Shamy Limited (SL), a large conglomerate firm, has a capital structure that currently consists of 20 percent long-term debt, 10 percent preferred stock, and 70 percent common equity. SL has determined that it will raise funds in the future using 40 percent long-term debt, 10 percent preferred stock, and 50 percent common equity. SL can raise up to $50 million in the long-term debt market at a pretax cost of 15 percent. Beyond $50 million, the pretax cost of long-term debt is expected to increase to 17 percent. Preferred stock can be raised at a cost of 15 percent. The limited demand for this security permits SL to sell only $25 million of preferred stock. SLs marginal tax rate is 40 percent. SLs stock currently sells for $21 per share and has a beta of 1.4. SL pays no dividends and is not expected to pay any dividends for the foreseeable future. Investment advisory services expect the stock price to increase from its current level of $21 per share to a level of $52.25 per share at the end of 5 years. New shares can be sold to net the company $20.15. SL expects earnings after taxes and available for common stockholders to be $60 million. Compute the marginal cost of capital schedule for SL, and determine the break points in the schedule. Use Table II to answer the questions. Round your answers for break points to the nearest dollar. Round your answers for weighted marginal cost of capital to two decimal places. Enter your answer in whole dollar. For example, an answer of $1.20 million should be entered as 1,200,000, not 1.20.

| Break point | Weighted marginal cost of capital |

| $ | % |

| $ | % |

| $ | % |

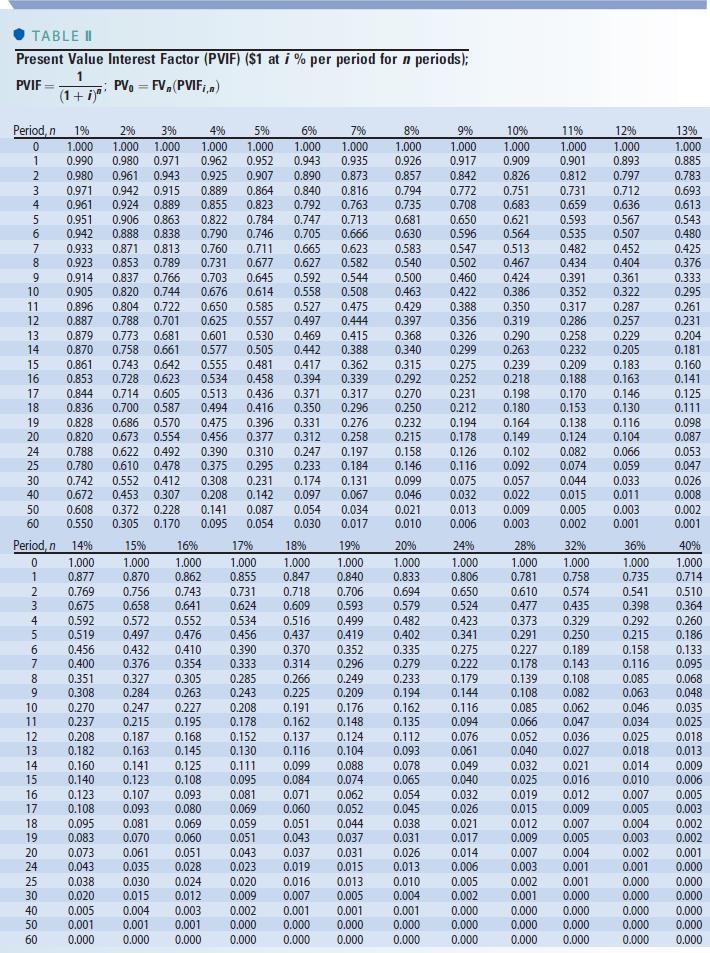

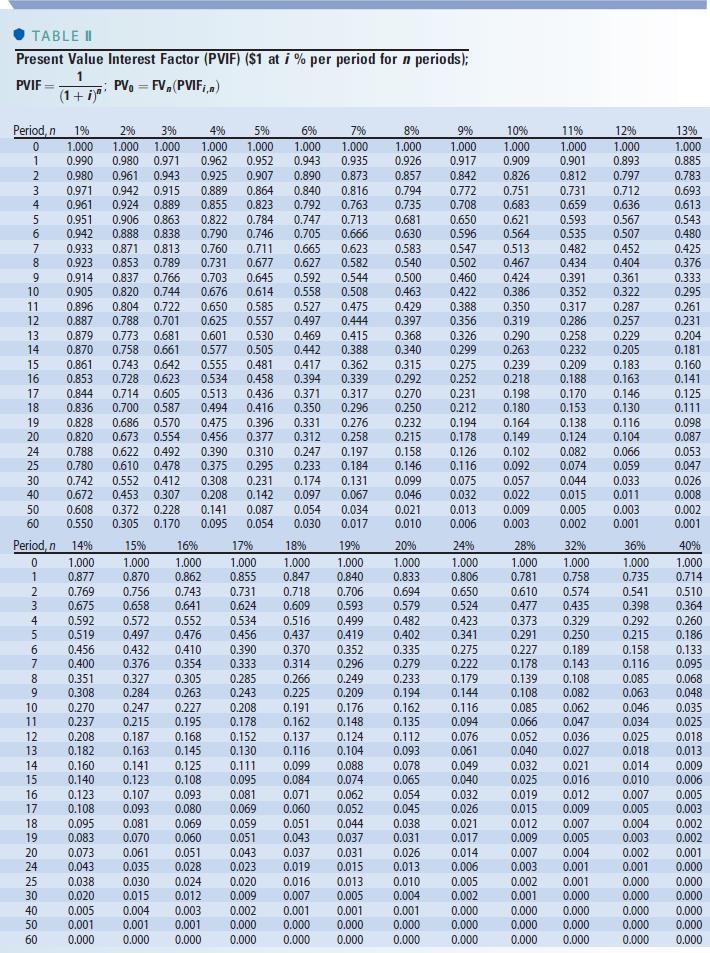

TABLE Present Value Interest Factor (PVIF) ($1 at i % per period for n periods); PVIF : PV= FV,(PVIF;,n) (1 + i)" 7% 1.000 0.935 0.873 0.816 0.763 0.713 0.666 0.623 0.582 0.544 0.508 0.475 0.444 0.415 0.388 0.362 0.339 0.317 0.296 0.276 0.258 0.197 0.184 0.131 0.067 0.034 0.017 13% 1.000 0.885 0.783 0.693 0.613 0.543 0.480 0.425 0.376 0.333 0.295 0.261 0.231 0.204 0.181 0.160 0.141 0.125 0.111 0.098 0.087 0.053 0.047 0.026 0.008 0.002 0.001 Period, 1% 2% 3% 4% 5% 6% 0 1.000 1.000 1.000 1.000 1.000 1.000 1 0.990 0.980 0.971 0.962 0.952 0.943 2 0.980 0.961 0.943 0.925 0.907 0.890 3 0.971 0.942 0.915 0.889 0.864 0.840 4 0.961 0.924 0.889 0.855 0.823 0.792 5 0.951 0.906 0.863 0.822 0.784 0.747 6 0.942 0.888 0.838 0.790 0.746 0.705 7 0.933 0.871 0.813 0.760 0.711 0.665 8 0.923 0.853 0.789 0.731 0.677 0.627 9 0.914 0.837 0.766 0.703 0.645 0.592 10 0.905 0.820 0.744 0.676 0.614 0.558 11 0.896 0.804 0.722 0.650 0.585 0.527 12 0.887 0.788 0.701 0.625 0.557 0.497 13 0.879 0.773 0.681 0.601 0.530 0.469 14 0.870 0.758 0.661 0.577 0.505 0.442 15 0.861 0.743 0.642 0.555 0.481 0.417 16 0.853 0.728 0.623 0.534 0.458 0.394 17 0.844 0.714 0.605 0.513 0.436 0.371 18 0.836 0.700 0.587 0.494 0.416 0.350 19 0.828 0.686 0.570 0.475 0.396 0.331 20 0.820 0.673 0.554 0.456 0.377 0.312 24 0.788 0.622 0.492 0.390 0.310 0.247 25 0.780 0.610 0.478 0.375 0.295 0.233 30 0.742 0.552 0.412 0.308 0.231 0.174 40 0.672 0.453 0.307 0.208 0.142 0.097 50 0.608 0.372 0.228 0.141 0.087 0.054 60 0.550 0.305 0.170 0.095 0.054 0.030 Period, n 14% 15% 16% 17% 18% 0 1.000 1.000 1.000 1.000 1.000 1 0.877 0.870 0.862 0.855 0.847 2 0.769 0.756 0.743 0.731 0.718 3 0.675 0.658 0.641 0.624 0.609 4 0.592 0.572 0.552 0.534 0.516 5 0.519 0.497 0.476 0.456 0.437 6 0.456 0.432 0.410 0.390 0.370 7 0.400 0.376 0.354 0.333 0.314 8 0.351 0.327 0.305 0.285 0.266 9 0.308 0.284 0.263 0.243 0.225 10 0.270 0.247 0.227 0.208 0.191 11 0.237 0.215 0.195 0.178 0.162 12 0.208 0.187 0.168 0.152 0.137 13 0.182 0.163 0.145 0.130 0.116 14 0.160 0.141 0.125 0.111 0.099 15 0.140 0.123 0.108 0.095 0.084 16 0.123 0.107 0.093 0.081 0.071 17 0.108 0.093 0.080 0.069 0.060 18 0.095 0.081 0.069 0.059 0.051 19 0.083 0.070 0.060 0.051 0.043 20 0.073 0.061 0.051 0.043 0.037 24 0.043 0.035 0.028 0.023 0.019 25 0.038 0.030 0.024 0.020 0.016 30 0.020 0.015 0.012 0.009 0.007 40 0.005 0.004 0.003 0.002 0.001 50 0.001 0.001 0.001 0.000 0.000 60 0.000 0.000 0.000 0.000 0.000 8% 1.000 0.926 0.857 0.794 0.735 0.681 0.630 0.583 0.540 0.500 0.463 0.429 0.397 0.368 0.340 0.315 0.292 0.270 0.250 0.232 0.215 0.158 0.146 0.099 0.046 0.021 0.010 20% 1.000 0.833 0.694 0.579 0.482 0.402 0.335 0.279 0.233 0.194 0.162 0.135 0.112 0.093 0.078 0.065 0.054 0.045 0.038 0.031 0.026 0.013 0.010 0.004 0.001 0.000 0.000 9% 10% 1.000 1.000 0.917 0.909 0.842 0.826 0.772 0.751 0.708 0.683 0.650 0.621 0.596 0.564 0.547 0.513 0.502 0.467 0.460 0.424 0.422 0.386 0.388 0.350 0.356 0.319 0.326 0.290 0.299 0.263 0.275 0.239 0.252 0.218 0.231 0.198 0.212 0.180 0.194 0.164 0.178 0.149 0.126 0.102 0.116 0.092 0.075 0.057 0.032 0.022 0.013 0.009 0.006 0.003 24% 28% 1.000 1.000 0.806 0.781 0.650 0.610 0.524 0.477 0.423 0.373 0.341 0.291 0.275 0.227 0.222 0.178 0.179 0.139 0.144 0.108 0.116 0.085 0.094 0.066 0.076 0.052 0.061 0.040 0.049 0.032 0.040 0.025 0.032 0.019 0.026 0.015 0.021 0.012 0.017 0.009 0.014 0.007 0.006 0.003 0.005 0.002 0.002 0.001 0.000 0.000 0.000 0.000 0.000 0.000 11% 1.000 0.901 0.812 0.731 0.659 0.593 0.535 0.482 0.434 0.391 0.352 0.317 0.286 0.258 0.232 0.209 0.188 0.170 0.153 0.138 0.124 0.082 0.074 0.044 0.015 0.005 0.002 32% 1.000 0.758 0.574 0.435 0.329 0.250 0.189 0.143 0.108 0.082 0.062 0.047 0.036 0.027 0.021 0.016 0.012 0.009 0.007 0.005 0.004 0.001 0.001 0.000 0.000 0.000 0.000 12% 1.000 0.893 0.797 0.712 0.636 0.567 0.507 0.452 0.404 0.361 0.322 0.287 0.257 0.229 0.205 0.183 0.163 0.146 0.130 0.116 0.104 0.066 0.059 0.033 0.011 0.003 0.001 36% 1.000 0.735 0.541 0.398 0.292 0.215 0.158 0.116 0.085 0.063 0.046 0.034 0.025 0.018 0.014 0.010 0.007 0.005 0.004 0.003 0.002 0.001 0.000 0.000 0.000 0.000 0.000 19% 1.000 0.840 0.706 0.593 0.499 0.419 0.352 0.296 0.249 0.209 0.176 0.148 0.124 0.104 0.088 0.074 0.062 0.052 0.044 0.037 0.031 0.015 0.013 0.005 0.001 0.000 0.000 40% 1.000 0.714 0.510 0.364 0.260 0.186 0.133 0.095 0.068 0.048 0.035 0.025 0.018 0.013 0.009 0.006 0.005 0.003 0.002 0.002 0.001 0.000 0.000 0.000 0.000 0.000 0.000 TABLE Present Value Interest Factor (PVIF) ($1 at i % per period for n periods); PVIF : PV= FV,(PVIF;,n) (1 + i)" 7% 1.000 0.935 0.873 0.816 0.763 0.713 0.666 0.623 0.582 0.544 0.508 0.475 0.444 0.415 0.388 0.362 0.339 0.317 0.296 0.276 0.258 0.197 0.184 0.131 0.067 0.034 0.017 13% 1.000 0.885 0.783 0.693 0.613 0.543 0.480 0.425 0.376 0.333 0.295 0.261 0.231 0.204 0.181 0.160 0.141 0.125 0.111 0.098 0.087 0.053 0.047 0.026 0.008 0.002 0.001 Period, 1% 2% 3% 4% 5% 6% 0 1.000 1.000 1.000 1.000 1.000 1.000 1 0.990 0.980 0.971 0.962 0.952 0.943 2 0.980 0.961 0.943 0.925 0.907 0.890 3 0.971 0.942 0.915 0.889 0.864 0.840 4 0.961 0.924 0.889 0.855 0.823 0.792 5 0.951 0.906 0.863 0.822 0.784 0.747 6 0.942 0.888 0.838 0.790 0.746 0.705 7 0.933 0.871 0.813 0.760 0.711 0.665 8 0.923 0.853 0.789 0.731 0.677 0.627 9 0.914 0.837 0.766 0.703 0.645 0.592 10 0.905 0.820 0.744 0.676 0.614 0.558 11 0.896 0.804 0.722 0.650 0.585 0.527 12 0.887 0.788 0.701 0.625 0.557 0.497 13 0.879 0.773 0.681 0.601 0.530 0.469 14 0.870 0.758 0.661 0.577 0.505 0.442 15 0.861 0.743 0.642 0.555 0.481 0.417 16 0.853 0.728 0.623 0.534 0.458 0.394 17 0.844 0.714 0.605 0.513 0.436 0.371 18 0.836 0.700 0.587 0.494 0.416 0.350 19 0.828 0.686 0.570 0.475 0.396 0.331 20 0.820 0.673 0.554 0.456 0.377 0.312 24 0.788 0.622 0.492 0.390 0.310 0.247 25 0.780 0.610 0.478 0.375 0.295 0.233 30 0.742 0.552 0.412 0.308 0.231 0.174 40 0.672 0.453 0.307 0.208 0.142 0.097 50 0.608 0.372 0.228 0.141 0.087 0.054 60 0.550 0.305 0.170 0.095 0.054 0.030 Period, n 14% 15% 16% 17% 18% 0 1.000 1.000 1.000 1.000 1.000 1 0.877 0.870 0.862 0.855 0.847 2 0.769 0.756 0.743 0.731 0.718 3 0.675 0.658 0.641 0.624 0.609 4 0.592 0.572 0.552 0.534 0.516 5 0.519 0.497 0.476 0.456 0.437 6 0.456 0.432 0.410 0.390 0.370 7 0.400 0.376 0.354 0.333 0.314 8 0.351 0.327 0.305 0.285 0.266 9 0.308 0.284 0.263 0.243 0.225 10 0.270 0.247 0.227 0.208 0.191 11 0.237 0.215 0.195 0.178 0.162 12 0.208 0.187 0.168 0.152 0.137 13 0.182 0.163 0.145 0.130 0.116 14 0.160 0.141 0.125 0.111 0.099 15 0.140 0.123 0.108 0.095 0.084 16 0.123 0.107 0.093 0.081 0.071 17 0.108 0.093 0.080 0.069 0.060 18 0.095 0.081 0.069 0.059 0.051 19 0.083 0.070 0.060 0.051 0.043 20 0.073 0.061 0.051 0.043 0.037 24 0.043 0.035 0.028 0.023 0.019 25 0.038 0.030 0.024 0.020 0.016 30 0.020 0.015 0.012 0.009 0.007 40 0.005 0.004 0.003 0.002 0.001 50 0.001 0.001 0.001 0.000 0.000 60 0.000 0.000 0.000 0.000 0.000 8% 1.000 0.926 0.857 0.794 0.735 0.681 0.630 0.583 0.540 0.500 0.463 0.429 0.397 0.368 0.340 0.315 0.292 0.270 0.250 0.232 0.215 0.158 0.146 0.099 0.046 0.021 0.010 20% 1.000 0.833 0.694 0.579 0.482 0.402 0.335 0.279 0.233 0.194 0.162 0.135 0.112 0.093 0.078 0.065 0.054 0.045 0.038 0.031 0.026 0.013 0.010 0.004 0.001 0.000 0.000 9% 10% 1.000 1.000 0.917 0.909 0.842 0.826 0.772 0.751 0.708 0.683 0.650 0.621 0.596 0.564 0.547 0.513 0.502 0.467 0.460 0.424 0.422 0.386 0.388 0.350 0.356 0.319 0.326 0.290 0.299 0.263 0.275 0.239 0.252 0.218 0.231 0.198 0.212 0.180 0.194 0.164 0.178 0.149 0.126 0.102 0.116 0.092 0.075 0.057 0.032 0.022 0.013 0.009 0.006 0.003 24% 28% 1.000 1.000 0.806 0.781 0.650 0.610 0.524 0.477 0.423 0.373 0.341 0.291 0.275 0.227 0.222 0.178 0.179 0.139 0.144 0.108 0.116 0.085 0.094 0.066 0.076 0.052 0.061 0.040 0.049 0.032 0.040 0.025 0.032 0.019 0.026 0.015 0.021 0.012 0.017 0.009 0.014 0.007 0.006 0.003 0.005 0.002 0.002 0.001 0.000 0.000 0.000 0.000 0.000 0.000 11% 1.000 0.901 0.812 0.731 0.659 0.593 0.535 0.482 0.434 0.391 0.352 0.317 0.286 0.258 0.232 0.209 0.188 0.170 0.153 0.138 0.124 0.082 0.074 0.044 0.015 0.005 0.002 32% 1.000 0.758 0.574 0.435 0.329 0.250 0.189 0.143 0.108 0.082 0.062 0.047 0.036 0.027 0.021 0.016 0.012 0.009 0.007 0.005 0.004 0.001 0.001 0.000 0.000 0.000 0.000 12% 1.000 0.893 0.797 0.712 0.636 0.567 0.507 0.452 0.404 0.361 0.322 0.287 0.257 0.229 0.205 0.183 0.163 0.146 0.130 0.116 0.104 0.066 0.059 0.033 0.011 0.003 0.001 36% 1.000 0.735 0.541 0.398 0.292 0.215 0.158 0.116 0.085 0.063 0.046 0.034 0.025 0.018 0.014 0.010 0.007 0.005 0.004 0.003 0.002 0.001 0.000 0.000 0.000 0.000 0.000 19% 1.000 0.840 0.706 0.593 0.499 0.419 0.352 0.296 0.249 0.209 0.176 0.148 0.124 0.104 0.088 0.074 0.062 0.052 0.044 0.037 0.031 0.015 0.013 0.005 0.001 0.000 0.000 40% 1.000 0.714 0.510 0.364 0.260 0.186 0.133 0.095 0.068 0.048 0.035 0.025 0.018 0.013 0.009 0.006 0.005 0.003 0.002 0.002 0.001 0.000 0.000 0.000 0.000 0.000 0.000