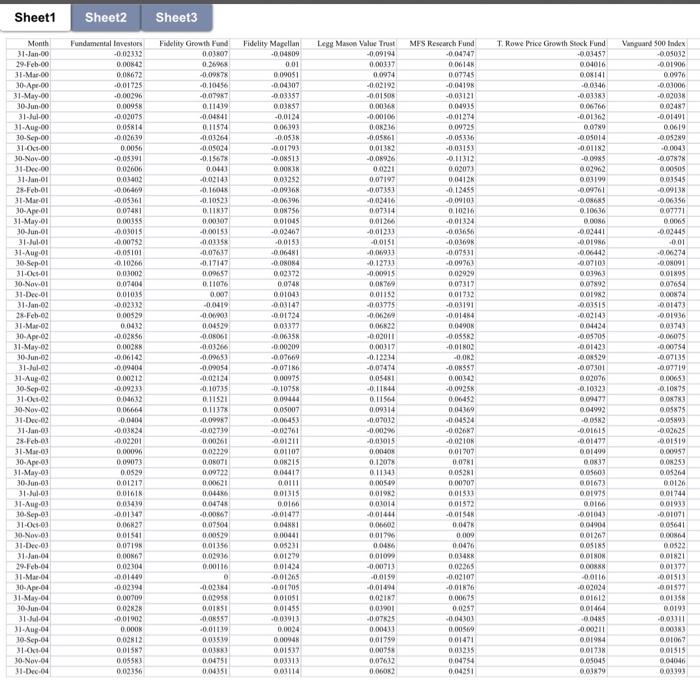

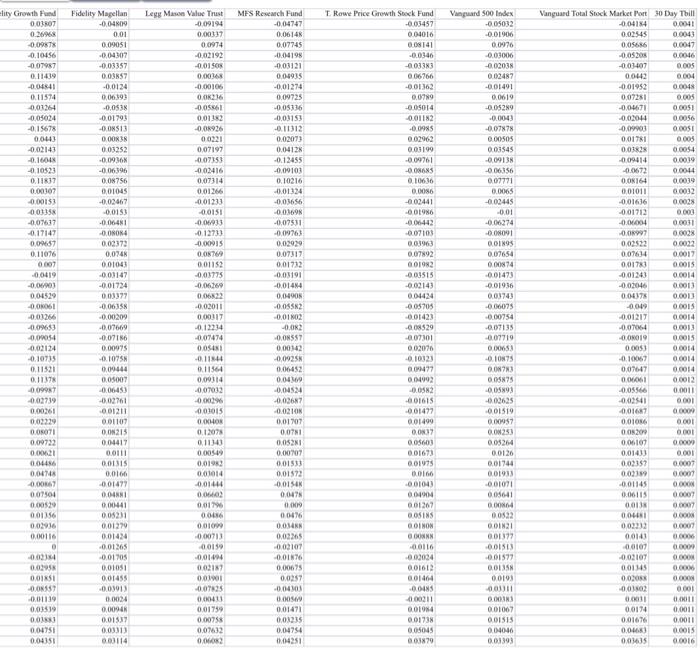

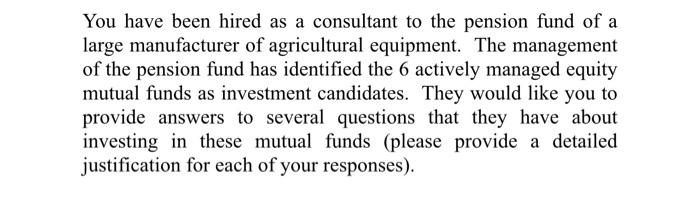

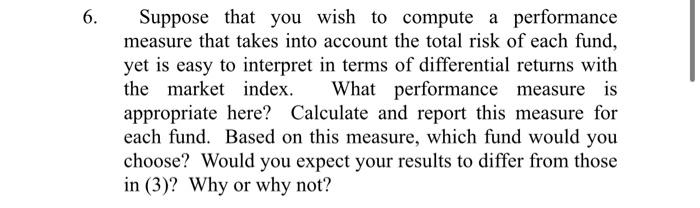

Sheet1 Sheet2 Sheet3 Vanguard 500 Index -0.05032 -0.01906 0096 -0.03006 -00203 0.02487 -0.01491 0.0619 Fundamental lavestors -0.02332 0.00842 0,08672 -0.01725 -0.00296 0.00958 -0.02075 0.05814 -0.02639 0.0056 -009391 0,02606 0.03402 -0.06469 -0.05361 0.0741 0.00355 -0.03015 -0.00752 T. Rowe Price Growth Stock Fund -0.03457 0.04016 0.08141 -0.0146 -0.03383 0.05766 -0.01362 0.0789 -0.05014 -0.01182 -0.0985 0.02962 0.03199 -0.00761 -0.03685 010636 0.0086 -0.02441 6NZSOO -0.0043 -0.07878 0.00505 SPSEOO - ( Fidelity Magellan -0.04809 0,01 0.09051 -0.047 -0.03357 OORS? -0.0124 0.06391 -0.0SUN -0.01293 -0.0NS13 0.003 0.03252 -00916N -0.06396 0.0N756 0.01045 -0.02467 -0,015) -0.064N1 -0.0NONG 0.02372 0.074 0.01043 -0.03147 0.01724 003377 -0.063SN -0.00209 -0,07669 -0.0716 0.00975 -0.1075 0.00444 0.05007 -0.06453 -0.02761 -0.01211 986100 TOIS0O- Month 31-Jan-00 29-Feb-00 31-Mar-00 30-Apr.00 31-May-00 30-Jun-00 31-Jul-00 31-Aug-00 30-Sep-00 31-00-00 so. Nov.00 31-Dec-00 31-Jan-01 28-Feb01 31-Mar-01 30-Apr-01 31-May.01 30-Jun-01 31-Jul-01 31-Aug-01 30-Sep-01 31-Oct-01 10.Nov.01 31-Dec-01 31-Jan-02 28-Feb-02 31-Mar-02 10-Apr-02 31-May-02 30-Jun-02 31-Jul-2 31-Aug-02 30-Sep-02 31-Oct-02 30-Nov.02 31-Dec-02 31-Jan-03 28-Feb-03 31-Mar-03 30-Apr-03 31. May 03 30-Jun-03 31 Jul 03 31-Aug-03 30-Sep-63 31-Oct-00 3. Nov.03 31-Dec-03 31. Jan 04 29-Feb-04 Fidelity Growth Fund 0.0107 0.26% -0.09878 -0.10456 -0,07967 0.11419 -0.04841 0.11574 -0.03264 -0.05024 -0.15678 0,043 4102141 -0.16015 -0.10523 0.1187 0.00T -0.00153 -0.00158 -4:07637 -0.17147 0.0057 0.11076 0.007 -0,0419 4.00 0.04529 -0.0061 -003266 -0.0963 -0,09054 -0.02124 -0.10735 0.11521 0.11378 -0.0997 -0.02730 0.00261 0.02229 0.080TI 0.09722 0.00621 0.0146 0.04745 -0.00367 0.07504 0.06442 -0.07103 0.03963 0.07892 0.01982 Legg Maw Value Trust -0.09194 0.00337 0.0974 -0,02192 -0.01505 0.00368 -0.00106 0.0X216 -0.0561 0.01382 -0.01926 0,0221 0,07197 -0.07153 -0,02416 0,07314 0.01266 -0.01233 -0.0151 00913 -0.12733 -0.00915 0.05769 0.01152 -0,03775 -0.0629 0.06822 -0.02011 0.00317 -0.12214 -0,07474 0.05481 -0.11844 0.11564 0.09314 -0.07032 -0.00296 -0.01015 0.00405 0.1 2018 0.11343 0.005.09 0.01952 0.01014 -0.01444 0.002 SISED MES Research Fund -0.04747 0.0614 0,07745 -0.04198 -0,03121 0,04935 -0.01274 0,09725 -0.05336 -0.03153 -0.11312 0.02073 0,0412 -0.12455 -0,09103 0.10216 -0.01324 -0.03656 -0.03698 -0.07931 -0,0976) 0.02929 0.07317 0.01732 -0,03191 -0.0144 0.0490 -0.05582 -0.018 -0.02 -0.08557 0.00342 -0,09258 0.06452 0.04369 -0.04524 -0,02657 -0.0210N 0.01707 0.0781 0,05281 0.00207 0.01931 0.01572 -0.0154 0.0478 0.009 00476 0.034 0,02265 -0.02107 -0.016 0.00675 0.0257 -0.04301 0.0050 0.01471 0.03235 0.04754 0,04251 -0.02143 0.04424 -0.05705 -0.01423 -0.08529 -0.07301 0.02076 -0.10323 0.09477 0.04992 -0.052 -0.10266 0,03002 0.07404 0.01035 -0.02332 0.00529 0.0432 -0.02856 0.00288 -0.06142 -0,09404 0.00212 -0.09233 0.04632 0.06664 -0.0404 -0,03824 -0.02201 0.00096 0.09073 0.0529 0.01217 0.0161 0,03419 -0.01347 0.06827 001541 0.07198 0.00167 0.02304 -0.01449 -0.02394 0.00709 0.02828 -0.01902 0.000 0.02812 0.0157 00013 0.06356 0.07771 0.0065 -0.02445 -0.01 -006274 00091 0.0195 0.07654 0.00874 -0.01473 001936 0.03743 -0.06075 -0.00754 -0.07135 -0.07719 0.00653 -0.10075 0.04783 0.05875 -0.05893 -0.02625 -0.01519 0.004957 0.00253 0.05264 0.0126 0.01744 0.01933 -0.01071 0.05641 - $19100- LO1100 LENOVO 0.01427 001499 0.0 0.05603 001673 0.01975 0.0106 ER100 OLSO WALIO PROTO 0.01356 0,02936 0.00116 0.08215 0.04417 00111 0.01315 0.0160 0.01427 0.04881 0.00441 0,05231 0.01279 0.01424 -0.01265 -0.01705 0.01051 0.01455 -0.03913 0.0024 0.009 0.0151 0.03313 003114 0.01904 0.01267 COSINS 0.0ISON OOONNN POWIE 0 91100 30-Apr-04 31 May.01 30-Jun-04 31-Jul-04 31-Aug-04 30-Sep-04 31.01.04 30-Nov.04 31-Dec-14 00486 0.0100 -0.00713 -0.0159 -0.01494 0,02187 0.01901 -0.07625 0.00431 0.01759 0.00758 0,07612 0.0602 4002134 0.00958 0.01851 -0,08557 -0.01139 0.03519 0.035 0,04751 0,04351 -0.02024 0.01612 0.01464 -0.0NS -0.00211 0.01984 0.01738 00522 0.01821 0.01172 -0.01513 -0.01577 0.01358 0.0199 -0,03311 0.00383 0.01067 . SIS100 (NSS00 SPOSOO 0.04046 0.03399 0.02356 DON9 lity Growth Fund Fidelity Magellan -0.04809 Legg Mason Value Trust Vanguard 500 Index LONDO 1600- LETOVO MES Reach Fund -0,04747 0.0614 T Rowe Price Growth Stock Fund -0.03457 0.04016 TEOSO- 906100 Vanguard Total Stock Market Port 30 Day Thill -0.04184 0.02545 100 0.2696 -0.09678 Itovo 1000 LOOD 9700 0.09051 0.0974 SPLZOO 861100 IP1800 STOIO LOEN -0.0346 C6IzOO SOS 100- 0.0976 -0.03006 -0.0203N 0.02487 ENEEDO 9900 OTSOO LOTEOO- CHOD -007987 0.005 EPITO 006766 -0.03357 0.03857 -0.0124 0,06193 -0.03121 0.00935 -0.01274 0.09725 29E100- FOOD 700D 16100- 0.00365 -0.00105 0.02.16 -0.05861 -0.04841 0.11574 -0.01264 0.079 0.0619 -0.01952 0,07281 -0,04671 0.005 SESOO- 16.100- CISMO SEESO ESCO- 20.00 oso 1000- PIOS ZRI 100 SRO EN 100 1500 95000 ISODIO TOTOO ESO -0.15678 -0.0936 00321 0.07197 0.02062 0.0038 0.03252 0.01781 -0.07878 0.00505 0.01545 0.005 -0.11312 0.02073 0.04126 -0.13455 1100 CPI- TO ETSOL 06100 SENDO 1600 94600 -0.09761 S1600- ESTO IROD PIELOO -0.06.196 0.08756 ED1000- SNY - -0.06156 -0.0672 0.0164 0.11837 ILLLOO SP0100 SOOD 6000 T1000 66000 TEODO 80DD 1000 1E000 LOEDO ES1000 0.10636 0.006 -007441 0.0065 0.01266 -0.01233 -0.0151 110100 9E9100 -0.02467 -0.0153 -0.06481 ST1000- 100- 986100 -0.01712 LOWO- 0.10216 -0.01324 -0.0166 -0.01698 -0,07531 -0,09763 0,02929 0.07317 0.01712 -0.00274 00335 -0.07.17 -0.17147 DOWS7 0.11076 TOWO PNONOO- -0.07103 69600 100800- SORIOS 0.02373 0.0741 -0.12733 -0.00015 0.0576 001152 -0.03775 -0.02997 0.02522 0.07634 0.0173 0.002% 0.0032 0.0012 0.07492 286100 0.07654 0.00874 CODO 6110 E10100 LP100- -0.03515 1600- 100- COO- 96100 CPIO O Socor S1000 POD (1000 -0.01724 003377 www EPITO PERO 0.0078 0.0013 -0.06.203 0,04529 -0.0061 -0.03256 -0.0063 0,06822 -0.02011 NS1900- -0.05705 6100 0,0490 -0.0552 -0.01 NOZ 0.02 SIODO 100 LIC000 (CP100 0.03743 -0.06025 000754 -0.07135 -0.07719 -0.01217 -0.07064 -0.00209 -0.07669 -0.07186 0.00075 -0.1075 0.0013 -0.12234 -0.07474 LSSONO CHOO LONDO INSO 10- -0,0925 008529 -0.07301 0.02076 0.10023 000477 004992 -0.052 SIDO P1000 100D HITOO SELOTO ISITO NLEITO SMO SLOO NGOO 0.0053 -0.10067 0.0747 0.0001 1000 11564 ZSP900 0.0014 0.05007 P600 0.0419 0.0575 ESP900- -0.07032 RESPOO 009987 -0.02739 CORSO 995500 CIOCO 11000 1000 -0.02625 -0.02761 001211 0.01107 TOO SIOOD S1910 LUPO -0,03541 0,016 015100 19000 672200 ILOSOO 0 000 -0,0267 -0.0210 0.01707 0.071 0.000 0.01499 0.01036 SIENDO 1000 1000 0.09722 SOZIO CHETTO 65000 ONDO LO1000 004417 LCHOO 09900 0.00957 0.0253 0.03264 0.0126 0.01744 INSUO 0.000 11100 0.01673 0.0143 ICO 900 0.01315 0.01952 0.00707 0.01533 0.01572 SL6100 1000 LOOD 99100 LLPi00 0.0166 10.00 100- COMO LSCOO 6000 SP1100- NES100 6100 120100 119900 CHICO 0.0007 0.000 0.0007 0.04 0.06115 0.0448 -0.007 007504 0.00520 0.01356 0.02936 0.00110 0019 001207 000 LOOD 0.0478 0.000 00476 0.034 0.02205 0.016 0.016 0.01099 0.00713 0.0004 00522 HEID INH100 TOO IPOD 005231 0,01279 0.01434 0.01265 -0.010 0.01051 TENIDO LLEID (15100 0.000 0.0007 0.000 0.000 65100 LOIC OF 0.0107 POO -0.01577 SRISOO NORTOD NOOD 91100 POOD 219100 POP100 SPOO 1100 OOOO -0.0176 0.00075 0.0257 -0.01494 002117 0.010 -0.07235 LOILOO SPOO NSK100 DO SSP100 00193 0.005 FOTO TTOO COMO IS OO LSSON 611 GESTO -0.03913 00024 OOOO 1000 TOYO 110 0.0011 N70000 IZPIDO 0.0033 0.01067 P100 0.01537 0.018 0.045 0.01759 0.00758 0.0194 0.01738 0.05045 0.01676 0,02235 0.04754 01.04251 CICO 0.0011 0.0011 0.0015 CERLOO FISIO ORIO 100 ISETOO 0.00114 0.002 BLOG 200 SENDO 91000 You have been hired as a consultant to the pension fund of a large manufacturer of agricultural equipment. The management of the pension fund has identified the 6 actively managed equity mutual funds as investment candidates. They would like you to provide answers to several questions that they have about investing in these mutual funds (please provide a detailed justification for each of your responses). 6. Suppose that you wish to compute a performance measure that takes into account the total risk of each fund, yet is easy to interpret in terms of differential returns with the market index. What performance measure is appropriate here? Calculate and report this measure for each fund. Based on this measure, which fund would you choose? Would you expect your results to differ from those in (3)? Why or why not? Sheet1 Sheet2 Sheet3 Vanguard 500 Index -0.05032 -0.01906 0096 -0.03006 -00203 0.02487 -0.01491 0.0619 Fundamental lavestors -0.02332 0.00842 0,08672 -0.01725 -0.00296 0.00958 -0.02075 0.05814 -0.02639 0.0056 -009391 0,02606 0.03402 -0.06469 -0.05361 0.0741 0.00355 -0.03015 -0.00752 T. Rowe Price Growth Stock Fund -0.03457 0.04016 0.08141 -0.0146 -0.03383 0.05766 -0.01362 0.0789 -0.05014 -0.01182 -0.0985 0.02962 0.03199 -0.00761 -0.03685 010636 0.0086 -0.02441 6NZSOO -0.0043 -0.07878 0.00505 SPSEOO - ( Fidelity Magellan -0.04809 0,01 0.09051 -0.047 -0.03357 OORS? -0.0124 0.06391 -0.0SUN -0.01293 -0.0NS13 0.003 0.03252 -00916N -0.06396 0.0N756 0.01045 -0.02467 -0,015) -0.064N1 -0.0NONG 0.02372 0.074 0.01043 -0.03147 0.01724 003377 -0.063SN -0.00209 -0,07669 -0.0716 0.00975 -0.1075 0.00444 0.05007 -0.06453 -0.02761 -0.01211 986100 TOIS0O- Month 31-Jan-00 29-Feb-00 31-Mar-00 30-Apr.00 31-May-00 30-Jun-00 31-Jul-00 31-Aug-00 30-Sep-00 31-00-00 so. Nov.00 31-Dec-00 31-Jan-01 28-Feb01 31-Mar-01 30-Apr-01 31-May.01 30-Jun-01 31-Jul-01 31-Aug-01 30-Sep-01 31-Oct-01 10.Nov.01 31-Dec-01 31-Jan-02 28-Feb-02 31-Mar-02 10-Apr-02 31-May-02 30-Jun-02 31-Jul-2 31-Aug-02 30-Sep-02 31-Oct-02 30-Nov.02 31-Dec-02 31-Jan-03 28-Feb-03 31-Mar-03 30-Apr-03 31. May 03 30-Jun-03 31 Jul 03 31-Aug-03 30-Sep-63 31-Oct-00 3. Nov.03 31-Dec-03 31. Jan 04 29-Feb-04 Fidelity Growth Fund 0.0107 0.26% -0.09878 -0.10456 -0,07967 0.11419 -0.04841 0.11574 -0.03264 -0.05024 -0.15678 0,043 4102141 -0.16015 -0.10523 0.1187 0.00T -0.00153 -0.00158 -4:07637 -0.17147 0.0057 0.11076 0.007 -0,0419 4.00 0.04529 -0.0061 -003266 -0.0963 -0,09054 -0.02124 -0.10735 0.11521 0.11378 -0.0997 -0.02730 0.00261 0.02229 0.080TI 0.09722 0.00621 0.0146 0.04745 -0.00367 0.07504 0.06442 -0.07103 0.03963 0.07892 0.01982 Legg Maw Value Trust -0.09194 0.00337 0.0974 -0,02192 -0.01505 0.00368 -0.00106 0.0X216 -0.0561 0.01382 -0.01926 0,0221 0,07197 -0.07153 -0,02416 0,07314 0.01266 -0.01233 -0.0151 00913 -0.12733 -0.00915 0.05769 0.01152 -0,03775 -0.0629 0.06822 -0.02011 0.00317 -0.12214 -0,07474 0.05481 -0.11844 0.11564 0.09314 -0.07032 -0.00296 -0.01015 0.00405 0.1 2018 0.11343 0.005.09 0.01952 0.01014 -0.01444 0.002 SISED MES Research Fund -0.04747 0.0614 0,07745 -0.04198 -0,03121 0,04935 -0.01274 0,09725 -0.05336 -0.03153 -0.11312 0.02073 0,0412 -0.12455 -0,09103 0.10216 -0.01324 -0.03656 -0.03698 -0.07931 -0,0976) 0.02929 0.07317 0.01732 -0,03191 -0.0144 0.0490 -0.05582 -0.018 -0.02 -0.08557 0.00342 -0,09258 0.06452 0.04369 -0.04524 -0,02657 -0.0210N 0.01707 0.0781 0,05281 0.00207 0.01931 0.01572 -0.0154 0.0478 0.009 00476 0.034 0,02265 -0.02107 -0.016 0.00675 0.0257 -0.04301 0.0050 0.01471 0.03235 0.04754 0,04251 -0.02143 0.04424 -0.05705 -0.01423 -0.08529 -0.07301 0.02076 -0.10323 0.09477 0.04992 -0.052 -0.10266 0,03002 0.07404 0.01035 -0.02332 0.00529 0.0432 -0.02856 0.00288 -0.06142 -0,09404 0.00212 -0.09233 0.04632 0.06664 -0.0404 -0,03824 -0.02201 0.00096 0.09073 0.0529 0.01217 0.0161 0,03419 -0.01347 0.06827 001541 0.07198 0.00167 0.02304 -0.01449 -0.02394 0.00709 0.02828 -0.01902 0.000 0.02812 0.0157 00013 0.06356 0.07771 0.0065 -0.02445 -0.01 -006274 00091 0.0195 0.07654 0.00874 -0.01473 001936 0.03743 -0.06075 -0.00754 -0.07135 -0.07719 0.00653 -0.10075 0.04783 0.05875 -0.05893 -0.02625 -0.01519 0.004957 0.00253 0.05264 0.0126 0.01744 0.01933 -0.01071 0.05641 - $19100- LO1100 LENOVO 0.01427 001499 0.0 0.05603 001673 0.01975 0.0106 ER100 OLSO WALIO PROTO 0.01356 0,02936 0.00116 0.08215 0.04417 00111 0.01315 0.0160 0.01427 0.04881 0.00441 0,05231 0.01279 0.01424 -0.01265 -0.01705 0.01051 0.01455 -0.03913 0.0024 0.009 0.0151 0.03313 003114 0.01904 0.01267 COSINS 0.0ISON OOONNN POWIE 0 91100 30-Apr-04 31 May.01 30-Jun-04 31-Jul-04 31-Aug-04 30-Sep-04 31.01.04 30-Nov.04 31-Dec-14 00486 0.0100 -0.00713 -0.0159 -0.01494 0,02187 0.01901 -0.07625 0.00431 0.01759 0.00758 0,07612 0.0602 4002134 0.00958 0.01851 -0,08557 -0.01139 0.03519 0.035 0,04751 0,04351 -0.02024 0.01612 0.01464 -0.0NS -0.00211 0.01984 0.01738 00522 0.01821 0.01172 -0.01513 -0.01577 0.01358 0.0199 -0,03311 0.00383 0.01067 . SIS100 (NSS00 SPOSOO 0.04046 0.03399 0.02356 DON9 lity Growth Fund Fidelity Magellan -0.04809 Legg Mason Value Trust Vanguard 500 Index LONDO 1600- LETOVO MES Reach Fund -0,04747 0.0614 T Rowe Price Growth Stock Fund -0.03457 0.04016 TEOSO- 906100 Vanguard Total Stock Market Port 30 Day Thill -0.04184 0.02545 100 0.2696 -0.09678 Itovo 1000 LOOD 9700 0.09051 0.0974 SPLZOO 861100 IP1800 STOIO LOEN -0.0346 C6IzOO SOS 100- 0.0976 -0.03006 -0.0203N 0.02487 ENEEDO 9900 OTSOO LOTEOO- CHOD -007987 0.005 EPITO 006766 -0.03357 0.03857 -0.0124 0,06193 -0.03121 0.00935 -0.01274 0.09725 29E100- FOOD 700D 16100- 0.00365 -0.00105 0.02.16 -0.05861 -0.04841 0.11574 -0.01264 0.079 0.0619 -0.01952 0,07281 -0,04671 0.005 SESOO- 16.100- CISMO SEESO ESCO- 20.00 oso 1000- PIOS ZRI 100 SRO EN 100 1500 95000 ISODIO TOTOO ESO -0.15678 -0.0936 00321 0.07197 0.02062 0.0038 0.03252 0.01781 -0.07878 0.00505 0.01545 0.005 -0.11312 0.02073 0.04126 -0.13455 1100 CPI- TO ETSOL 06100 SENDO 1600 94600 -0.09761 S1600- ESTO IROD PIELOO -0.06.196 0.08756 ED1000- SNY - -0.06156 -0.0672 0.0164 0.11837 ILLLOO SP0100 SOOD 6000 T1000 66000 TEODO 80DD 1000 1E000 LOEDO ES1000 0.10636 0.006 -007441 0.0065 0.01266 -0.01233 -0.0151 110100 9E9100 -0.02467 -0.0153 -0.06481 ST1000- 100- 986100 -0.01712 LOWO- 0.10216 -0.01324 -0.0166 -0.01698 -0,07531 -0,09763 0,02929 0.07317 0.01712 -0.00274 00335 -0.07.17 -0.17147 DOWS7 0.11076 TOWO PNONOO- -0.07103 69600 100800- SORIOS 0.02373 0.0741 -0.12733 -0.00015 0.0576 001152 -0.03775 -0.02997 0.02522 0.07634 0.0173 0.002% 0.0032 0.0012 0.07492 286100 0.07654 0.00874 CODO 6110 E10100 LP100- -0.03515 1600- 100- COO- 96100 CPIO O Socor S1000 POD (1000 -0.01724 003377 www EPITO PERO 0.0078 0.0013 -0.06.203 0,04529 -0.0061 -0.03256 -0.0063 0,06822 -0.02011 NS1900- -0.05705 6100 0,0490 -0.0552 -0.01 NOZ 0.02 SIODO 100 LIC000 (CP100 0.03743 -0.06025 000754 -0.07135 -0.07719 -0.01217 -0.07064 -0.00209 -0.07669 -0.07186 0.00075 -0.1075 0.0013 -0.12234 -0.07474 LSSONO CHOO LONDO INSO 10- -0,0925 008529 -0.07301 0.02076 0.10023 000477 004992 -0.052 SIDO P1000 100D HITOO SELOTO ISITO NLEITO SMO SLOO NGOO 0.0053 -0.10067 0.0747 0.0001 1000 11564 ZSP900 0.0014 0.05007 P600 0.0419 0.0575 ESP900- -0.07032 RESPOO 009987 -0.02739 CORSO 995500 CIOCO 11000 1000 -0.02625 -0.02761 001211 0.01107 TOO SIOOD S1910 LUPO -0,03541 0,016 015100 19000 672200 ILOSOO 0 000 -0,0267 -0.0210 0.01707 0.071 0.000 0.01499 0.01036 SIENDO 1000 1000 0.09722 SOZIO CHETTO 65000 ONDO LO1000 004417 LCHOO 09900 0.00957 0.0253 0.03264 0.0126 0.01744 INSUO 0.000 11100 0.01673 0.0143 ICO 900 0.01315 0.01952 0.00707 0.01533 0.01572 SL6100 1000 LOOD 99100 LLPi00 0.0166 10.00 100- COMO LSCOO 6000 SP1100- NES100 6100 120100 119900 CHICO 0.0007 0.000 0.0007 0.04 0.06115 0.0448 -0.007 007504 0.00520 0.01356 0.02936 0.00110 0019 001207 000 LOOD 0.0478 0.000 00476 0.034 0.02205 0.016 0.016 0.01099 0.00713 0.0004 00522 HEID INH100 TOO IPOD 005231 0,01279 0.01434 0.01265 -0.010 0.01051 TENIDO LLEID (15100 0.000 0.0007 0.000 0.000 65100 LOIC OF 0.0107 POO -0.01577 SRISOO NORTOD NOOD 91100 POOD 219100 POP100 SPOO 1100 OOOO -0.0176 0.00075 0.0257 -0.01494 002117 0.010 -0.07235 LOILOO SPOO NSK100 DO SSP100 00193 0.005 FOTO TTOO COMO IS OO LSSON 611 GESTO -0.03913 00024 OOOO 1000 TOYO 110 0.0011 N70000 IZPIDO 0.0033 0.01067 P100 0.01537 0.018 0.045 0.01759 0.00758 0.0194 0.01738 0.05045 0.01676 0,02235 0.04754 01.04251 CICO 0.0011 0.0011 0.0015 CERLOO FISIO ORIO 100 ISETOO 0.00114 0.002 BLOG 200 SENDO 91000 You have been hired as a consultant to the pension fund of a large manufacturer of agricultural equipment. The management of the pension fund has identified the 6 actively managed equity mutual funds as investment candidates. They would like you to provide answers to several questions that they have about investing in these mutual funds (please provide a detailed justification for each of your responses). 6. Suppose that you wish to compute a performance measure that takes into account the total risk of each fund, yet is easy to interpret in terms of differential returns with the market index. What performance measure is appropriate here? Calculate and report this measure for each fund. Based on this measure, which fund would you choose? Would you expect your results to differ from those in (3)? Why or why not