Answered step by step

Verified Expert Solution

Question

1 Approved Answer

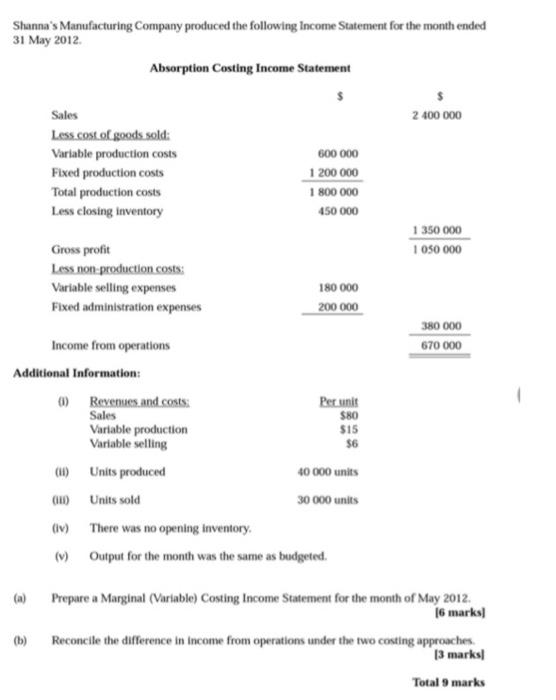

Shanna's Manufacturing Company produced the following Income Statement for the month ended 31 May 2012. Absorption Costing Income Statement Sales 2 400 000 Less.cost

Shanna's Manufacturing Company produced the following Income Statement for the month ended 31 May 2012. Absorption Costing Income Statement Sales 2 400 000 Less.cost of goods sold: Variable production costs 600 000 Fixed production costs 1 200 000 Total production costs 1 800 000 Less closing inventory 450 000 1 350 000 1 050 000 Gross profit Less non-production costs: Variable selling expenses 180 000 Fixed administration expenses 200 000 380 000 670 000 Income from operations Additional Information: ) Revenues and .costs: Sales Per unit S80 Variable production Variable selling $15 $6 (1) Units produced 40 000 units (1) Units sold 30 000 units (Iv) There was no opening inventory. (v) Output for the month was the same as budgeted. (a) Prepare a Marginal (Variable) Costing Income Statement for the month of May 2012. (6 marks) Reconcile the difference in income from operations under the two costing approaches. 13 marks (b) Total 9 marks

Step by Step Solution

★★★★★

3.49 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

a variable costing Income Statement b Reconciliation between net operat...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started