Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Shanti Yoga Studio has the following account balances on May 1, 2020. (all accounts have their normal balances) Part 1) During May 2020, the following

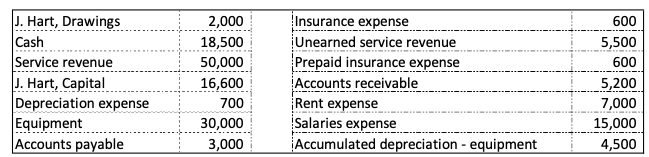

Shanti Yoga Studio has the following account balances on May 1, 2020. (all accounts have their normal balances)

Part 1) During May 2020, the following events took place. Where appropriate, record a journal entry for each transaction. If no journal entry is required, write no entry.

- On May 2, the company prepaid rent for June to August for $6,000.

- On May 5, the owner, Jenny, invested $5,000 cash and a computer system valued at $4,700 into Shanti Yoga Studio.

- On May 7, the company collected $3,500 it was owed on account.

- On May 8 Shanti Yoga Studio provided a quotation for membership fees to a corporation looking to provide fitness benefits to its employees. The quotation was for $10,000. The corporation will decide next month if Shanti is a good fit.

- On May 15 the yoga studio provided classes and collected $4,500.

- On May 17 the company received a $820 bill for advertising expense that it will pay in the near future.

- On May 18 the company paid $2,000 cash on account.

- On May 20 the owner, Jenny, withdrew $500 for personal use.

- On May 25 Shanti Yoga Studio purchased $900 of supplies on account.

- On May 31 the company paid employee salaries of $1,500.

Part 2) Open T-accounts using the beginning balances provided and post entries into T-accounts. Calculate the balance of each one

Part 3) Prepare the unadjusted trial balance for Shanti Yoga Studio at May 31, 2020

J. Hart, Drawings Cash Service revenue J. Hart, Capital Depreciation expense Equipment Accounts payable 2,000 18,500 50,000 16,600 700 30,000 3,000 Insurance expense Unearned service revenue Prepaid insurance expense Accounts receivable Rent expense Salaries expense Accumulated depreciation - equipment 600 5,500 600 5,200 7,000 15,000 4,500Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started