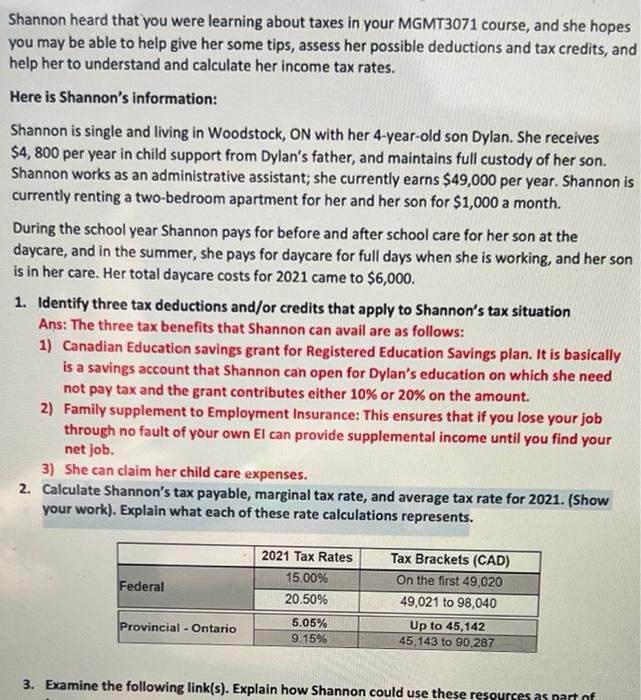

Shannon heard that you were learning about taxes in your MGMT3071 course, and she hopes you may be able to help give her some tips, assess her possible deductions and tax credits, and help her to understand and calculate her income tax rates. Here is Shannon's information: Shannon is single and living in Woodstock, ON with her 4-year-old son Dylan. She receives $4, 800 per year in child support from Dylan's father, and maintains full custody of her son. Shannon works as an administrative assistant; she currently earns $49,000 per year. Shannon is currently renting a two-bedroom apartment for her and her son for $1,000 a month. During the school year Shannon pays for before and after school care for her son at the daycare, and in the summer, she pays for daycare for full days when she is working, and her son is in her care. Her total daycare costs for 2021 came to $6,000. 1. Identify three tax deductions and/or credits that apply to Shannon's tax situation Ans: The three tax benefits that Shannon can avail are as follows: 1) Canadian Education savings grant for Registered Education Savings plan. It is basically is a savings account that Shannon can open for Dylan's education on which she need not pay tax and the grant contributes either 10% or 20% on the amount. 2) Family supplement to Employment Insurance: This ensures that if you lose your job through no fault of your own El can provide supplemental income until you find your net job. 3) She can claim her child care expenses. 2. Calculate Shannon's tax payable, marginal tax rate, and average tax rate for 2021. (Show your work). Explain what each of these rate calculations represents. 2021 Tax Rates 15.00% 20.50% Federal Tax Brackets (CAD) On the first 49,020 49,021 to 98,040 Up to 45,142 45,143 to 90,287 Provincial - Ontario 5.05% 9.15% 3. Examine the following link(s). Explain how Shannon could use these resources as part of Shannon heard that you were learning about taxes in your MGMT3071 course, and she hopes you may be able to help give her some tips, assess her possible deductions and tax credits, and help her to understand and calculate her income tax rates. Here is Shannon's information: Shannon is single and living in Woodstock, ON with her 4-year-old son Dylan. She receives $4, 800 per year in child support from Dylan's father, and maintains full custody of her son. Shannon works as an administrative assistant; she currently earns $49,000 per year. Shannon is currently renting a two-bedroom apartment for her and her son for $1,000 a month. During the school year Shannon pays for before and after school care for her son at the daycare, and in the summer, she pays for daycare for full days when she is working, and her son is in her care. Her total daycare costs for 2021 came to $6,000. 1. Identify three tax deductions and/or credits that apply to Shannon's tax situation Ans: The three tax benefits that Shannon can avail are as follows: 1) Canadian Education savings grant for Registered Education Savings plan. It is basically is a savings account that Shannon can open for Dylan's education on which she need not pay tax and the grant contributes either 10% or 20% on the amount. 2) Family supplement to Employment Insurance: This ensures that if you lose your job through no fault of your own El can provide supplemental income until you find your net job. 3) She can claim her child care expenses. 2. Calculate Shannon's tax payable, marginal tax rate, and average tax rate for 2021. (Show your work). Explain what each of these rate calculations represents. 2021 Tax Rates 15.00% 20.50% Federal Tax Brackets (CAD) On the first 49,020 49,021 to 98,040 Up to 45,142 45,143 to 90,287 Provincial - Ontario 5.05% 9.15% 3. Examine the following link(s). Explain how Shannon could use these resources as part of