Question

Shaz company's (SHZ) stock is currently priced at $55.00 per share. During the latest 12 months, the company made $280.0 million in reported net

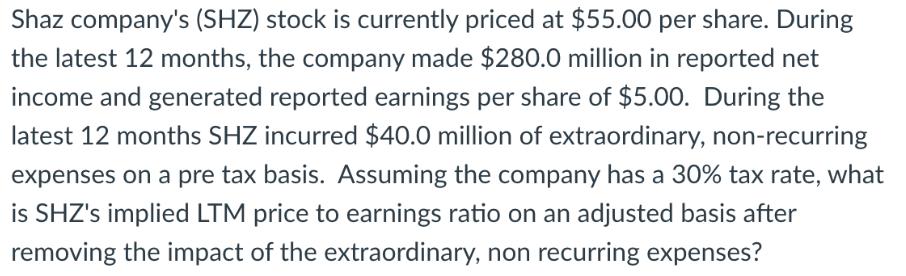

Shaz company's (SHZ) stock is currently priced at $55.00 per share. During the latest 12 months, the company made $280.0 million in reported net income and generated reported earnings per share of $5.00. During the latest 12 months SHZ incurred $40.0 million of extraordinary, non-recurring expenses on a pre tax basis. Assuming the company has a 30% tax rate, what is SHZ's implied LTM price to earnings ratio on an adjusted basis after removing the impact of the extraordinary, non recurring expenses?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the implied LTM price to earnings ratio on an adjusted basis we need to adjust the repo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Foundations of Financial Management

Authors: Stanley Block, Geoffrey Hirt, Bartley Danielsen

15th edition

77861612, 1259194078, 978-0077861612, 978-1259194078

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App