Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Shamrock Inc. manufactures an X ray machine with an estimated life 12 years and leases it to Chambers Medical Center for a period of 10

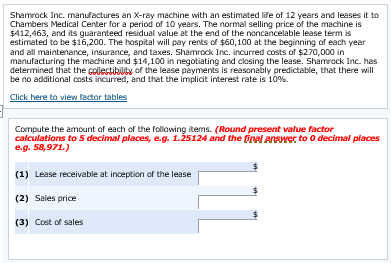

Shamrock Inc. manufactures an X ray machine with an estimated life 12 years and leases it to Chambers Medical Center for a period of 10 years. The normal selling price of the machine is $412,463, and its guaranteed residual val ue at the end of the noncancelable lease term is estimated to be $16,200. The hospital wi pay rents of $60,100 at the beginning of each year and all maintenance, insurance, and taxes. Shamrock Inc. incurred costs of $270,000 in manufacturing the machine and $14,100 in negotiating and closing the lease. Shamrock Inc. has determined that the of the lease payments is reasonably p redictable, that there wi be no additional costs incurred, and that the implicit interest rate is 10%. Click here to view factor tables Compute the amount of each of the following items. (Round present value factor calculations to 5 decimal places, e 9. 1.25124 and the firAIARAWgt to decimal places e.g. 58,971.) (1) Lease receivable at inception of the lease (2) sales price (3) Cost of sales

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started