Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Sharia, a Malaysian citizen, disposed of her properties as follows: In 2015 she sold a shop house for RM320,000 which she had bought for RM360,000.The

Sharia, a Malaysian citizen, disposed of her properties as follows: In 2015 she sold a shop house for RM320,000 which she had bought for RM360,000.The shop house was sold within two years after the date of acquisition In 2018 she sold a bungalow lot for RM490,000 and incurred agents fees of RM6,800on the disposal. She had bought the bungalow lot for RM480,000. The bungalow lotwas sold in the fifth year after the date of acquisition. On 13 May 2022, she sold a townhouse for RM280,000. She had boughtthe townhouse for RM185,000 on 6 April 2019.

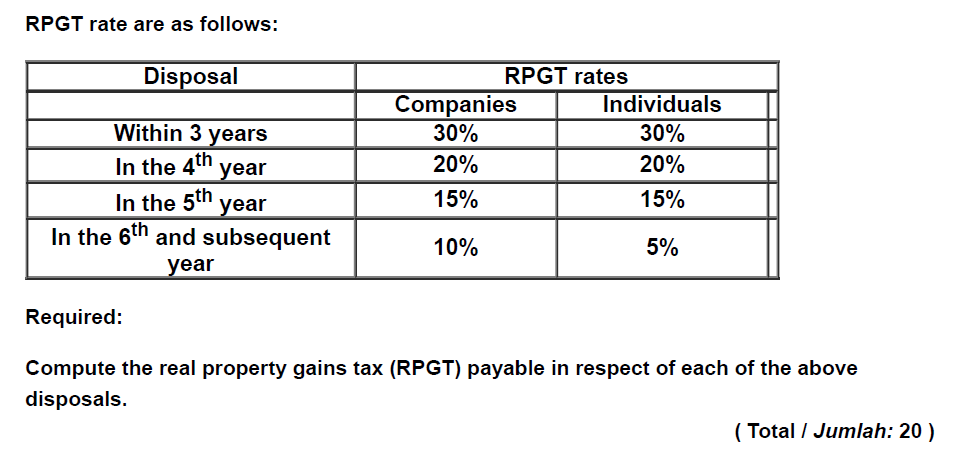

RPGT rate are as follows: Required: Compute the real property gains tax (RPGT) payable in respect of each of the above disposals

RPGT rate are as follows: Required: Compute the real property gains tax (RPGT) payable in respect of each of the above disposals Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started