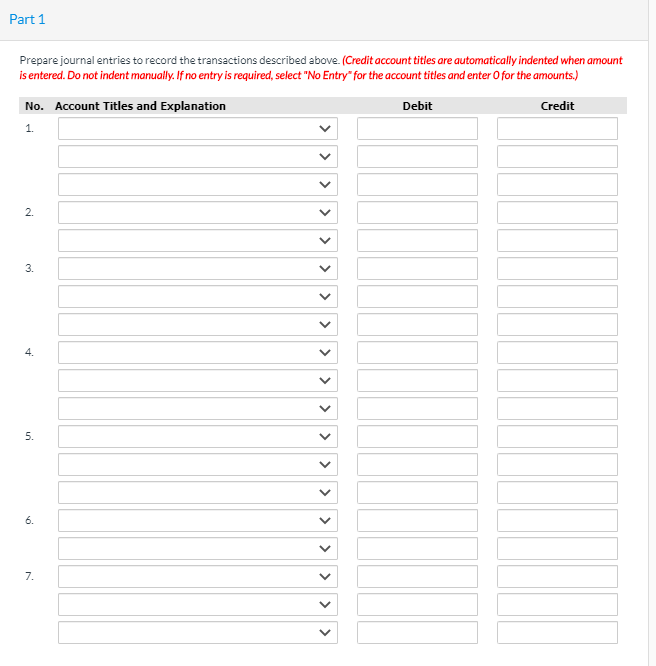

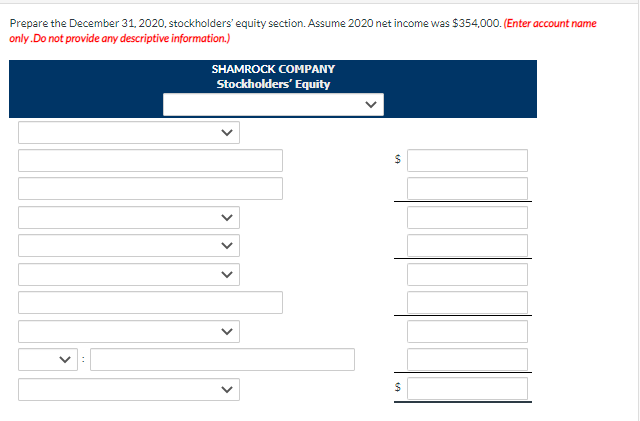

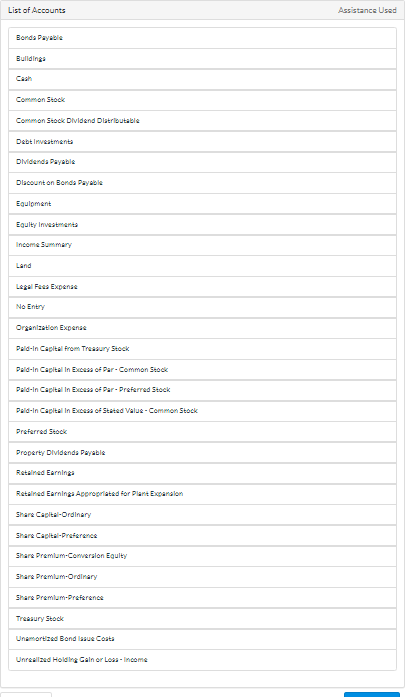

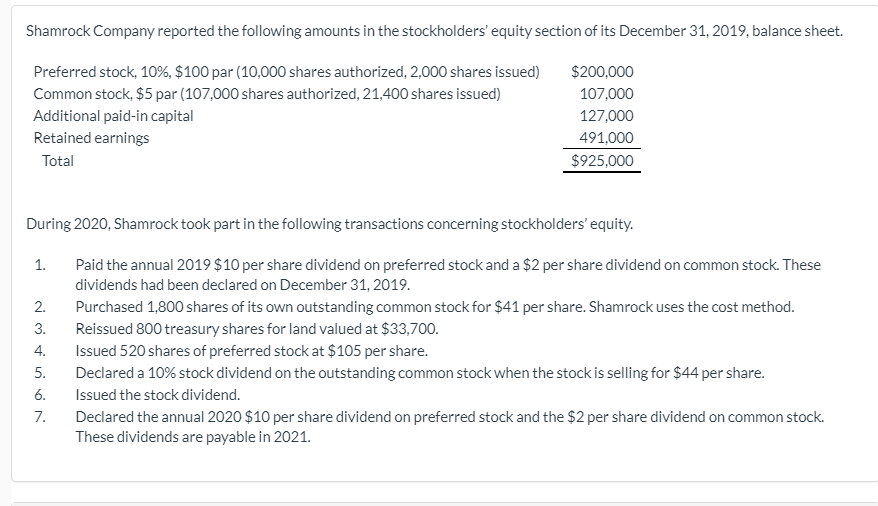

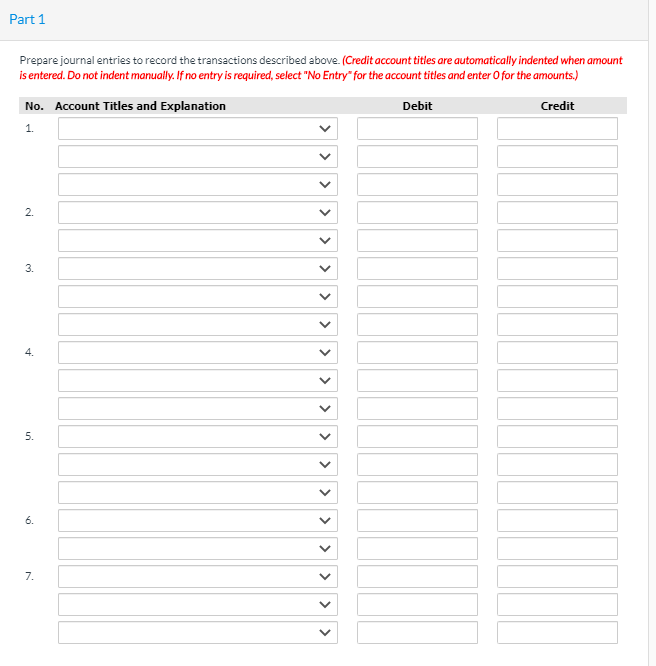

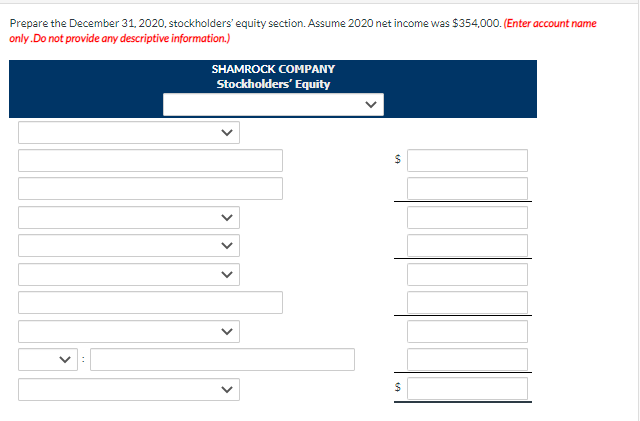

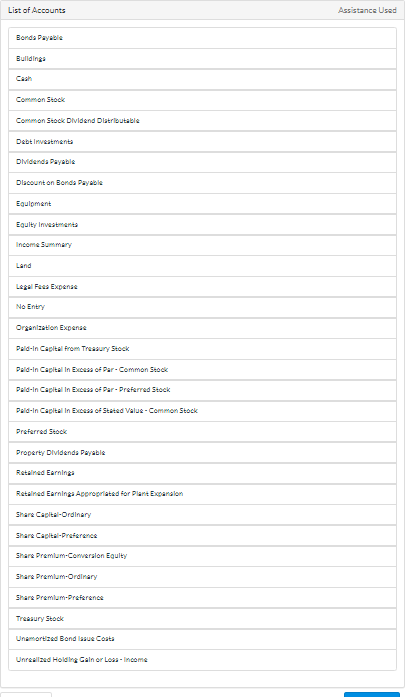

Shamrock Company reported the following amounts in the stockholders' equity section of its December 31, 2019, balance sheet. Preferred stock, 10%, $100 par (10,000 shares authorized, 2,000 shares issued) $200,000 Common stock, $5 par (107,000 shares authorized, 21,400 shares issued) 107,000 Additional paid-in capital 127,000 Retained earnings 491,000 Total $925,000 During 2020, Shamrock took part in the following transactions concerning stockholders' equity. 1. 2. 3. 4. 5. 6. 7. Paid the annual 2019 $10 per share dividend on preferred stock and a $2 per share dividend on common stock. These dividends had been declared on December 31, 2019. Purchased 1,800 shares of its own outstanding common stock for $41 per share. Shamrock uses the cost method. Reissued 800 treasury shares for land valued at $33,700. Issued 520 shares of preferred stock at $105 per share. Declared a 10% stock dividend on the outstanding common stock when the stock is selling for $44 per share. Issued the stock dividend. Declared the annual 2020 $10 per share dividend on preferred stock and the $2 per share dividend on common stock. These dividends are payable in 2021. Part 1 Prepare journal entries to record the transactions described above. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter for the amounts.) Debit Credit No. Account Titles and Explanation 1. 2. > 3. > 4. 5. > 6. 7. $ List of Accounts Assistance Used Bonda Payable Building Common Stock Common Stock Dividend Dlatributable Debt Investment Dividenda Payable Dlacount on Bonda Payable Equipment Equity Investments Income Summary Land Legal Fees Expense No Entry Organization Expense Peld-in Capital From Treasury Stock Peld-in Capital Incasso Par-Common Stock Peld-in Capital In Excess of Par. Preferred Stock Peld-in Capital In Excess of Stated Value-Common Stock Preferred Stock Property Dividenda Puyable Retired Earnings Retained Earnings Appropriate for Plant Expansion Share Capital-Ordinary Share Capital-Preference Share Premium Cowwersion Equity Share Premium Ordinary Share Premium-Preference Treasury Stock Un mortized Bond lase Coata Unrealized Holding Cain or Leas-Income