Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Shanks Corporation is considering a capital budgeting project that involves Investing $604,000 in equipment that would have a useful life of 3 years and

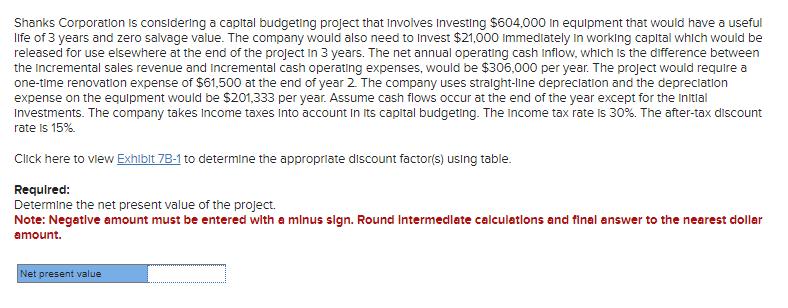

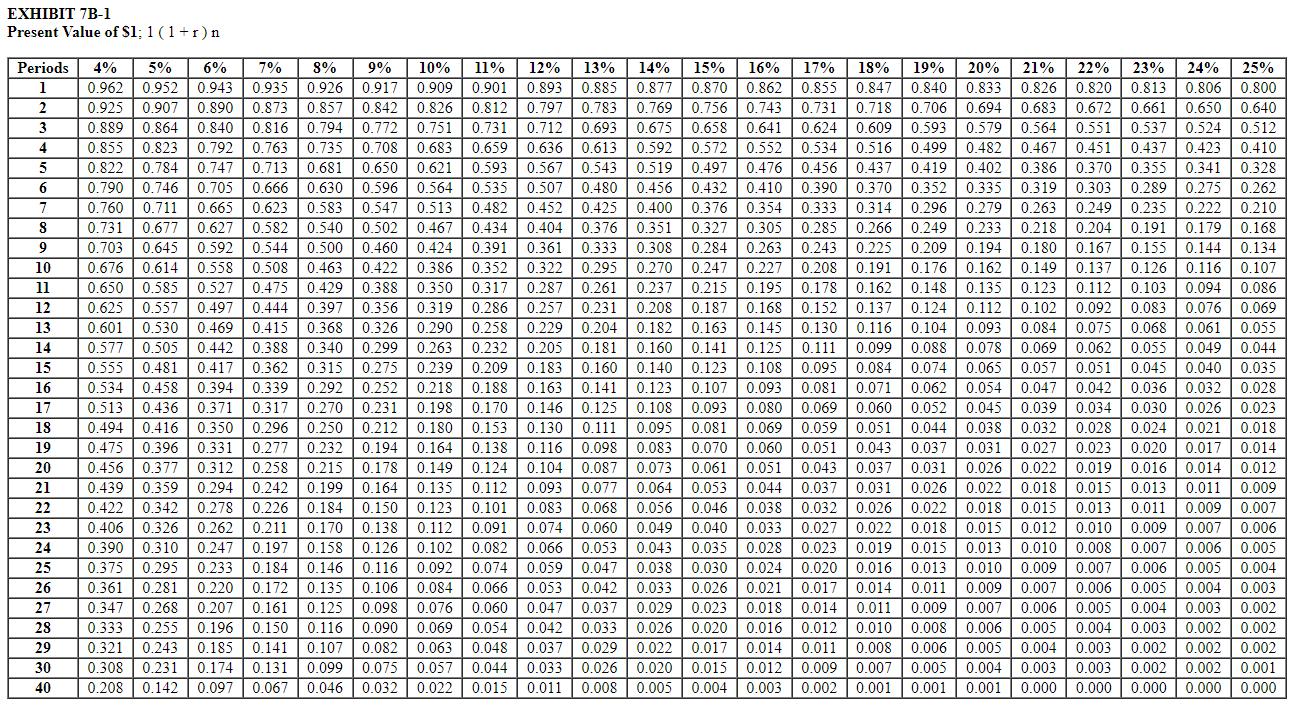

Shanks Corporation is considering a capital budgeting project that involves Investing $604,000 in equipment that would have a useful life of 3 years and zero salvage value. The company would also need to invest $21,000 Immediately in working capital which would be released for use elsewhere at the end of the project in 3 years. The net annual operating cash Inflow, which is the difference between the incremental sales revenue and incremental cash operating expenses, would be $306,000 per year. The project would require a one-time renovation expense of $61,500 at the end of year 2. The company uses straight-line depreciation and the depreciation expense on the equipment would be $201,333 per year. Assume cash flows occur at the end of the year except for the initial Investments. The company takes Income taxes into account in its capital budgeting. The income tax rate is 30%. The after-tax discount rate is 15%. Click here to view Exhibit 7B-1 to determine the appropriate discount factor(s) using table. Required: Determine the net present value of the project. Note: Negative amount must be entered with a minus sign. Round Intermediate calculations and final answer to the nearest dollar amount. Net present value EXHIBIT 7B-1 Present Value of $1; 1 (1+r) n. Periods 4% 1 2 3 4 5 6 0.314 0.296 0.279 0.429 0.625 0.557 0.497 0.444 0.444 0.397 0.601 0.530 0.469 5% 6% 7% 8% 9% 10% 11% 12% 13% 14% 15% 16% 17% 18% 19% 20% 21% 22% 23% 24% 25% 0.962 0.952 0.943 0.935 0.926 0.917 0.909 0.901 0.893 0.885 0.877 0.870 0.862 0.855 0.847 0.840 0.833 0.826 0.820 0.813 0.813 0.806 0.800 0.925 0.907 0.890 0.873 0.857 0.842 0.842 0.826 0.812 0.797 0.797 0.783 0.769 0.756 0.743 0.731 0.718 0.706 0.694 0.683 0.672 0.661 0.650 0.640 0.889 0.864 0.840 0.816 0.794 0.772 0.751 0.731 0.712 0.693 0.675 0.658 0.641 0.624 0.609 0.593 0.579 0.564 0.551 0.537 0.524 0.512 0.855 0.823 0.792 0.763 0.735 0.708 0.683 0.659 0.636 0.613 0.592 0.572 0.552 | 0.534 0.516 0.499 0.482 0.467 0.451 0.437 0.423 0.410 0.822 0.784 0.747 0.713 0.681 0.650 0.621 0.593 0.567 0.543 0.519 0.497 0.476 0.456 0.437 0.419 0.402 0.386 0.370 0.355 0.341 0.328 0.790 0.746 0.746 0.705 0.666 0.630 0.596 0.564 0.535 0.507 0.480 0.456 0.432 0.410 0.390 0.370 0.352 0.335 0.319 0.303 0.289 0.275 0.262 0.760 0.711 0.665 0.623 0.583 0.547 0.513 0.482 0.452 0.425 0.400 0.376 0.354 0.333 0.263 0.249 0.235 0.222 0.210 0.731 0.677 0.627 0.582 0.540 0.502 0.467 0.434 0.404 0.376 0.351 0.327 0.305 | 0.285 0.266 0.249 0.233 0.218 0.204 0.191 0.179 0.168 0.703 0.645 0.592 0.544 0.500 0.460 0.424 0.391 0.391 0.361 0.333 0.308 0.284 0.263 0.243 0.225 0.209 0.194 0.180 0.167 0.155 0.144 0.134 0.676 0.614 0.558 0.508 0.463 0.422 0.386 0.352 0.322 0.295 0.270 0.247 0.247 0.227 0.208 0.208 0.191 0.176 0.162 0.162 0.149 0.137 0.126 0.116 0.107 0.650 0.585 0.527 0.475 0.429 0.388 0.350 0.317 0.287 0.261 0.237 0.215 0.195 0.178 0.162 0.148 0.135 0.123 0.112 0.103 0.094 0.086 0.397 0.356 0.319 0.286 0.257 0.231 0.208 0.187 0.168 0.152 0.137 0.124 0.112 0.102 0.092 0.083 0.076 0.069 0.469 0.415 0.415 0.368 0.368 0.326 0.290 0.258 0.229 0.204 0.182 0.163 0.145 0.130 0.116 0.104 0.093 0.084 0.075 0.068 0.075 0.068 0.061 0.055 0.577 0.505 0.505 0.442 0.442 0.388 0.388 0.340 0.340 0.299 0.263 0.232 0.205 0.181 0.160 0.141 0.125 0.111 0.099 0.088 0.078 0.069 0.062 0.055 0.049 0.044 0.555 0.481 0.417 0.362 0.315 0.275 0.239 0.209 0.183 0.160 0.140 0.123 0.108 0.095 0.084 0.074 0.065 0.057 0.051 0.045 0.040 0.035 0.534 0.458 0.394 0.339 0.292 0.252 0.218 0.188 0.163 0.141 0.123 0.107 0.093 0.081 0.071 0.062 0.054 0.047 0.042 0.036 0.032 0.028 0.513 0.436 0.436 0.371 0.371 0.317 0.270 0.270 0.231 0.231 0.198 0.198 0.170 0.146 0.125 0.108 0.093 0.080 0.069 0.060 0.052 0.045 0.039 0.034 0.030 0.030 0.026 0.023 $ 0.494 0.416 0.350 0.350 0.296 0.296 0.250 0.250 0.212 0.180 0.153 0.130 0.111 0.095 0.081 0.069 0.059 0.051 0.044 0.038 0.032 0.028 0.024 0.021 0.018 0.475 0.396 0.331 0.277 0.232 0.194 0.164 0.138 0.116 0.098 0.083 0.070 0.060 0.051 0.043 0.037 0.031 0.027 0.023 0.020 0.017 0.014 0.456 0.377 0.312 0.258 0.215 0.178 0.178 0.149 0.124 0.104 | 0.087 0.073 0.061 0.051 0.043 0.037 0.031 0.026 0.022 0.019 0.016 0.014 0.012 0.242 0.242 0.199 0.164 0.135 0.112 0.093 0.077 0.064 0.053 0.044 0.037 0.031 0.026 0.022 0.018 0.015 0.013 0.011 0.009 0.226 0.184 0.150 0.123 0.101 0.083 0.068 0.056 0.046 0.038 0.032 0.026 0.022 0.018 0.015 0.013 0.011 0.009 0.007 0.211 0.170 0.138 0.138 0.112 0.091 0.074 0.060 0.049 0.040 0.033 0.027 0.022 0.018 0.015 0.012 0.010 0.009 0.007 0.006 0.126 0.126 0.102 0.082 0.066 0.053 0.043 0.035 0.028 0.023 0.019 0.015 0.013 0.010 0.008 0.007 0.006 0.005 0.184 0.146 0.116 0.092 0.074 0.059 0.047 0.038 0.030 0.024 0.020 0.016 0.013 0.010 0.009 0.007 0.006 0.006 0.005 0.005 0.004 0.361 0.281 0.220 0.172 0.135 0.106 0.084 0.066 0.053 0.042 0.033 0.026 0.021 0.017 0.014 0.011 0.009 0.007 0.006 0.005 0.004 0.003 0.347 0.268 0.207 0.161 0.125 0.098 0.076 0.060 0.047 0.037 0.029 0.023 0.018 0.014 0.011 0.009 0.007 0.006 0.005 0.004 0.003 0.002 0.333 0.255 0.196 0.196 0.150 0.150 0.116 0.090 0.069 0.054 0.042 0.033 0.026 0.020 0.016 0.012 0.010 0.008 0.006 0.005 0.004 0.003 0.002 0.002 0.321 0.243 0.185 0.141 0.107 0.082 0.063 0.048 0.037 0.029 0.022 0.017 0.014 0.011 0.008 0.006 0.005 0.004 0.003 0.002 0.002 0.002 0.002 0.308 0.231 0.174 0.131 0.099 0.075 0.057 0.044 0.033| 0.026 0.020 | 0.015| 0.012 0.009 0.007 0.005 0.004 0.003 0.003 0.002 0.002 0.001 0.208 0.142 0.097 0.067 0.046 0.032 0.032 0.022 0.015 0.011 0.008 0.005 0.004 0.003 0.002 0.001 0.001 0.001 0.000 0.000 0.000 0.000 0.000 0.108 0.439 0.359 0.294 0.278 0.262 0.422 0.342 0.406 0.326 0.390 0.310 0.247 0.197 0.158 0.375 0.295 0.233 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 40

Step by Step Solution

★★★★★

3.45 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below Shank Corp...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started