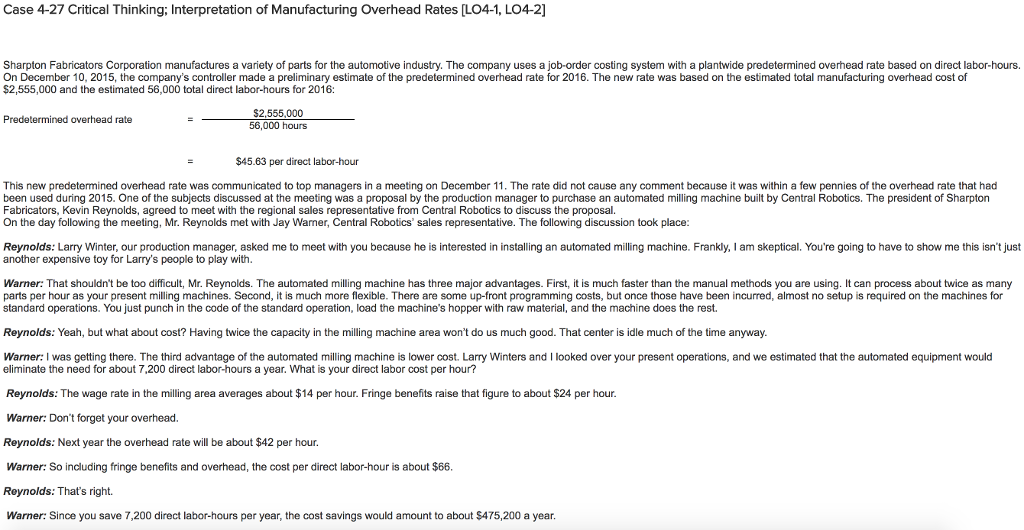

Sharpton Fabricators Corporation manufactures a variety of parts for the automotive industry. The company uses a job-order costing system with a plantwide predetermined overhead rate based on direct labor-hours. On December 10, 2015, the companys controller made a preliminary estimate of the predetermined overhead rate for 2016. The new rate was based on the estimated total manufacturing overhead cost of $2,555,000 and the estimated 56,000 total direct labor-hours for 2016:

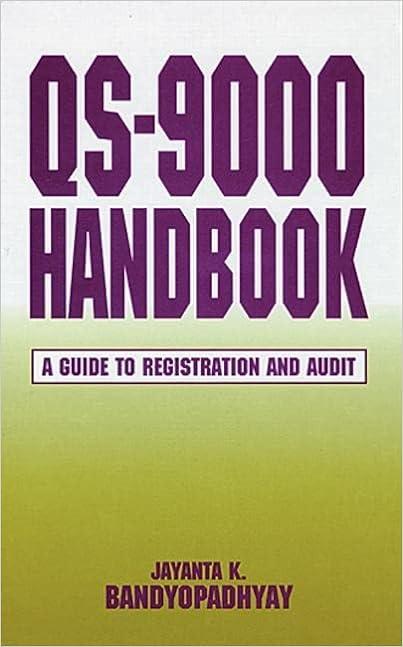

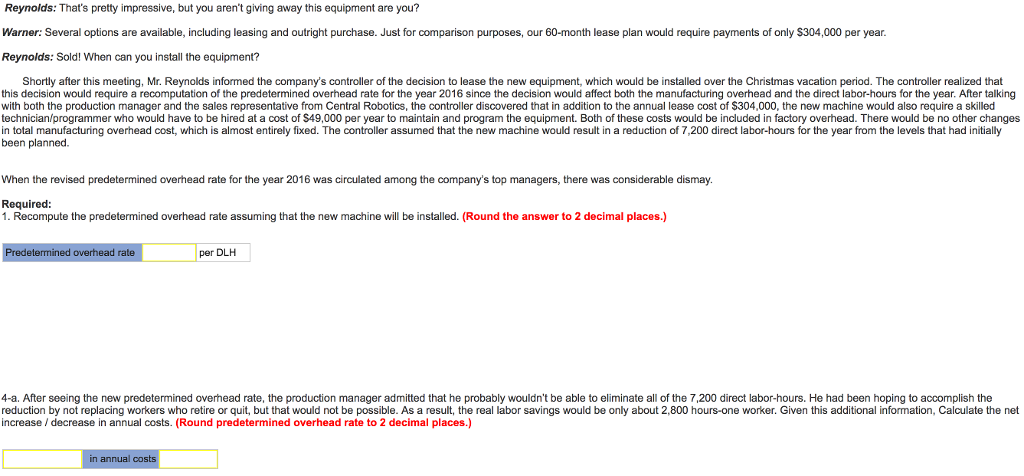

Case 4-27 Critical Thinking; Interpretation of Manufacturing Overhead Rates CLO4-1, LO4-2] Sharpton Fabricators Corporation manufactures a variety of parts for the automotive industry. The company uses a job-order costing system with a plantwide predetermined overhead rate based on direct labor-hours On December 10, 2015, the company's controller made a preliminary estimate of the predetermined overhead rate for 2016. The new rate was based on the estimated total manufacturing overhead cost of $2,555,000 and the estimated 56,000 total direct labor-hours for 2016 $2.555.000 Predetermined overhead rate 56,000 hours $45.63 per direct labor-hou This new predetermined overhead rate was communicated to top managers in a meeting on December 11. The rate did not cause any comment because it was within a few pennies of the overhead rate that had been used during 2015. One of the subjects discussed at the meeting was a proposal by the production manager to purchase an automated milling machine built by Central Robotics. The president of Sharpton Fabricators, Kevin Reynolds, agreed to meet with the regional sales representative from Central Robotics to discuss the proposal On the day following the meeting, Mr. Reynolds met with Jay Warner, Central Robotics' sales representative. The following discussion took place Reynolds: Larry Winter, our production manager, asked me to meet with you because he is interested in installing an automated milling machine. Frankly, I am skeptical. You're going to have to show me this isn't just another expensive toy for Larry's people to play with Warner: That shouldn't be too difficult, Mr. Reynolds. The automated milling machine has three major advantages. First, it is much faster than the manual methods you are using. It can process about twice as many parts per hour as your present milling machines. Second, it is much more flexible. There are some up-front programming costs, but once those have been incurred, almost no setup is required on the machines for standard operations. You just punch in the code of the standard operation, load the machine's hopper with raw material, and the machine does the rest. Reynolds: Yeah, but what about cost? Having twice the capacity in the milling machine area won't do us much good. That center is idle much of the time anyway. Warner: I was getting there. The third advantage of the automated milling machine is lower cost. Larry Winters and Ilooked over your present operations, and we estimated that the automated equipment would eliminate the need for about 7.200 direct labor-hours a year. What is your direct labor cost per hour? Reynolds: The wage rate in the milling area averages about $14 per hour. Fringe benefits raise that figure to about $24 per hour. Warner: Don't forget your overhead Reynolds: Next year the overhead rate will be about $42 per hour. Warner: So including fringe benefits and overhead, the cost per direct labor-hour is about $66. Reynolds: That's right. Warner: Since you save 200 direct labor-hours per year, the cost savings would amount to about $475,200 a year