Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Sharon wants to retire in 30 years time, and so decides to start a new retirement savings account. She wants to accumulate 400000 dollars

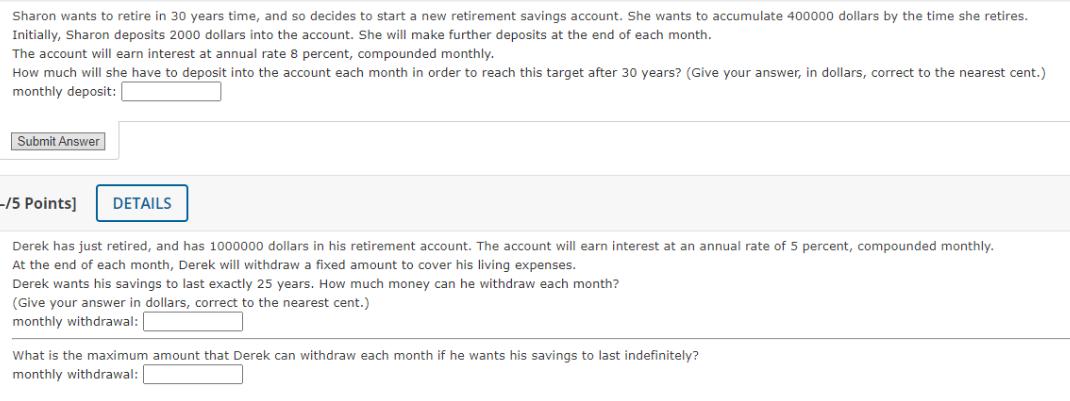

Sharon wants to retire in 30 years time, and so decides to start a new retirement savings account. She wants to accumulate 400000 dollars by the time she retires. Initially, Sharon deposits 2000 dollars into the account. She will make further deposits at the end of each month. The account will earn interest at annual rate 8 percent, compounded monthly. How much will she have to deposit into the account each month in order to reach this target after 30 years? (Give your answer, in dollars, correct to the nearest cent.) monthly deposit: Submit Answer -/5 Points] DETAILS Derek has just retired, and has 1000000 dollars in his retirement account. The account will earn interest at an annual rate of 5 percent, compounded monthly. At the end of each month, Derek will withdraw a fixed amount to cover his living expenses. Derek wants his savings to last exactly 25 years. How much money can he withdraw each month? (Give your answer in dollars, correct to the nearest cent.) monthly withdrawal: What is the maximum amount that Derek can withdraw each month if he wants his savings to last indefinitely? monthly withdrawal:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Solution 1 Sharons Monthly Deposit We can use the Future Value of an Ordinary Annuity formula to sol...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started