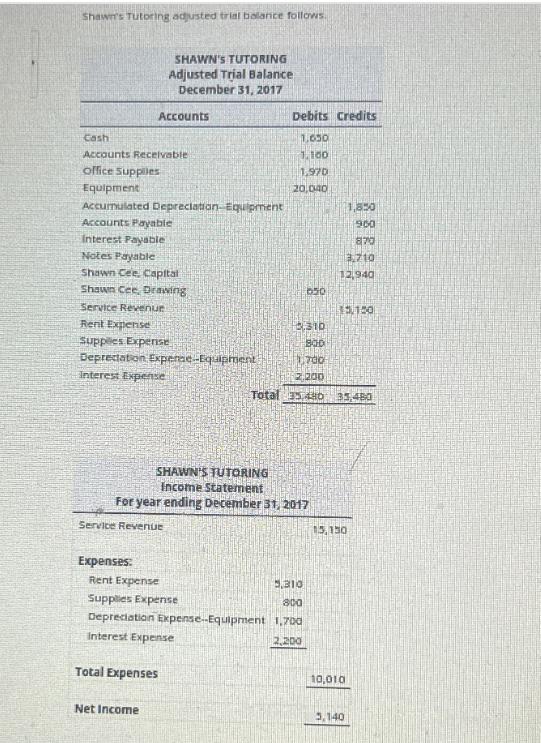

Prepare Shawn's statement of Owner's Equity for the year ended December 31, 2017. Shawn's Tutoring adjusted trial balance follows. SHAWN'S TUTORING Adjusted Trial Balance December

Shawn's Tutoring adjusted trial balance follows. SHAWN'S TUTORING Adjusted Trial Balance December 31, 2017 Accounts Debits Credits Cash Accounts Receivable Office Suppiles Equipment 1.630 1,100 1.970 20,040 Accumulated Depreciation-Equipment 1,850 960 Accounts Payable Interest Payable 870 Notes Payable 3.710 Shawn Cee. Capital 12,940 Shawn Cee, Drawing 050 Service Revenue 15.100 Rent Expense 5.310 Supplies Expense Depreciation Expense-Equipment BOD Interest Expense 1730 2.200 Total 35480 35,480 SHAWN'S TUTORING Income Statement For year ending December 31, 2017 Service Revenue Expenses: Rent Expense Supplies Expense 5.310 800 Depreciation Expense-Equipment 1,700 Interest Expense 2,200 Total Expenses Net Income 15,150 10,010 3,140

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The image you sent is of Shawns Tutoring adjusted trial balance for the year ended December 31 2017 It also includes an income statement The adjusted trial balance lists all of the accounts in the gen...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started