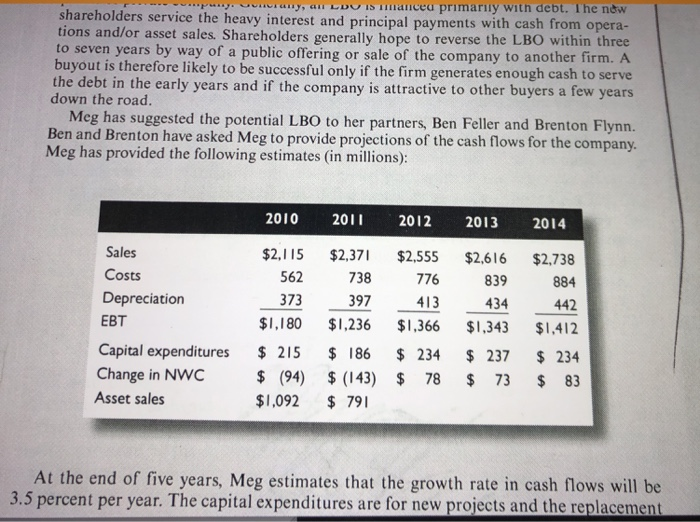

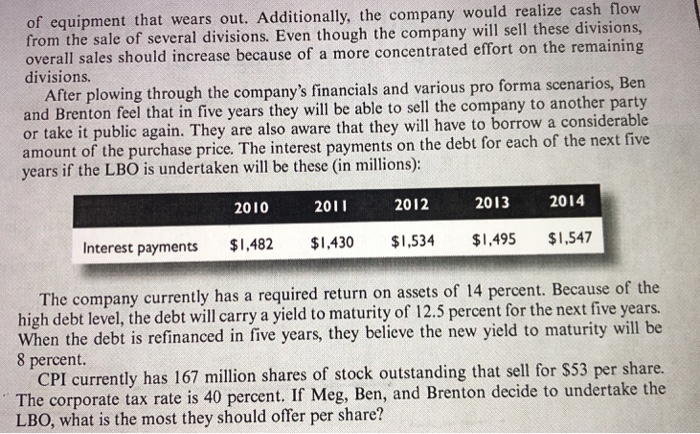

shareholders service the heavy interest and principal payments with cash from opera tions and/or asset sales. Shareholders generally hope to to seven years by way of a public offering or sale of the company to another firm. A buyout is therefore likely to be successful only if the firm generates enough cash to serve the debt in the early years and if the company is attractive to other buyers a few years down the road. reverse the LBO within three Meg has suggested the potential LBO to her partners, Ben Feller and Brenton Flynn. Ben and Brenton have asked Meg to provide projections of the cash flows for the company Meg has provided the following estimates (in millions) 2010 201 2012 2013 2014 $2.115 $2,37 $2,555 $2,616 $2,738 Sales Costs 562 373 738 397413 776 839 434 884 442 $1.180 $1,236 $1,366 $1.343 $1.412 Capital expenditures 215 $ 186 234 $ 237 $ 234 Change in Nwc (94) (143) 78 $ 73 $ 83 Depreciation EBT Asset sales $1,092 $ 791 At the end of five years, Meg estimates that the growth rate in cash flows will be 3.5 percent per year. The capital expenditures are for new projects and the replacement equipment that wears out. Additionally, the company would realize cash flow from the sale of several divisions. Even though the company will sell these divisions, overall sales should increase because of a more concentrated effort on the remaining divisions. a scenarios, Ben and Brenton feel that in five years they will be able to sell the company to another party lic again. They are also aware that they will have to borrow a considerable mount of the purchase price. The interest payments on the debt for each of the next five After plowing through the company's financials and various pro form or take it pub years if the LBO is undertaken will be these (in millions): 2011 Interest payments $1.482 $1.430 $1.534$1,495 $1,547 The company currently has a required return on assets of 14 percent. Because of When the debt is refinanced in five years, they believe the new yield to maturity will be The corporate tax rate is 40 percent. If Meg, Ben, and Brenton decide to undertake the 2010 2012 2013 2014 high debt level, the debt will carry a yield to maturity of 12.5 percent for the next five years 8 percent. y has 167 million shares of stock outstanding that sell for $53 per share. LBO, what is the most they should offer per share