Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Sharon Sutherland owned a home in Toronto, Ontario, a ski chalet in Whistler, British Columbia, and a condominium in Florida, U.S., until June 15,

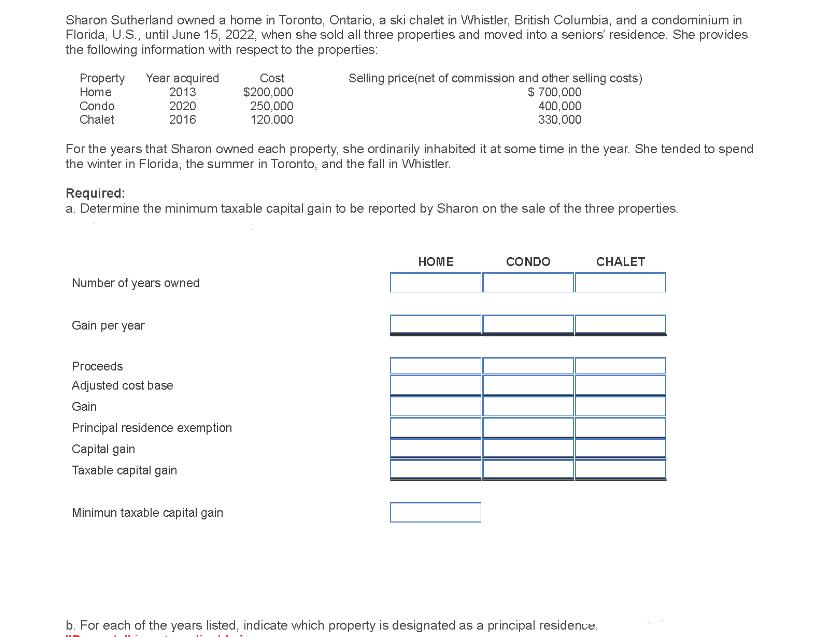

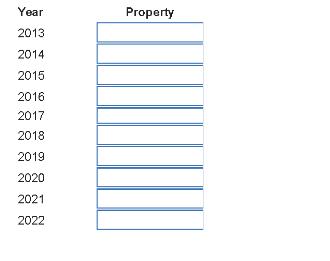

Sharon Sutherland owned a home in Toronto, Ontario, a ski chalet in Whistler, British Columbia, and a condominium in Florida, U.S., until June 15, 2022, when she sold all three properties and moved into a seniors' residence. She provides the following information with respect to the properties: Property Home Condo Chalet Year acquired 2013 2020 2016 For the years that Sharon owned each property, she ordinarily inhabited it at some time in the year. She tended to spend the winter in Florida, the summer in Toronto, and the fall in Whistler. Number of years owned Required: a. Determine the minimum taxable capital gain to be reported by Sharon on the sale of the three properties. Gain per year Proceeds Adjusted cost base Gain Cost $200,000 250,000 120.000 Principal residence exemption Capital gain Taxable capital gain Selling price(net of commission and other selling costs) $ 700,000 400,000 330,000 Minimun taxable capital gain HOME CONDO CHALET b. For each of the years listed, indicate which property is designated as a principal residence. Year 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 Property

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To determine the minimum taxable capital gain on the sale of the three properties we first need to calculate the capital gain for each property and th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started