Answered step by step

Verified Expert Solution

Question

1 Approved Answer

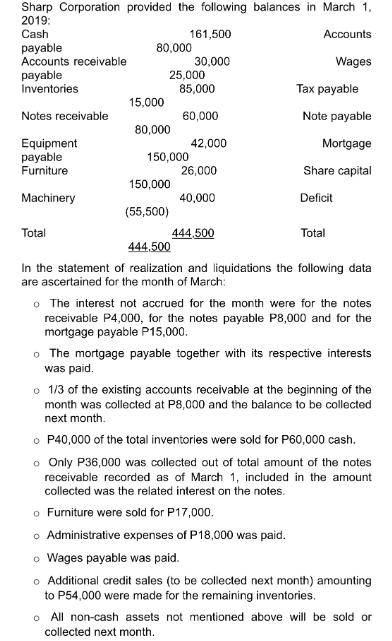

Sharp Corporation provided the following balances in March 1, 2019: Cash 161,500 30,000 payable Accounts receivable payable Inventories Notes receivable Equipment payable Furniture Machinery

Sharp Corporation provided the following balances in March 1, 2019: Cash 161,500 30,000 payable Accounts receivable payable Inventories Notes receivable Equipment payable Furniture Machinery Total 80,000 15,000 25,000 80,000 85,000 60,000 150,000 150,000 (55,500) 42,000 26,000 40,000 444,500 Accounts Wages Tax payable Note payable Mortgage Share capital Deficit Total 444,500 In the statement of realization and liquidations the following data are ascertained for the month of March: o The interest not accrued for the month were for the notes receivable P4,000, for the notes payable P8,000 and for the mortgage payable P15,000. o The mortgage payable together with its respective interests was paid. o 1/3 of the existing accounts receivable at the beginning of the month was collected at P8,000 and the balance to be collected next month. o P40,000 of the total inventories were sold for P60,000 cash. o Only P36,000 was collected out of total amount of the notes receivable recorded as of March 1, included in the amount collected was the related interest on the notes. o Furniture were sold for P17,000. o Administrative expenses of P18,000 was paid. o Wages payable was paid. o Additional credit sales (to be collected next month) amounting to P54,000 were made for the remaining inventories. o All non-cash assets not mentioned above will be sold or collected next month. 38. What is the total amount of assets to be realized in the Statement of Realization and Liquidation at the beginning of April? 39. What is the estate equity at the end of March? 40. What is the payment to unsecured without priority liabilities in March?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started