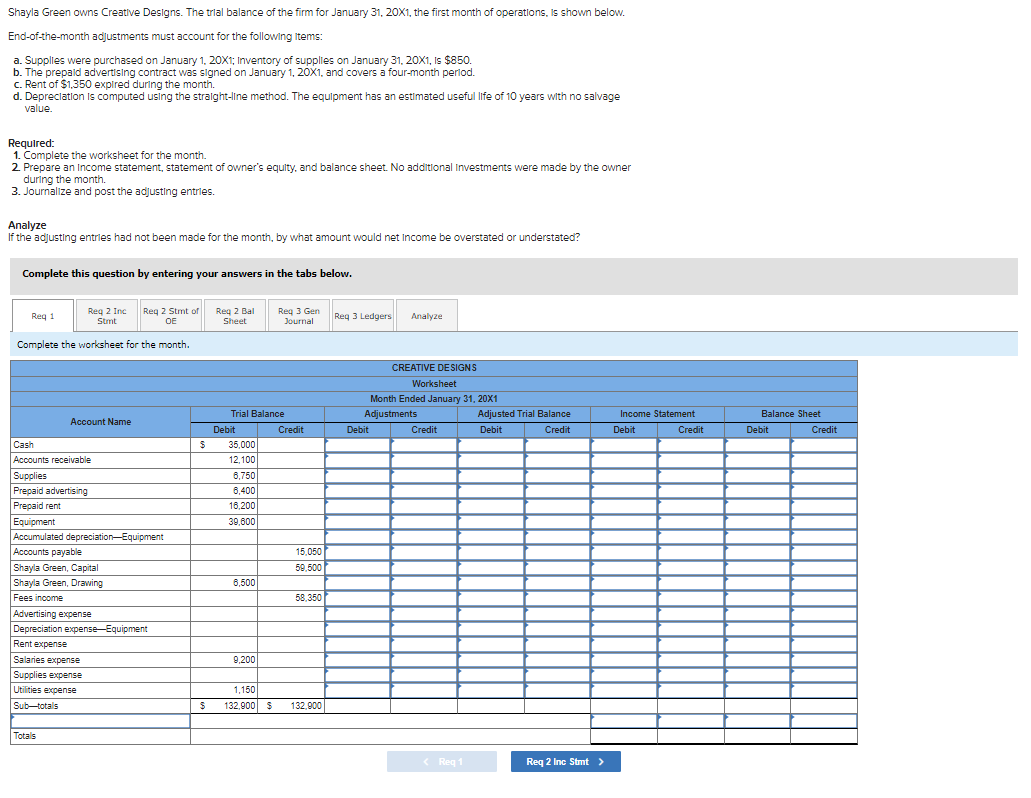

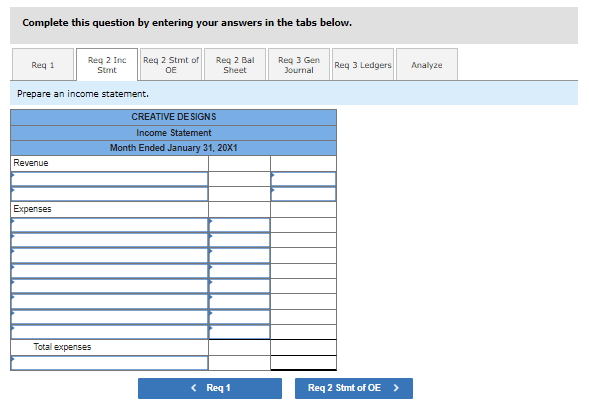

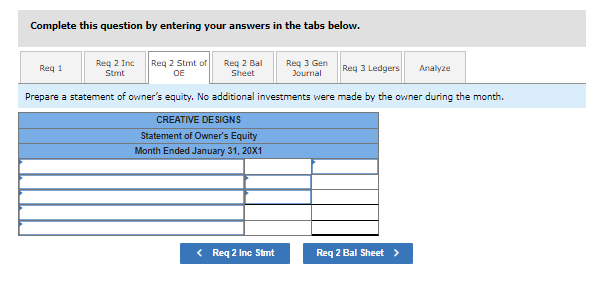

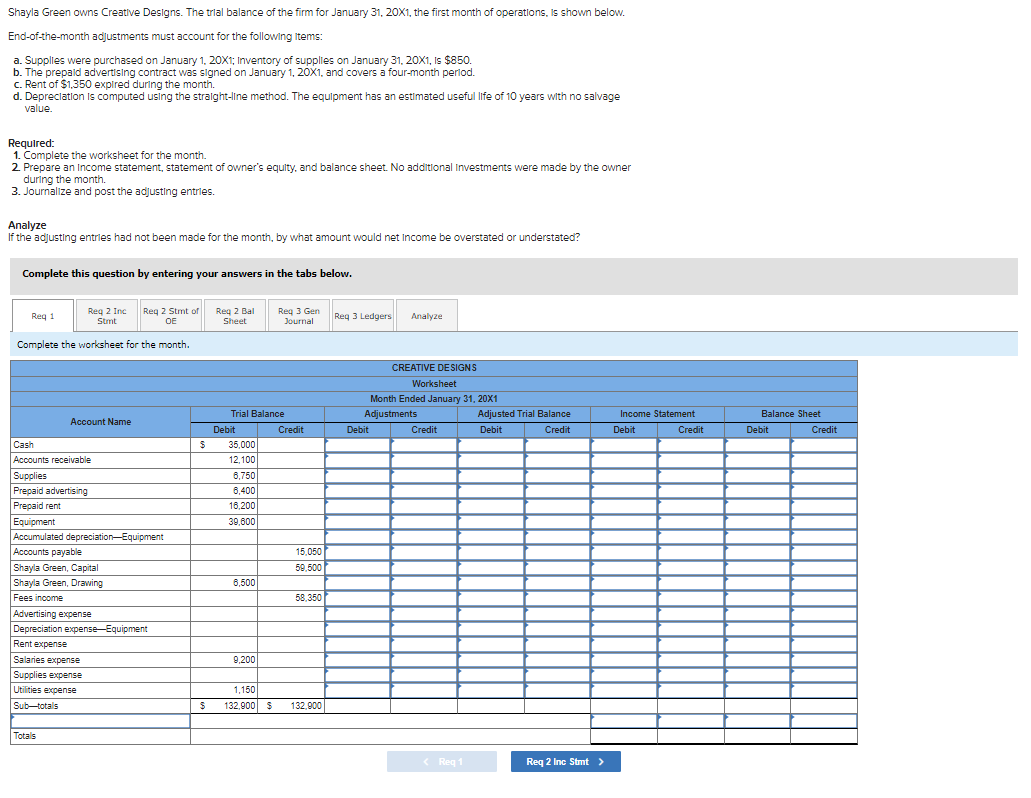

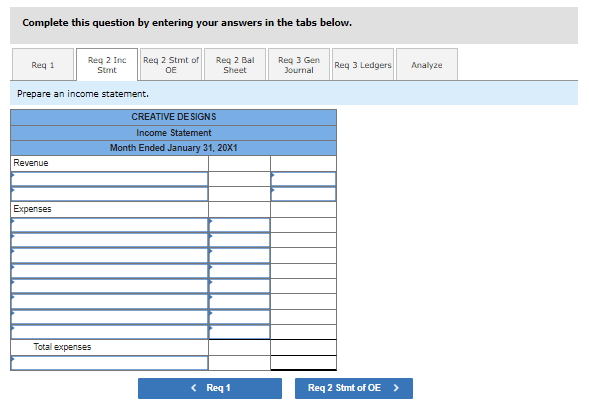

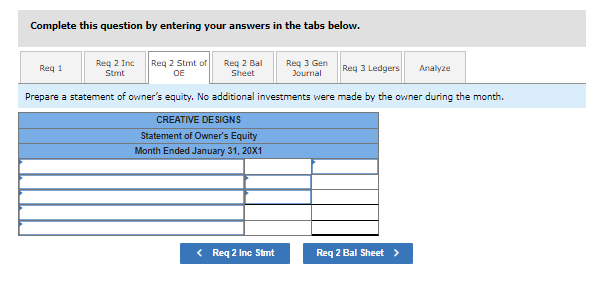

Shayla Green owns Creative Designs. The trial balance of the firm for January 31, 20X1, the first month of operations, is shown below. End-of-the-month adjustments must account for the following items: a. Supplies were purchased on January 1, 20X1; Inventory of supplies on January 31, 20X1, is $850. b. The prepaid advertising contract was signed on January 1, 20X1, and covers a four-month period. C. Rent of $1,350 expired during the month. d. Depreciation is computed using the straight-line method. The equipment has an estimated useful life of 10 years with no salvage value. Required: 1. Complete the worksheet for the month 2. Prepare an Income statement, statement of owner's equity, and balance sheet. No additional Investments were made by the owner during the month. 3. Journalize and post the adjusting entries. Analyze If the adjusting entries had not been made for the month, by what amount would net Income be overstated or understated? Complete this question by entering your answers in the tabs below. Req 1 Reg 2 Inc Stmt Reg 2 Stmt of OE Req 2 Bal Sheet Reg 3 Gen Journal Rey 3 Ledgers Analyze Complete the worksheet for the month. CREATIVE DESIGNS Worksheet Month Ended January 31, 20X1 Adjustments Adjusted Trial Balance Debit Credit Debit Credit Account Name Income Statement Debit Credit Balance Sheet Debit Credit 5 Trial Balance Debit Credit 35,000 12,100 8,750 8,400 16,200 39,600 15 050 59,500 Cash Accounts receivable Supplies Prepaid advertising Prepaid rent Equipment Accumulated depreciation-Equipment Accounts payable Shayla Green, Capital Shayla Green, Drawing For Fees income m Advertising expense Depreciation expense-Equipment Rent expense Salaries expense Supplies expense Utilities expense Sub-totals 6,500 58,350 9,200 1.150 132,900 $ $ 132.900 Totals Complete this question by entering your answers in the tabs below. Req 1 Reg 2 Inc Stmt Reg 2 Stmt of OE Req 2 Bal Sheet Req 3 Gen Journal Reg 3 Ledgers Analyze Prepare an income statement. CREATIVE DESIGNS Income Statement Month Ended January 31, 20X1 Revenue Expenses Total expenses Complete this question by entering your answers in the tabs below. Reg 2 Inc Reg 1 Sunt Reg 2 Stmt of OE Reg 2 Bal Sheet Reg 3 Gen Journal Reg 3 Ledgers Analyze Prepare a statement of owner's equity. No additional investments were made by the owner during the month. CREATIVE DESIGNS Statement of Owner's Equity Month Ended January 31, 20X1 Complete this question by entering your answers in the tabs below. Req1 Reg 2 Inc Simt Reg 2 Stmt of OE Reg 2 Bal Sheet Req 3 Gen Journal Rey 3 Ledgers Analyze Prepare a balance sheet. CREATIVE DESIGNS Balance Sheet January 31, 20X1 Assets Total assets Liabilities and Owner's Equity Liabilities Owner's Equity Total Liabilities and Owner's Equity Journal entry worksheet Post the adjusting entries. Supplies Date Debit Jan. 1. 20X1 Jan. 31. 20X1 Account No. 121 Credit Balance Account No. 130 Credit Balance Prepaid Advertising Date Debit Jan. 01, 20X1 Jan 31, 20X1 Account No.131 Credit Balance Prepaid Rent Date Debit Jan 1, 20X1 Jan. 31. 20X1 Accumulated Depreciation-Equipment Date Debit Jan 31, 20X1 Account No. 142 Credit Balance Supplies Expense Date Debit Jan. 31. 20X1 Account No.517 Credit Balance Advertising Expense Date Debit Jan 31, 20X1 Account No. 519 Credit Balance Rent Expense Date Debit Jan. 31, 20X1 Account No. 520 Credit Balance Depreciation Expense-Equipment Date Debit Jan 31, 20X1 Account No. 523 Credit Balance If the adjusting entries had not been made for the month, by what amount would net income be overstated or understated? Net income Amount Req 3 Ledgers Analyze