Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Shane is the managing director of Killer Zombies Limited and earns a basic gross salary of 230,000 (with 60,000 deducted through PAYE) during the

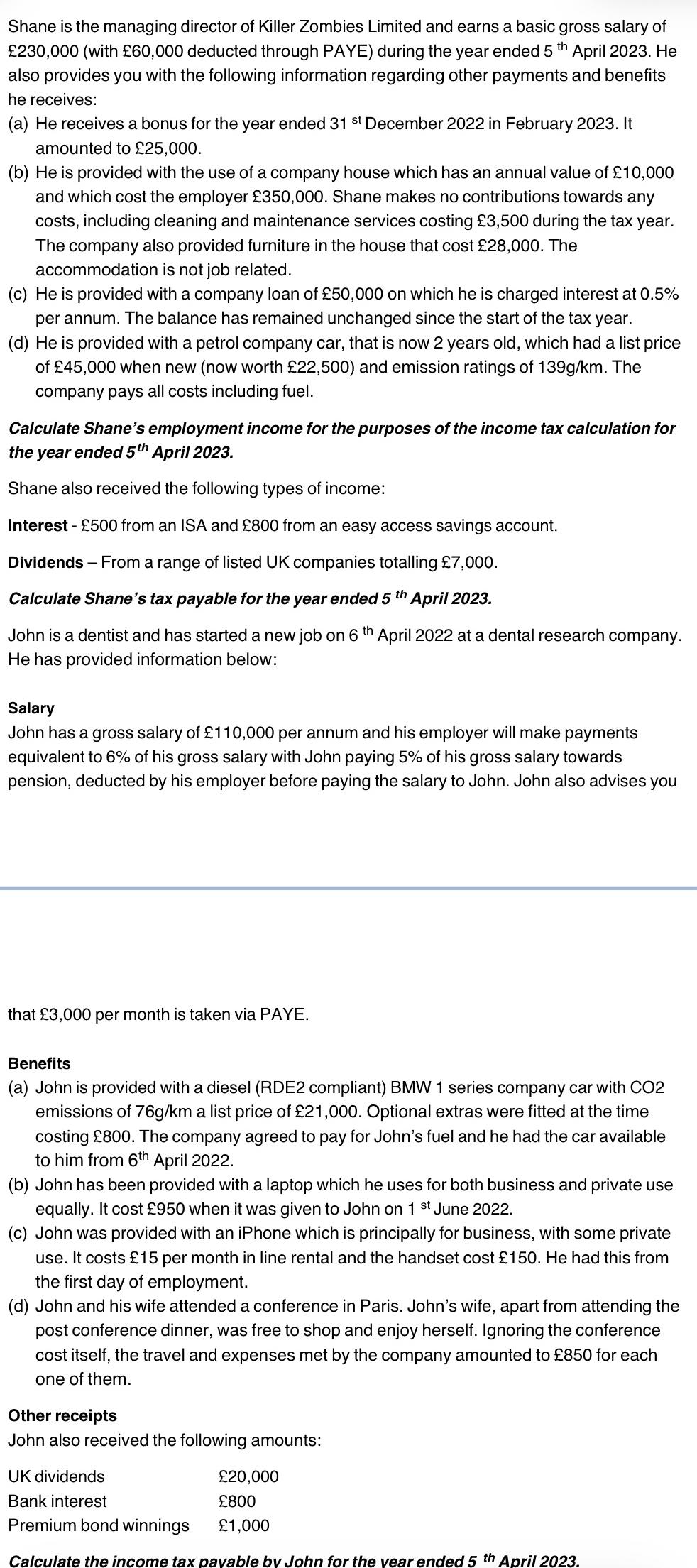

Shane is the managing director of Killer Zombies Limited and earns a basic gross salary of 230,000 (with 60,000 deducted through PAYE) during the year ended 5 th April 2023. He also provides you with the following information regarding other payments and benefits he receives: (a) He receives a bonus for the year ended 31 st December 2022 in February 2023. It amounted to 25,000. (b) He is provided with the use of a company house which has an annual value of 10,000 and which cost the employer 350,000. Shane makes no contributions towards any costs, including cleaning and maintenance services costing 3,500 during the tax year. The company also provided furniture in the house that cost 28,000. The accommodation is not job related. (c) He is provided with a company loan of 50,000 on which he is charged interest at 0.5% per annum. The balance has remained unchanged since the start of the tax year. (d) He is provided with a petrol company car, that is now 2 years old, which had a list price of 45,000 when new (now worth 22,500) and emission ratings of 139g/km. The company pays all costs including fuel. Calculate Shane's employment income for the purposes of the income tax calculation for the year ended 5th April 2023. Shane also received the following types of income: Interest 500 from an ISA and 800 from an easy access savings account. Dividends - From a range of listed UK companies totalling 7,000. Calculate Shane's tax payable for the year ended 5th April 2023. John is a dentist and has started a new job on 6 th April 2022 at a dental research company. He has provided information below: Salary John has a gross salary of 110,000 per annum and his employer will make payments equivalent to 6% of his gross salary with John paying 5% of his gross salary towards pension, deducted by his employer before paying the salary to John. John also advises you that 3,000 per month is taken via PAYE. Benefits (a) John is provided with a diesel (RDE2 compliant) BMW 1 series company car with CO2 emissions of 76g/km a list price of 21,000. Optional extras were fitted at the time costing 800. The company agreed to pay for John's fuel and he had the car available to him from 6th April 2022. (b) John has been provided with a laptop which he uses for both business and private use equally. It cost 950 when it was given to John on 1 st June 2022. (c) John was provided with an iPhone which is principally for business, with some private use. It costs 15 per month in line rental and the handset cost 150. He had this from the first day of employment. (d) John and his wife attended a conference in Paris. John's wife, apart from attending the post conference dinner, was free to shop and enjoy herself. Ignoring the conference cost itself, the travel and expenses met by the company amounted to 850 for each one of them. Other receipts John also received the following amounts: UK dividends 20,000 Bank interest 800 Premium bond winnings 1,000 Calculate the income tax payable by John for the year ended 5 th April 2023.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started