Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Share what we learn from the data and information collected for this discussion. Interpret each of the ratios. Review the Financial Ratios Guidelines document for

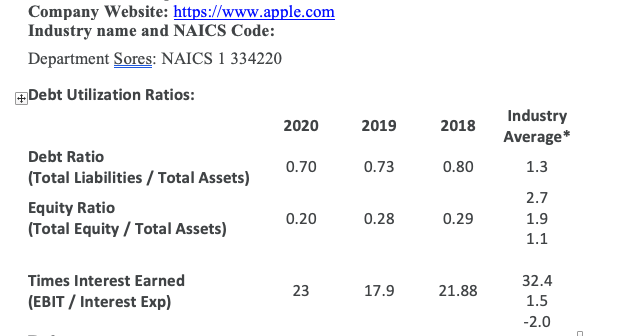

Share what we learn from the data and information collected for this discussion. Interpret each of the ratios. Review the Financial Ratios Guidelines document for direction. Do you see any red flags? Does the company make greater use of debt financing or equity financing? Does the company have too much debt? How safely can the company cover its interest expense? How does this company compare to the industry averages?

Company Website: https://www.apple.com Industry name and NAICS Code: Department Sores: NAICS 1 334220 +Debt Utilization Ratios: Industry 2020 2019 2018 Average* Debt Ratio 0.70 0.73 0.80 1.3 (Total Liabilities / Total Assets) 2.7 Equity Ratio 0.20 0.28 0.29 1.9 (Total Equity / Total Assets) 1.1 Times Interest Earned (EBIT / Interest Exp) 32.4 23 17.9 21.88 1.5 -2.0

Step by Step Solution

★★★★★

3.43 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Conversation with Gemini expandmoreedit Share what we learn from the data and information collected for this discussion Interpret each of the ratios R...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started