Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Sharon Oslo is considering making the following investment purchases on July 1, 2021 and is wondering what the impact of purchasing them personally would

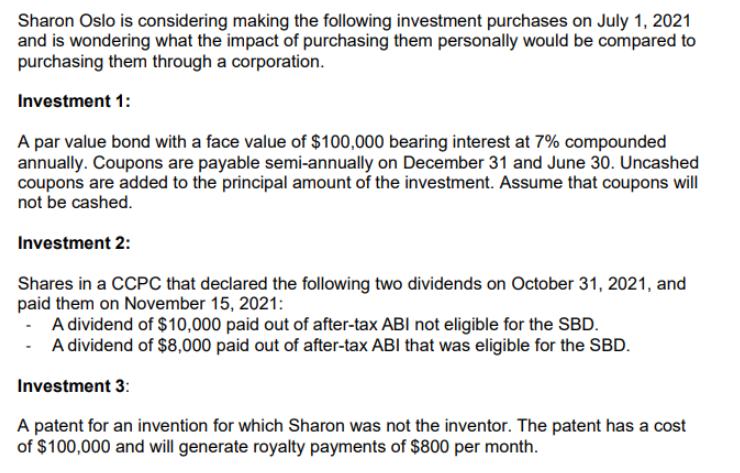

Sharon Oslo is considering making the following investment purchases on July 1, 2021 and is wondering what the impact of purchasing them personally would be compared to purchasing them through a corporation. Investment 1: A par value bond with a face value of $100,000 bearing interest at 7% compounded annually. Coupons are payable semi-annually on December 31 and June 30. Uncashed coupons are added to the principal amount of the investment. Assume that coupons will not be cashed. Investment 2: Shares in a CCPC that declared the following two dividends on October 31, 2021, and paid them on November 15, 2021: - A dividend of $10,000 paid out of after-tax ABI not eligible for the SBD. A dividend of $8,000 paid out of after-tax ABI that was eligible for the SBD. Investment 3: A patent for an invention for which Sharon was not the inventor. The patent has a cost of $100,000 and will generate royalty payments of $800 per month. Required: Determine what the difference would be to taxable income for the 2021 taxation year if Sharon purchased these investments personally compared to if they were purchased through a corporation. Show all your calculations. Note: Round all amounts to the nearest dollar and ignore GST and provincial taxes. Show all steps in your calculations, even if the result is zero.

Step by Step Solution

★★★★★

3.41 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

To compare the impact of purchasing these investments personally versus through a corporation well consider the tax implications for both scenarios Well assume that Sharon Oslo is a Canadian resident ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started