Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Sharon Smith operates a general, receivables and payables ledger using a computerised accounting package. She is registered for GST on an invoice basis and

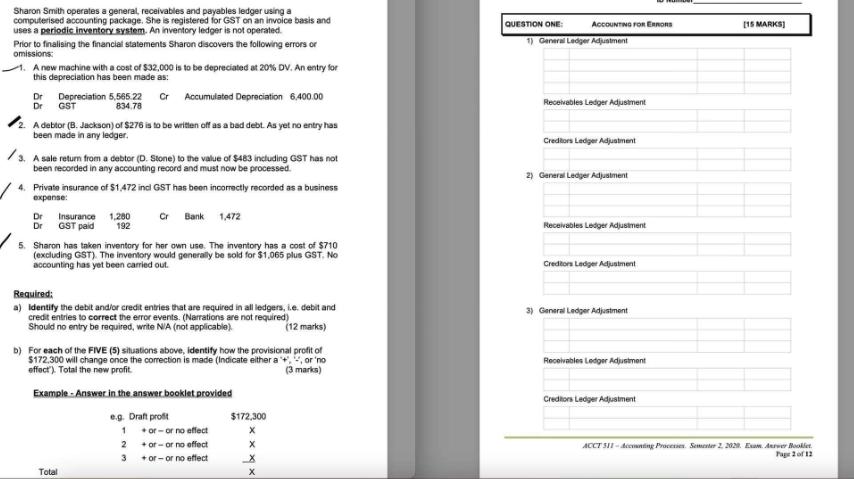

Sharon Smith operates a general, receivables and payables ledger using a computerised accounting package. She is registered for GST on an invoice basis and uses a periodic inventory system. An inventory ledger is not operated. Prior to finalising the financial statements Sharon discovers the following errors or omissions: 1. A new machine with a cost of $32,000 is to be depreciated at 20% DV. An entry for this depreciation has been made as: Accumulated Depreciation 6,400.00 2. A debtor (B. Jackson) of $276 is to be written off as a bad debt. As yet no entry has been made in any ledger. Depreciation 5,565.22 Cr 834.78 Dr Dr GST /3. A sale return from a debtor (D. Stone) to the value of $483 including GST has not been recorded in any accounting record and must now be processed. 4. Private insurance of $1,472 incl GST has been incorrectly recorded as a business expense: Cr Bank 1,472 Dr Insurance 1,280 Dr GST paid 192 5. Sharon has taken inventory for her own use. The inventory has a cost of $710 (excluding GST). The inventory would generally be sold for $1,065 plus GST. No accounting has yet been carried out. Required: a) Identify the debit and/or credit entries that are required in all ledgers, i.e. debit and credit entries to correct the error events. (Narrations are not required) Should no entry be required, write N/A (not applicable) (12 marks) b) For each of the FIVE (5) situations above, identify how the provisional profit of $172,300 will change once the correction is made (Indicate either a +,, or 'no effect). Total the new profit. (3 marks) Example - Answer in the answer booklet provided eg. Draft profit 1 2 Total 3 +or-or no effect + or- or no effect + or - or no effect $172,300 X X -X X QUESTION ONE: ACCOUNTING FOR ERRORS 1) General Ledger Adjustment Receivables Ledger Adjustment Creditors Ledger Adjustment 2) General Ledger Adjustment Receivables Ledger Adjustment Creditors Ledger Adjustment 3) General Ledger Adjustment Receivables Ledger Adjustment Creditors Ledger Adjustment [15 MARKS] ACCT 511-Accounting Procesies. Sementer 2, 2029. Exam Anrver Booklet Page 2 of 12

Step by Step Solution

★★★★★

3.31 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Answer a Debit andor credit entries required 1 New machine depreciation Dr Depreciation Expense 55...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started