Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Shaylea, age 22, just started working full-time and plans to deposit $4,300 annually into an IRA earning 7 percent interest compounded annually. How much would

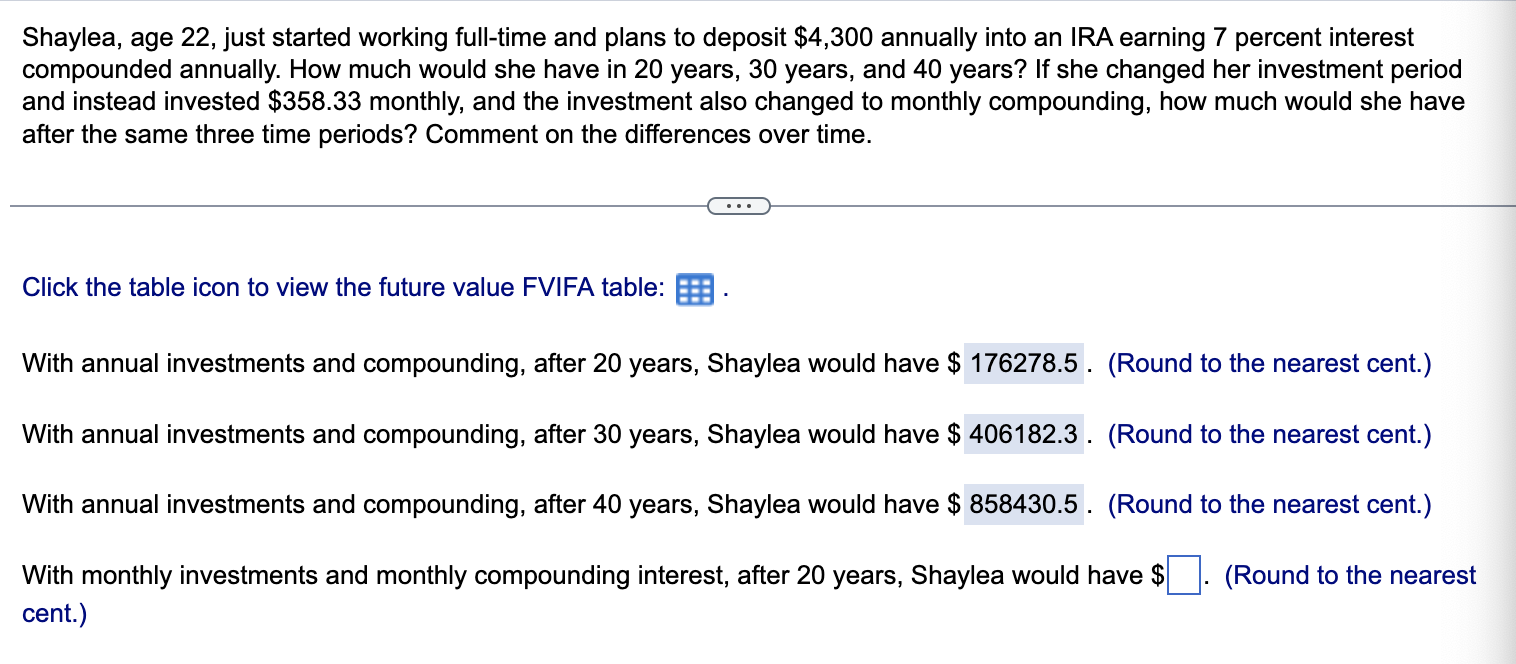

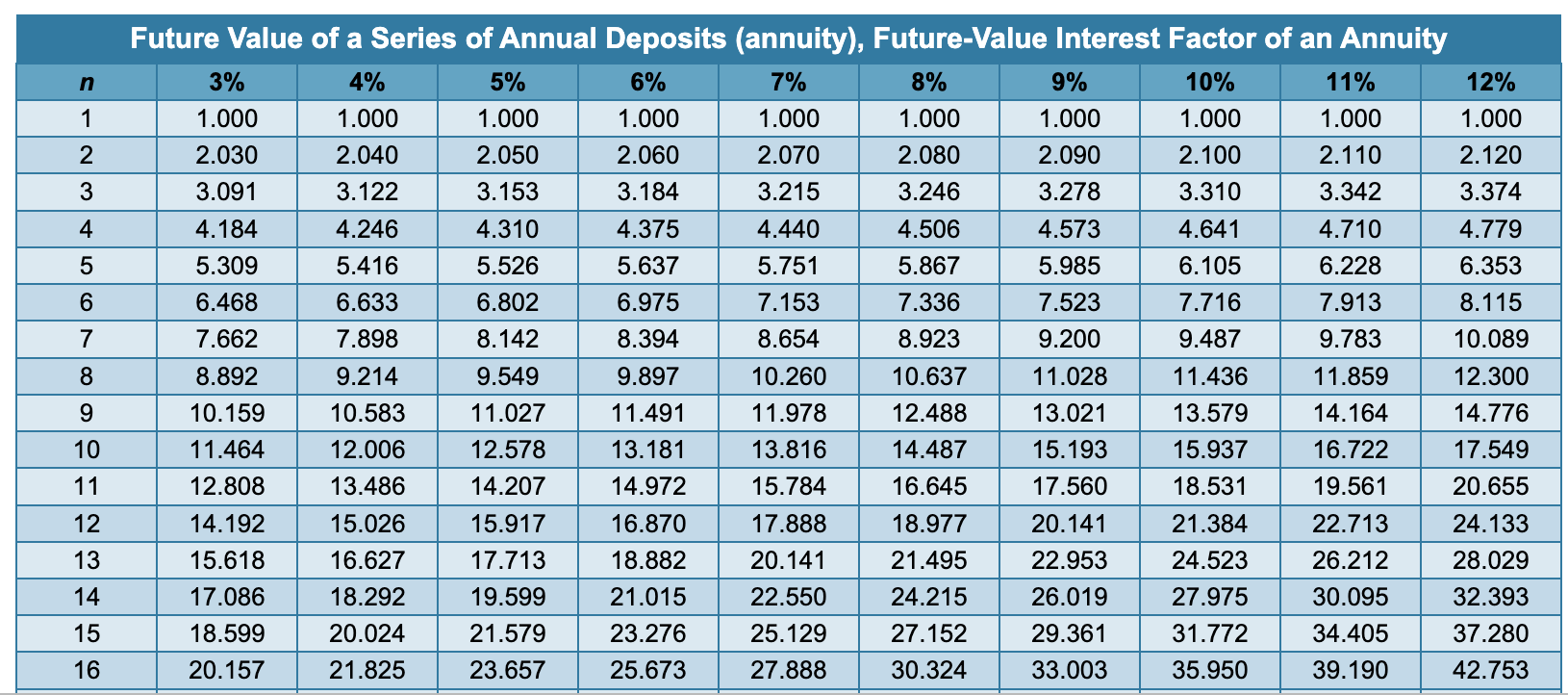

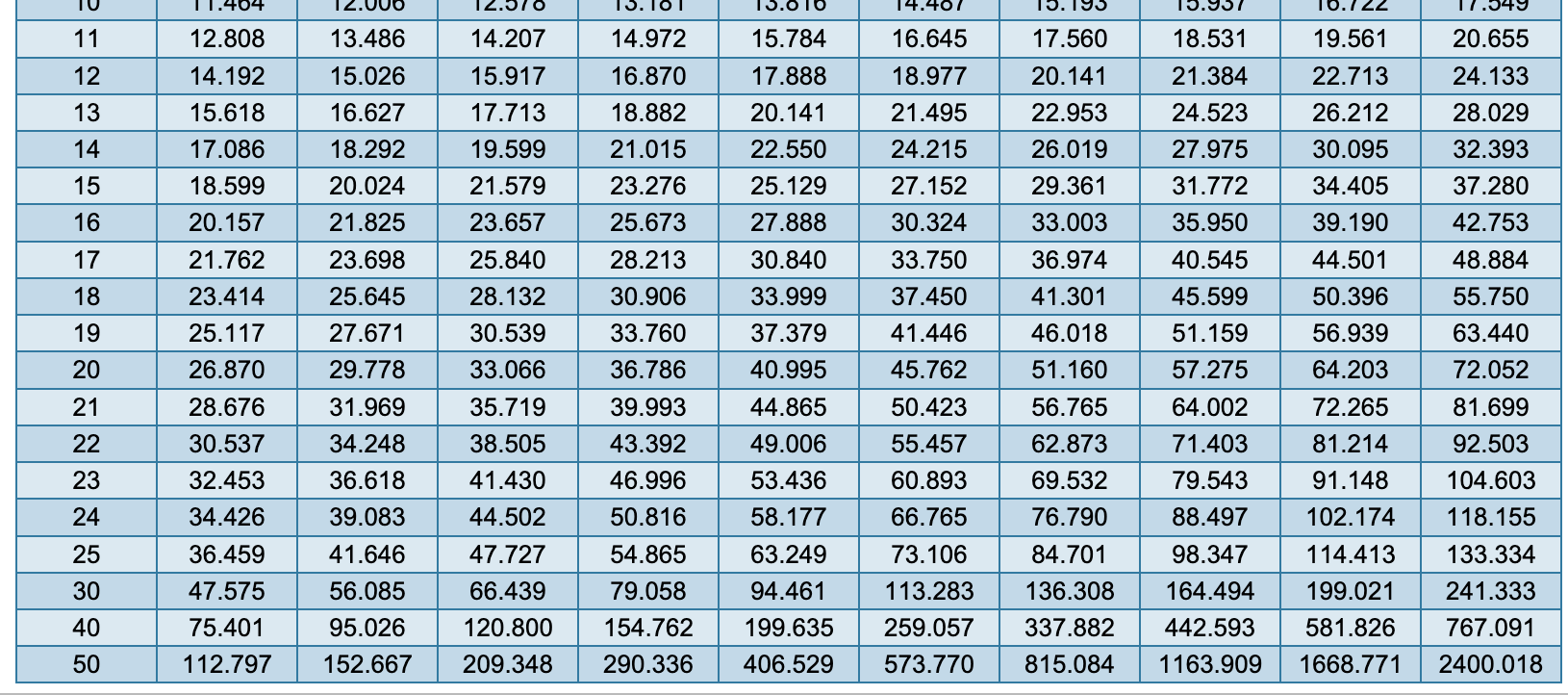

Shaylea, age 22, just started working full-time and plans to deposit $4,300 annually into an IRA earning 7 percent interest compounded annually. How much would she have in 20 years, 30 years, and 40 years? If she changed her investment period and instead invested $358.33 monthly, and the investment also changed to monthly compounding, how much would she have after the same three time periods? Comment on the differences over time. Click the table icon to view the future value FVIFA table: With annual investments and compounding, after 20 years, Shaylea would have $ (Round to the nearest cent.) With annual investments and compounding, after 30 years, Shaylea would have $ (Round to the nearest cent.) With annual investments and compounding, after 40 years, Shaylea would have $ (Round to the nearest cent.) With monthly investments and monthly compounding interest, after 20 years, Shaylea would have \$ . (Round to the nearest cent.) Future Value of a Series of Annual Deposits (annuity), Future-Value Interest Factor of an Annuity \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|} \hline 11 & 12.808 & 13.486 & 14.207 & 14.972 & 15.784 & 16.645 & 17.560 & 18.531 & 19.561 & 20.655 \\ \hline 12 & 14.192 & 15.026 & 15.917 & 16.870 & 17.888 & 18.977 & 20.141 & 21.384 & 22.713 & 24.133 \\ \hline 13 & 15.618 & 16.627 & 17.713 & 18.882 & 20.141 & 21.495 & 22.953 & 24.523 & 26.212 & 28.029 \\ \hline 14 & 17.086 & 18.292 & 19.599 & 21.015 & 22.550 & 24.215 & 26.019 & 27.975 & 30.095 & 32.393 \\ \hline 15 & 18.599 & 20.024 & 21.579 & 23.276 & 25.129 & 27.152 & 29.361 & 31.772 & 34.405 & 37.280 \\ \hline 16 & 20.157 & 21.825 & 23.657 & 25.673 & 27.888 & 30.324 & 33.003 & 35.950 & 39.190 & 42.753 \\ \hline 17 & 21.762 & 23.698 & 25.840 & 28.213 & 30.840 & 33.750 & 36.974 & 40.545 & 44.501 & 48.884 \\ \hline 18 & 23.414 & 25.645 & 28.132 & 30.906 & 33.999 & 37.450 & 41.301 & 45.599 & 50.396 & 55.750 \\ \hline 19 & 25.117 & 27.671 & 30.539 & 33.760 & 37.379 & 41.446 & 46.018 & 51.159 & 56.939 & 63.440 \\ \hline 20 & 26.870 & 29.778 & 33.066 & 36.786 & 40.995 & 45.762 & 51.160 & 57.275 & 64.203 & 72.052 \\ \hline 21 & 28.676 & 31.969 & 35.719 & 39.993 & 44.865 & 50.423 & 56.765 & 64.002 & 72.265 & 81.699 \\ \hline 22 & 30.537 & 34.248 & 38.505 & 43.392 & 49.006 & 55.457 & 62.873 & 71.403 & 81.214 & 92.503 \\ \hline 23 & 32.453 & 36.618 & 41.430 & 46.996 & 53.436 & 60.893 & 69.532 & 79.543 & 91.148 & 104.603 \\ \hline 24 & 34.426 & 39.083 & 44.502 & 50.816 & 58.177 & 66.765 & 76.790 & 88.497 & 102.174 & 118.155 \\ \hline 25 & 36.459 & 41.646 & 47.727 & 54.865 & 63.249 & 73.106 & 84.701 & 98.347 & 114.413 & 133.334 \\ \hline 30 & 47.575 & 56.085 & 66.439 & 79.058 & 94.461 & 113.283 & 136.308 & 164.494 & 199.021 & 241.333 \\ \hline 40 & 75.401 & 95.026 & 120.800 & 154.762 & 199.635 & 259.057 & 337.882 & 442.593 & 581.826 & 767.091 \\ \hline 50 & 112.797 & 152.667 & 209.348 & 290.336 & 406.529 & 573.770 & 815.084 & 1163.909 & 1668.771 & 2400.018 \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started