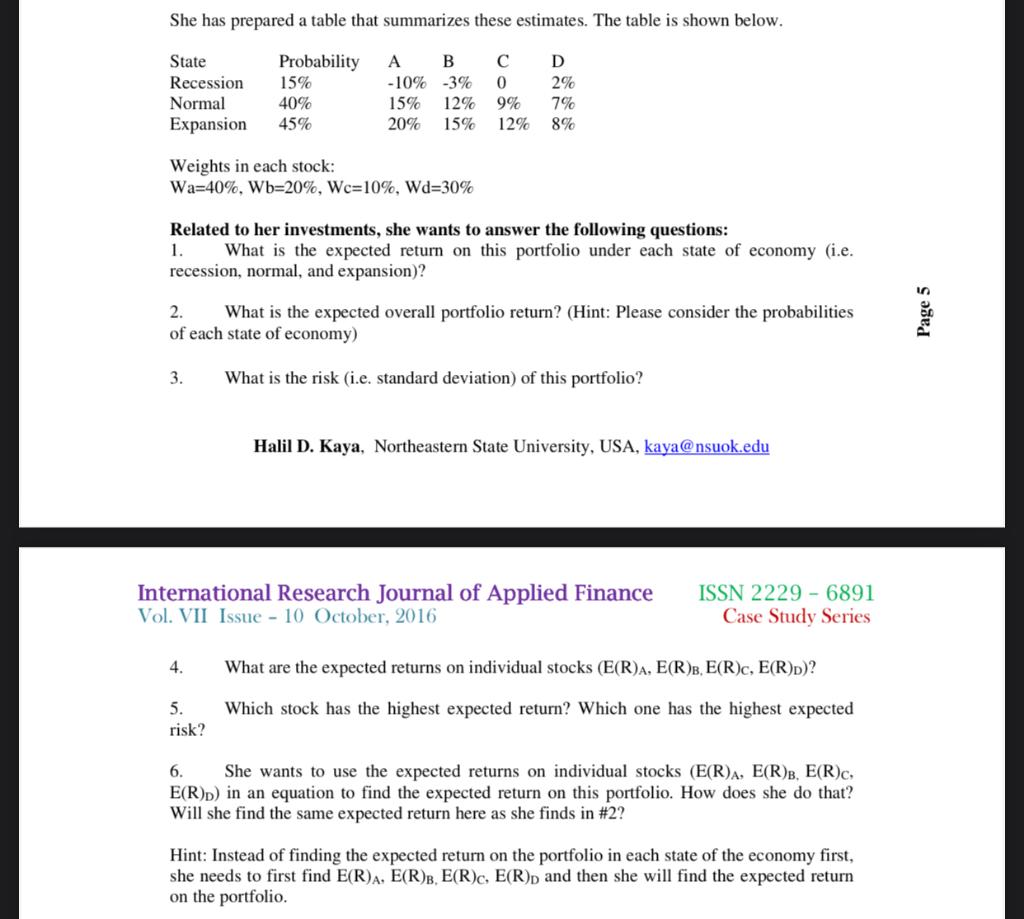

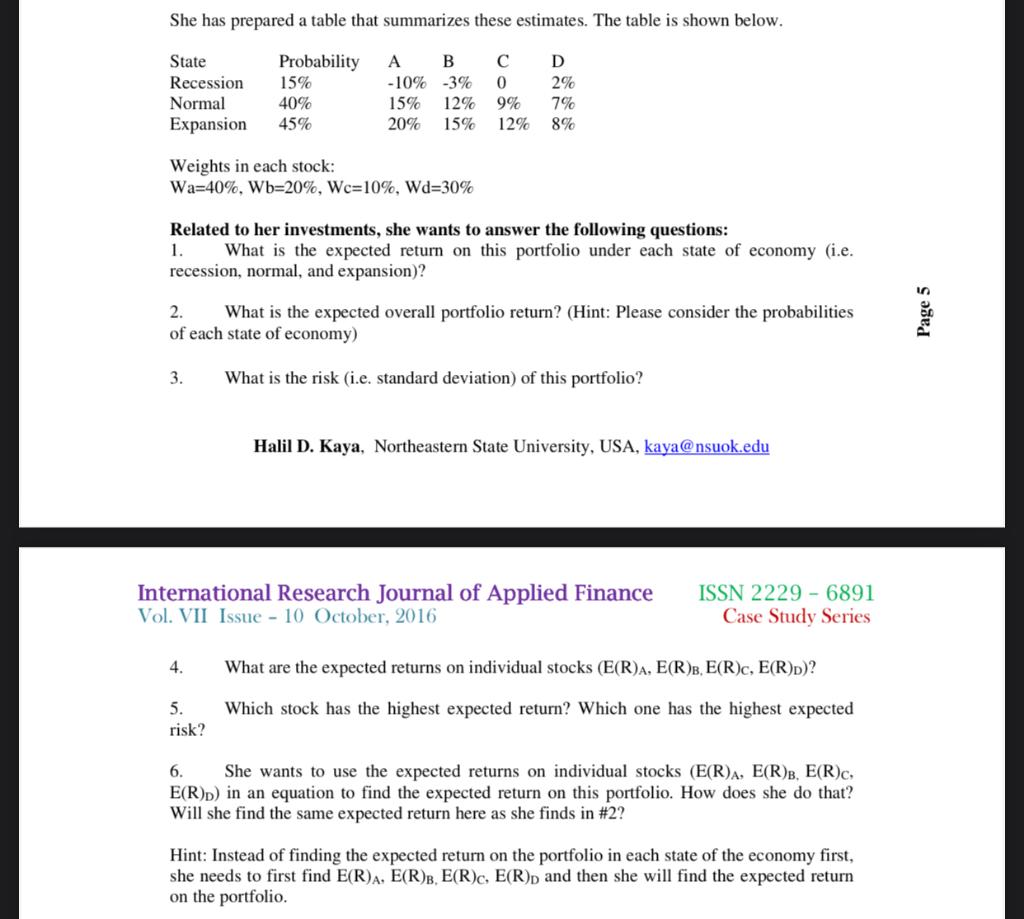

She has prepared a table that summarizes these estimates. The table is shown below. State Recession Normal Expansion Probability 15% 40% 45% A B -10% -3% 15% 12% 20% 15% 0 9% 12% D 2% 7% 8% Weights in each stock: Wa=40%, Wb=20%, Wc=10%, Wd=30% Related to her investments, she wants to answer the following questions: 1. What is the expected return on this portfolio under each state of economy (i.e. recession, normal, and expansion)? 2. What is the expected overall portfolio return? (Hint: Please consider the probabilities of each state of economy) Page 5 3. What is the risk i.e. standard deviation) of this portfolio? Halil D. Kaya, Northeastern State University, USA, kaya@nsuok.edu International Research Journal of Applied Finance Vol. VII Issue - 10 October, 2016 ISSN 2229 - 6891 Case Study Series 4. What are the expected returns on individual stocks (E(R)A, E(R), E(R), E(R)!)? 5. risk? Which stock has the highest expected return? Which one has the highest expected 6. She wants to use the expected returns on individual stocks (E(R)A, E(R), E(R)c, E(R)p) in an equation to find the expected return on this portfolio. How does she do that? Will she find the same expected return here as she finds in #2? Hint: Instead of finding the expected return on the portfolio in each state of the economy first, she needs to first find E(R)A, E(R)B, E(R), E(R) and then she will find the expected return on the portfolio She has prepared a table that summarizes these estimates. The table is shown below. State Recession Normal Expansion Probability 15% 40% 45% A B -10% -3% 15% 12% 20% 15% 0 9% 12% D 2% 7% 8% Weights in each stock: Wa=40%, Wb=20%, Wc=10%, Wd=30% Related to her investments, she wants to answer the following questions: 1. What is the expected return on this portfolio under each state of economy (i.e. recession, normal, and expansion)? 2. What is the expected overall portfolio return? (Hint: Please consider the probabilities of each state of economy) Page 5 3. What is the risk i.e. standard deviation) of this portfolio? Halil D. Kaya, Northeastern State University, USA, kaya@nsuok.edu International Research Journal of Applied Finance Vol. VII Issue - 10 October, 2016 ISSN 2229 - 6891 Case Study Series 4. What are the expected returns on individual stocks (E(R)A, E(R), E(R), E(R)!)? 5. risk? Which stock has the highest expected return? Which one has the highest expected 6. She wants to use the expected returns on individual stocks (E(R)A, E(R), E(R)c, E(R)p) in an equation to find the expected return on this portfolio. How does she do that? Will she find the same expected return here as she finds in #2? Hint: Instead of finding the expected return on the portfolio in each state of the economy first, she needs to first find E(R)A, E(R)B, E(R), E(R) and then she will find the expected return on the portfolio