Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Sharon Von Hatton is the only employee of a self - employed businessperson. She earned a monthly salary of $ 2 , 0 5 0

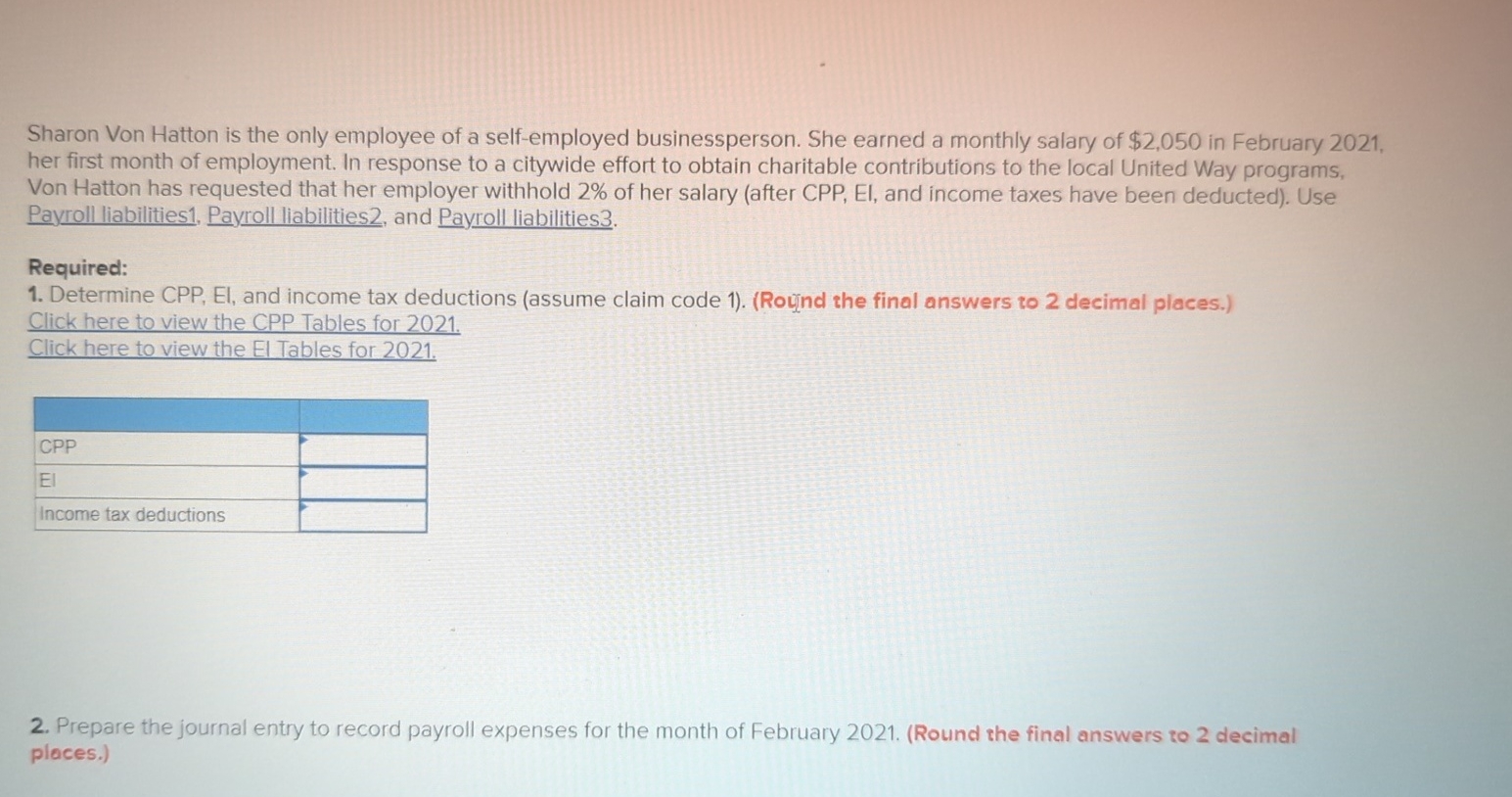

Sharon Von Hatton is the only employee of a selfemployed businessperson. She earned a monthly salary of $ in February her first month of employment. In response to a citywide effort to obtain charitable contributions to the local United Way programs, Von Hatton has requested that her employer withhold of her salary after CPP EI and income taxes have been deducted Use Payroll liabilities Payroll liabilities and Payroll liabilities

Required:

Determine CPP EI and income tax deductions assume claim code Rond the final answers to decimal places.

Click here to view the CPP Tables for

Click here to view the El Tables for

tableCPPEIIncome tax deductions,

Prepare the journal entry to record payroll expenses for the month of February Round the final answers to decimal places.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started