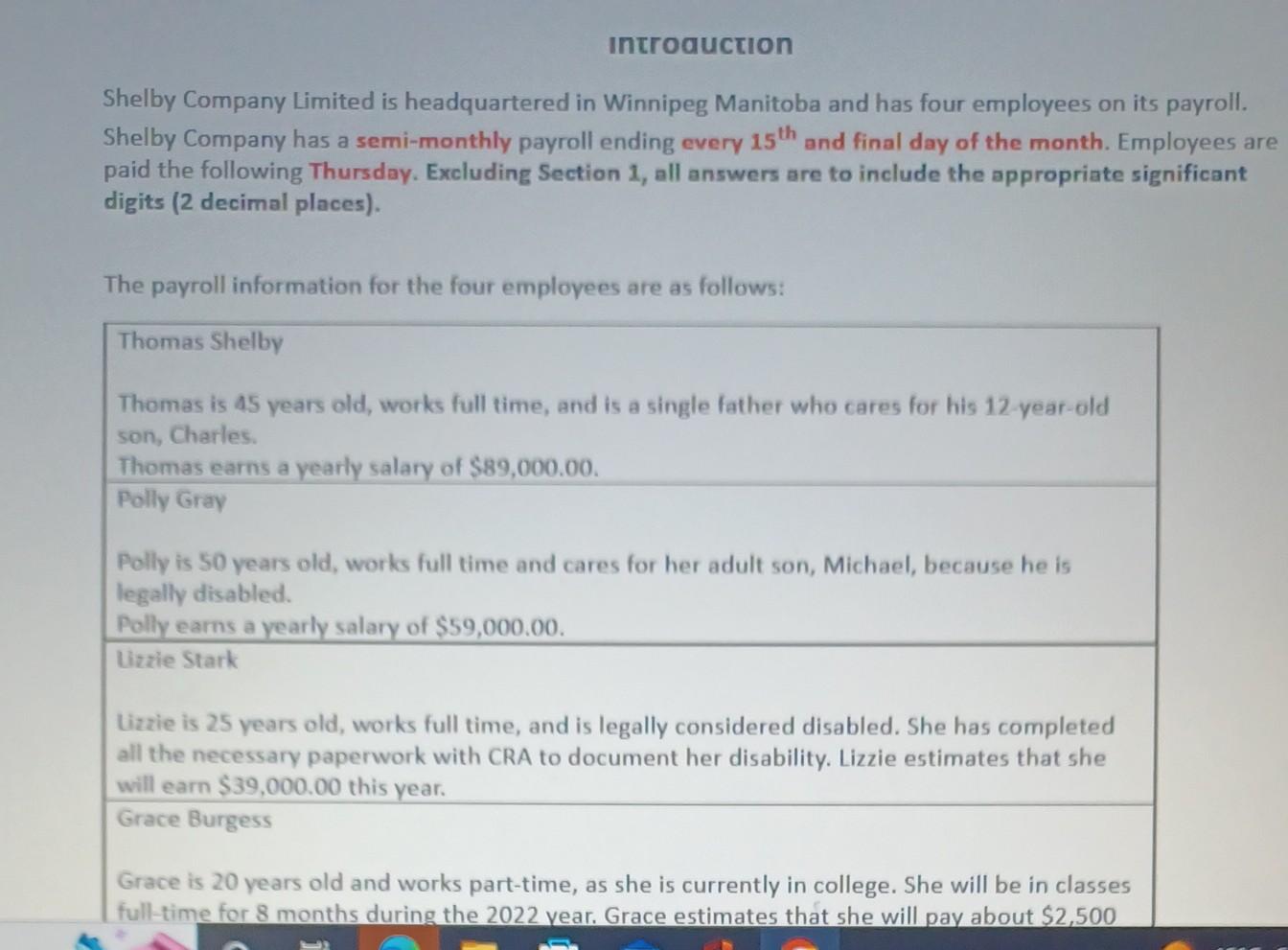

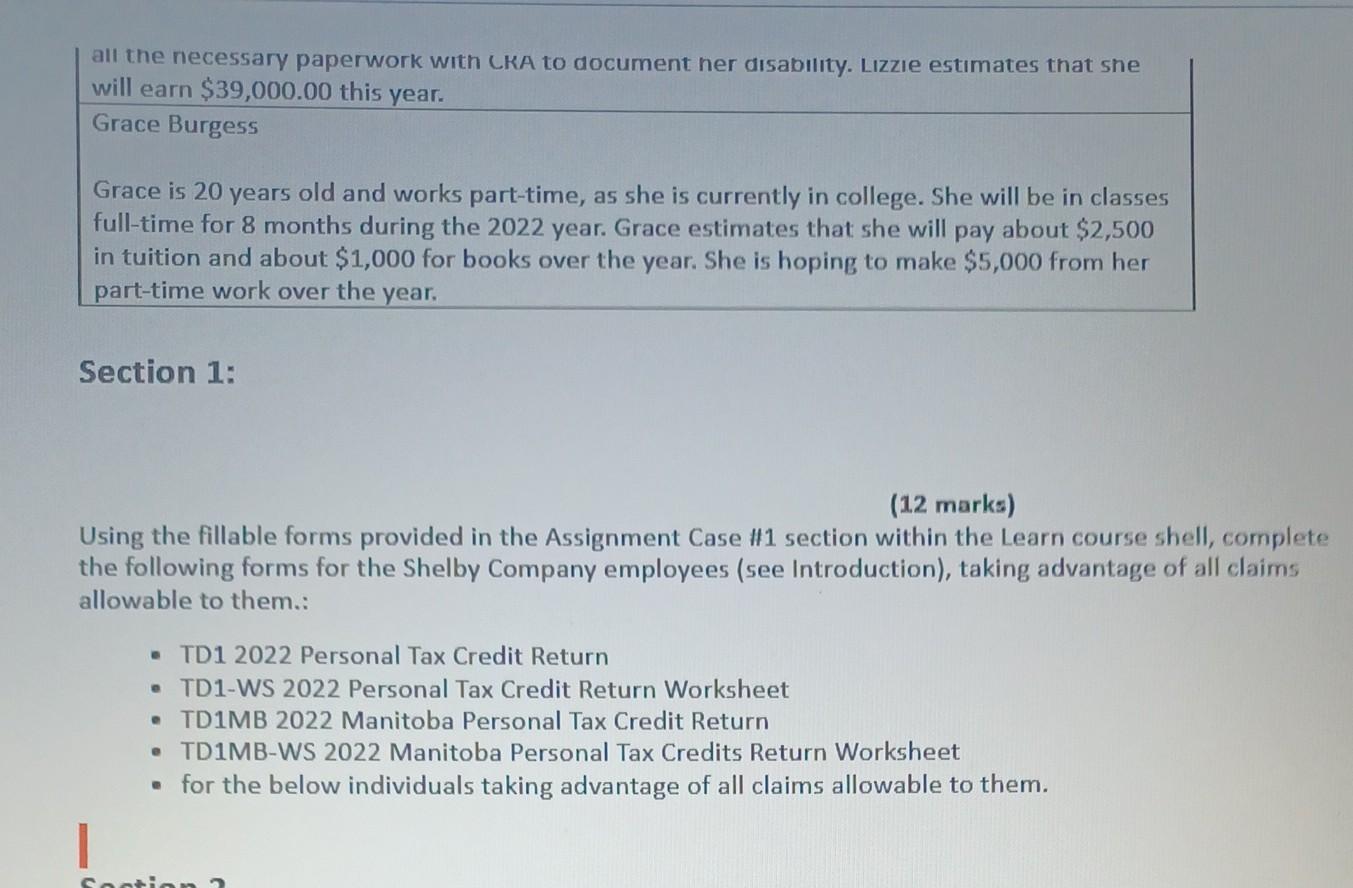

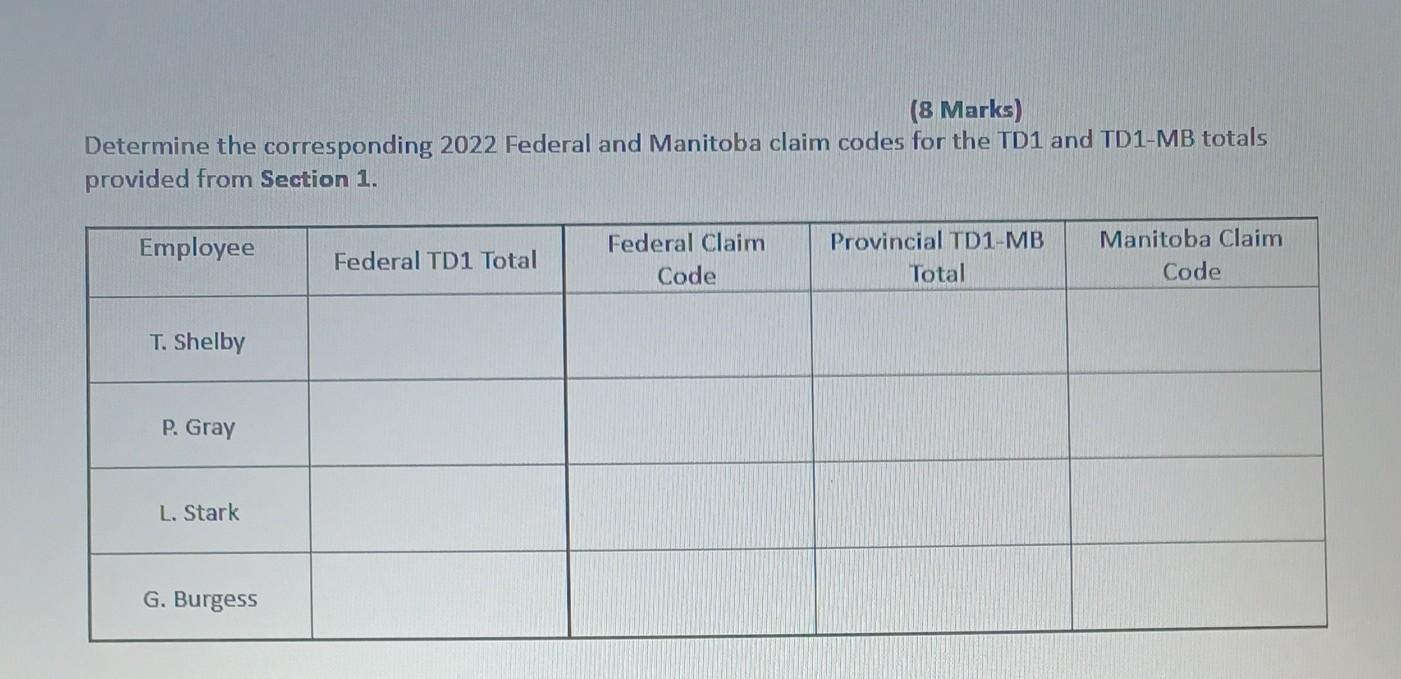

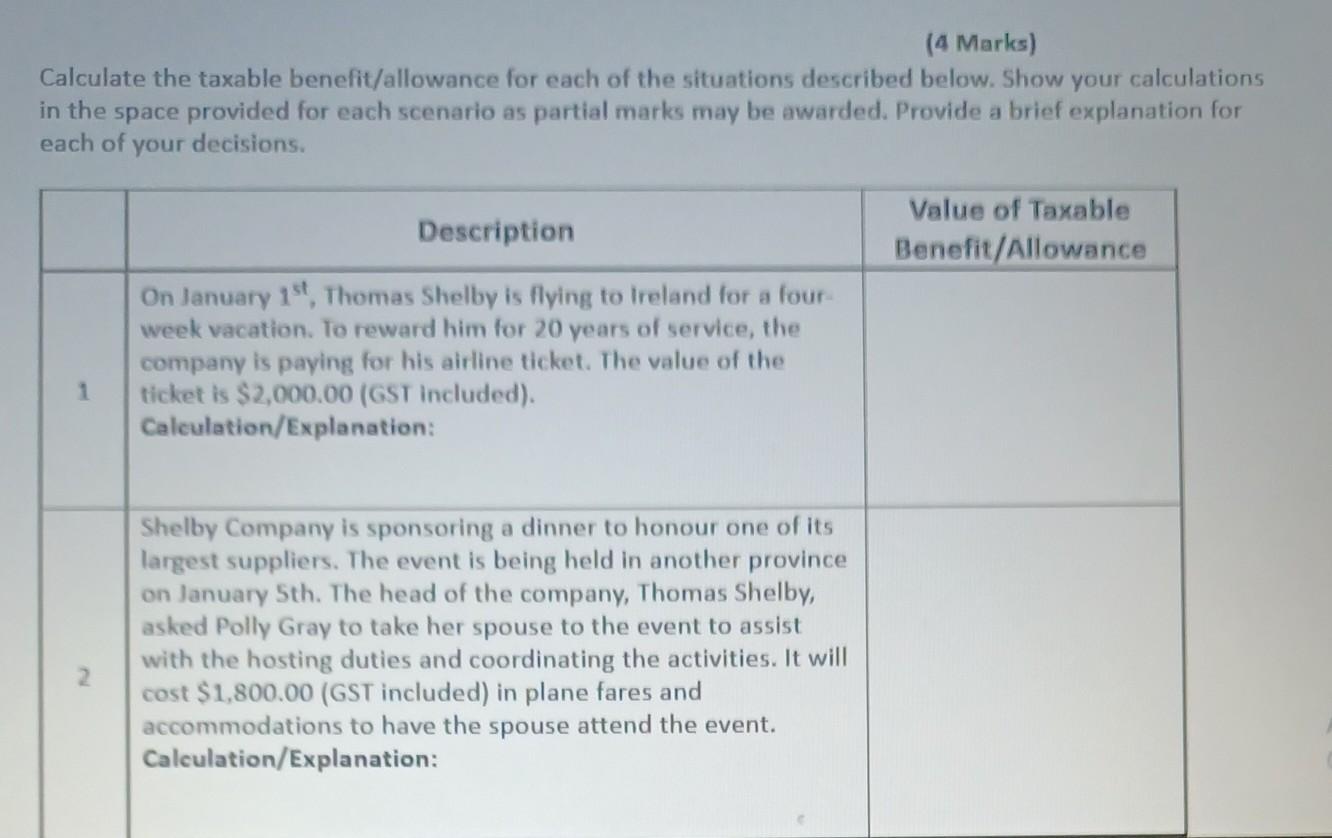

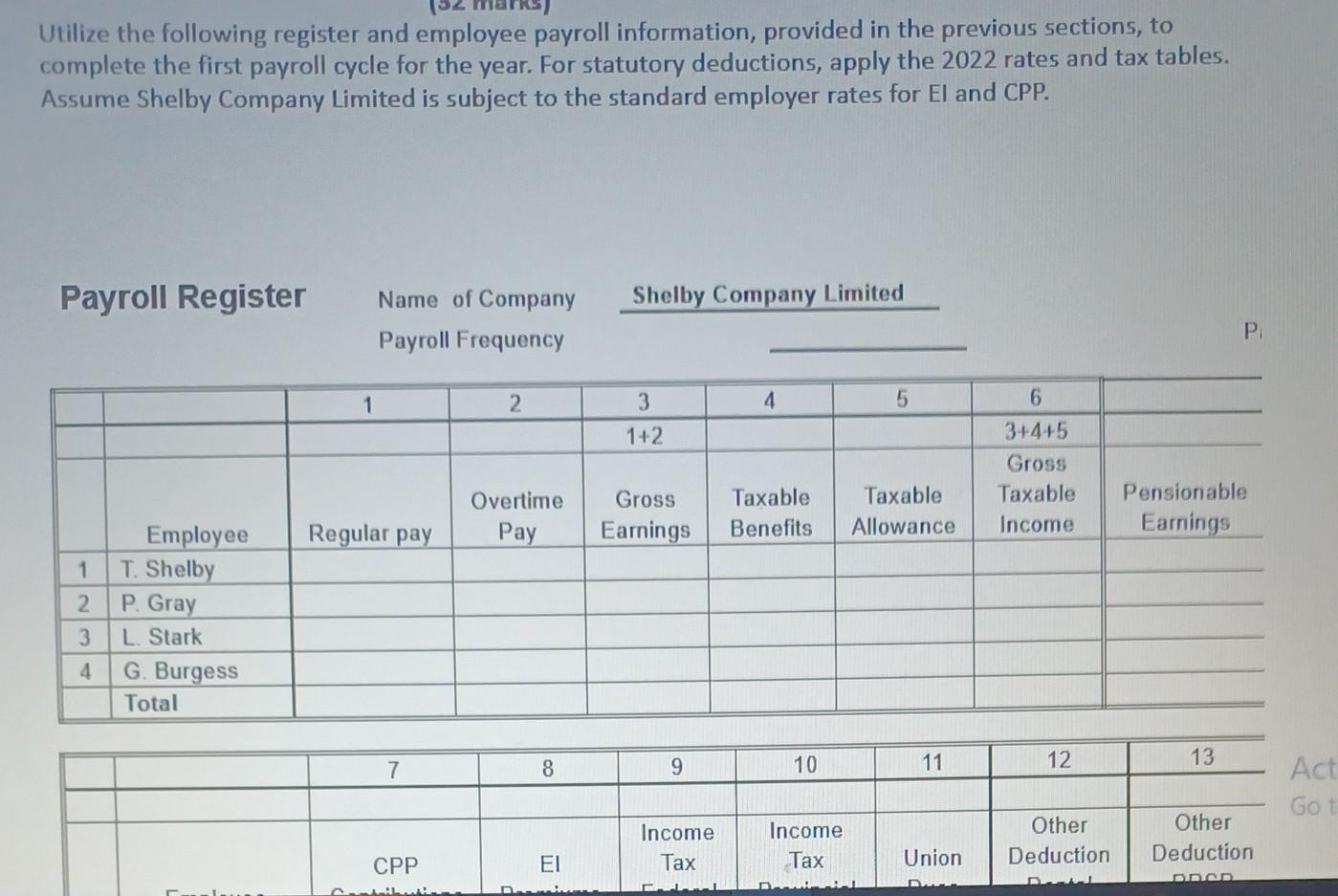

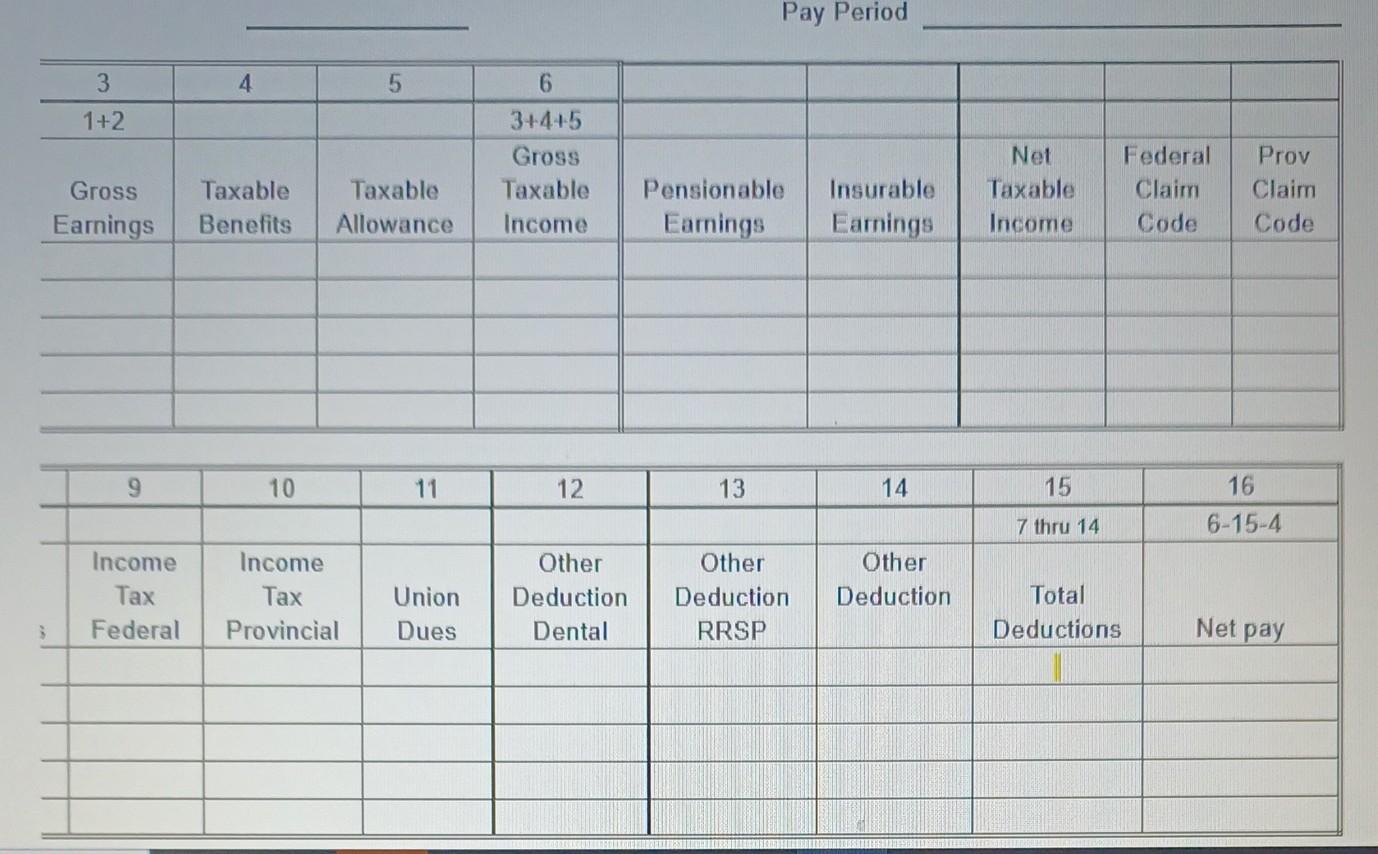

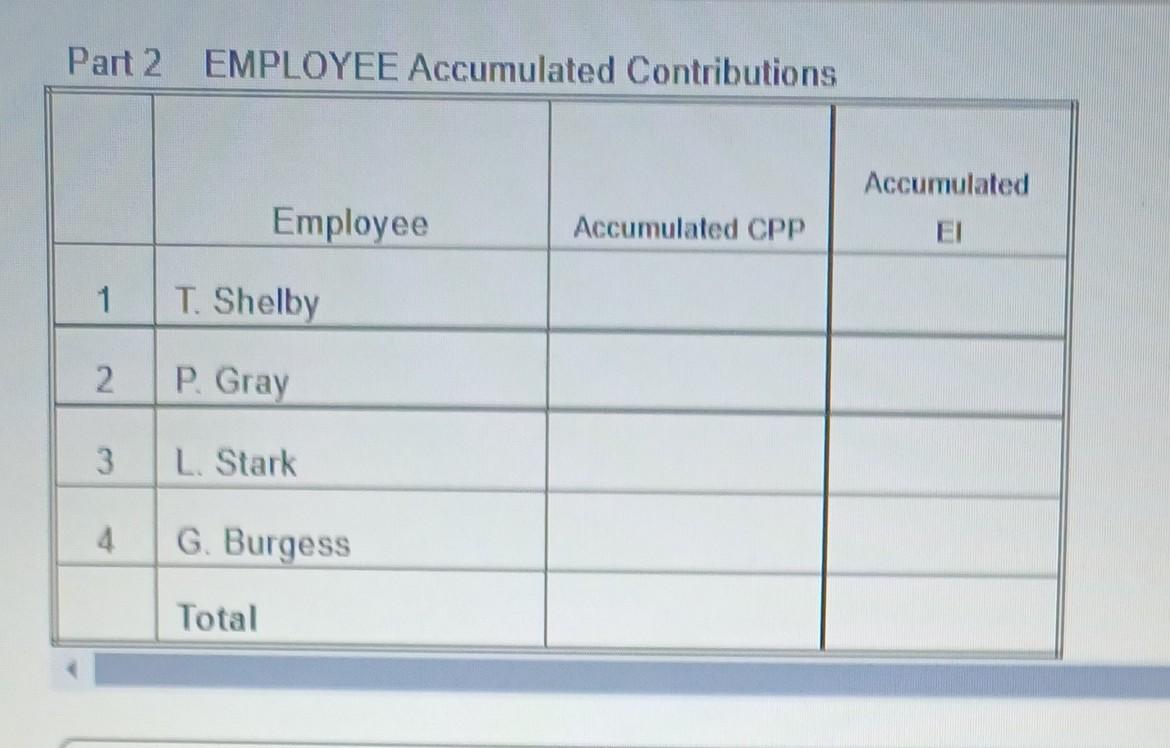

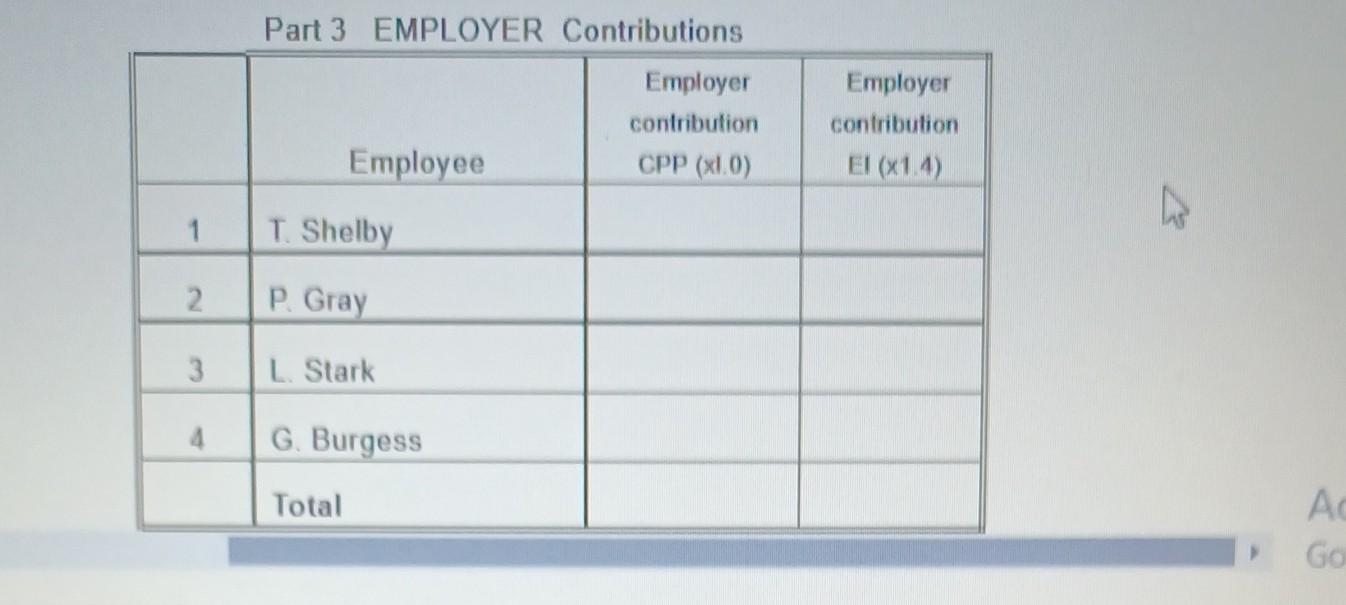

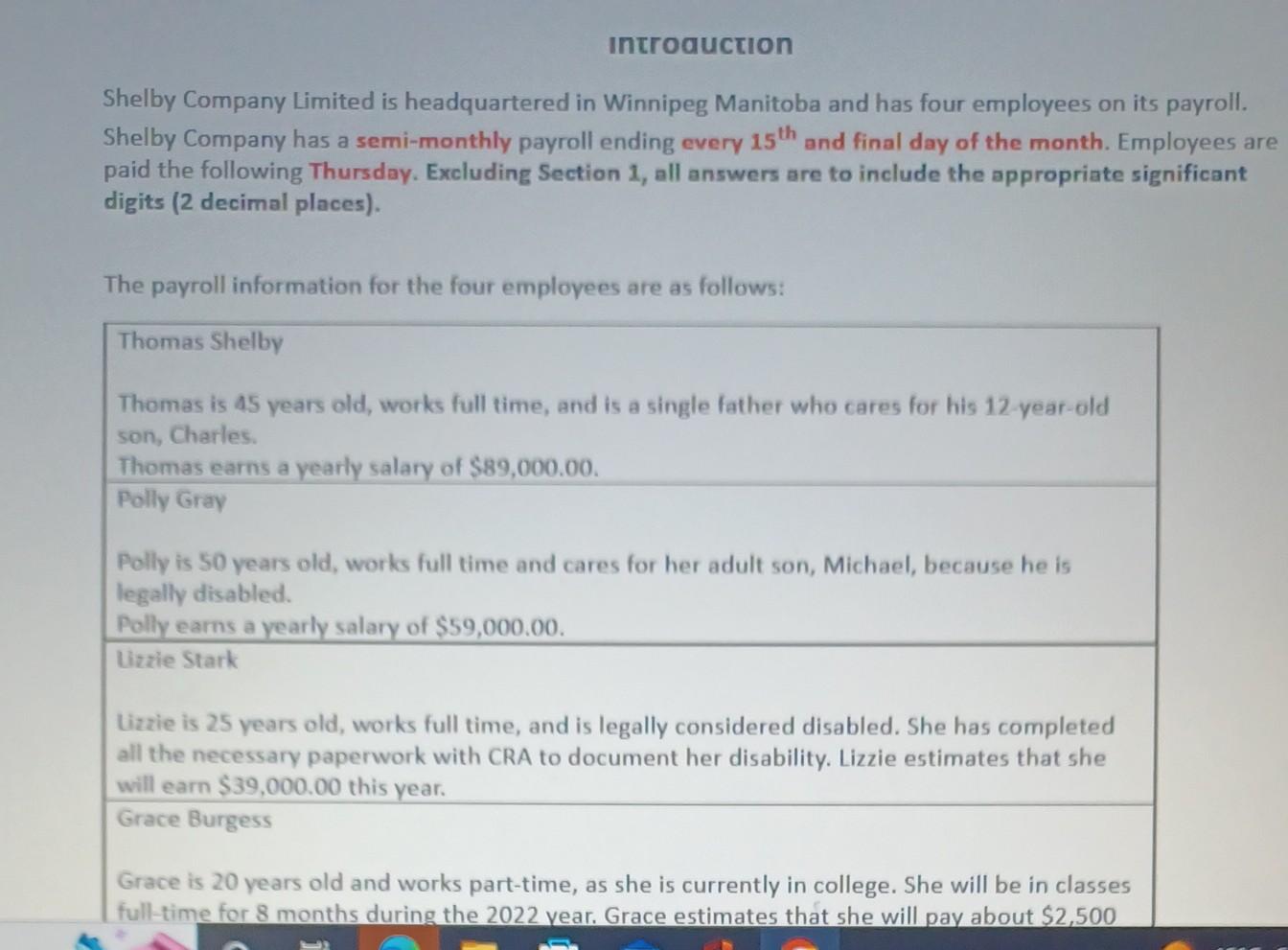

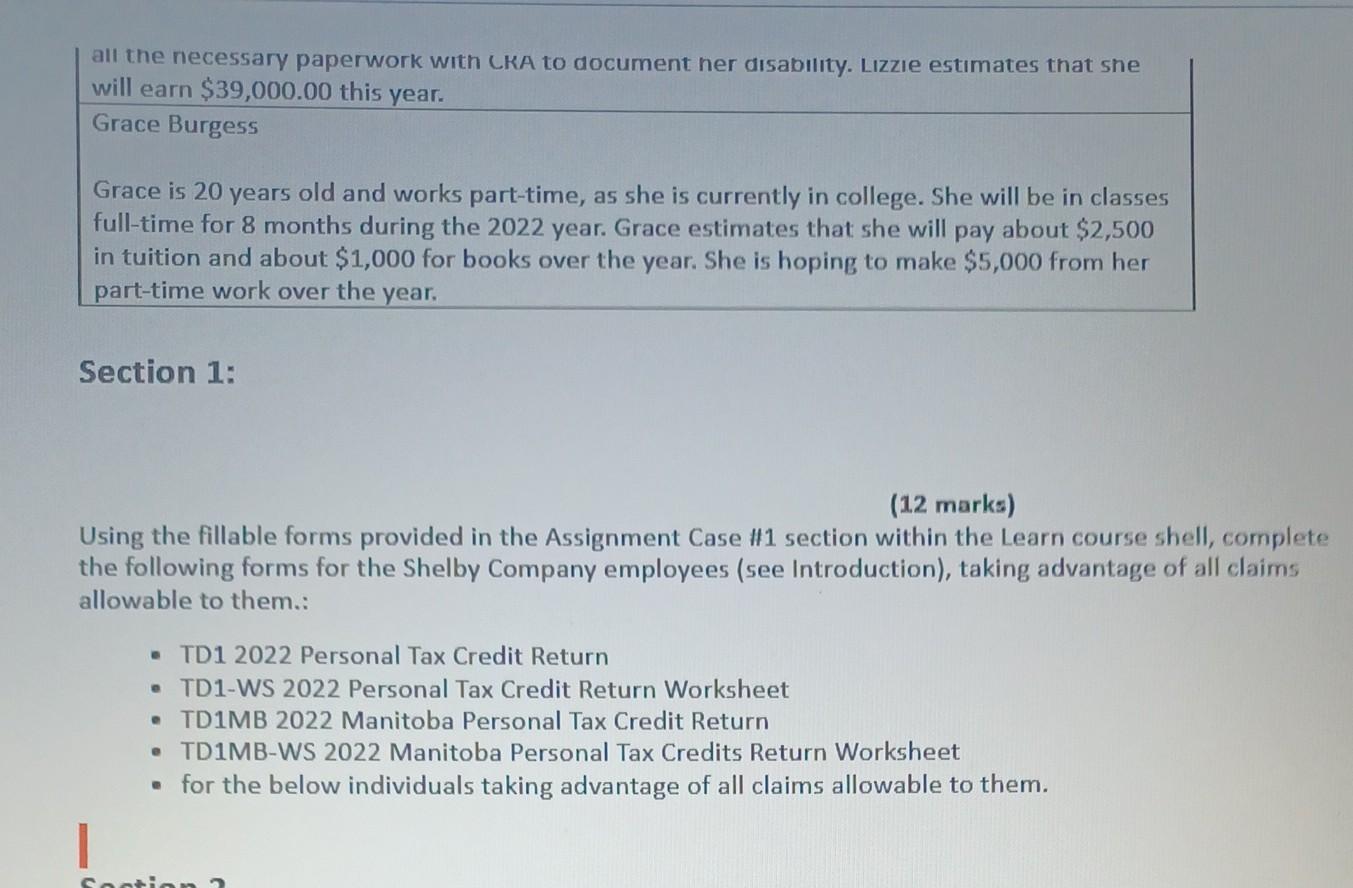

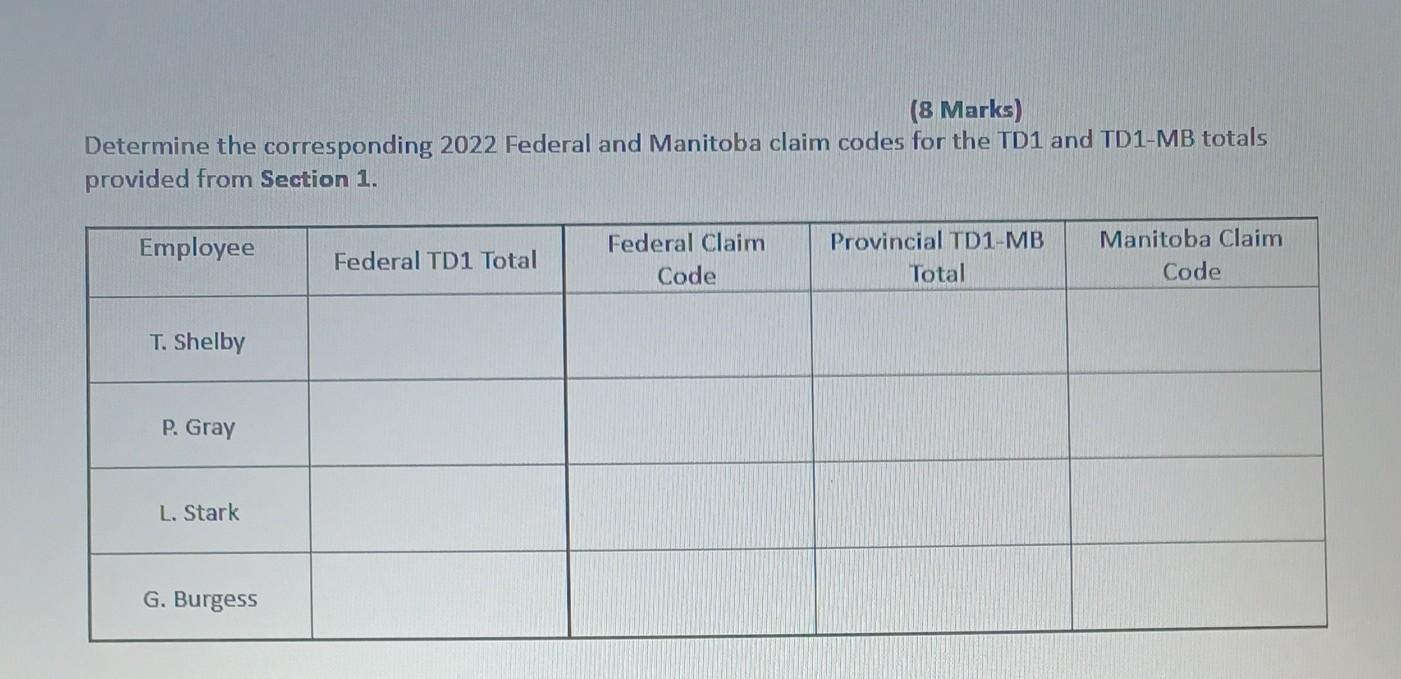

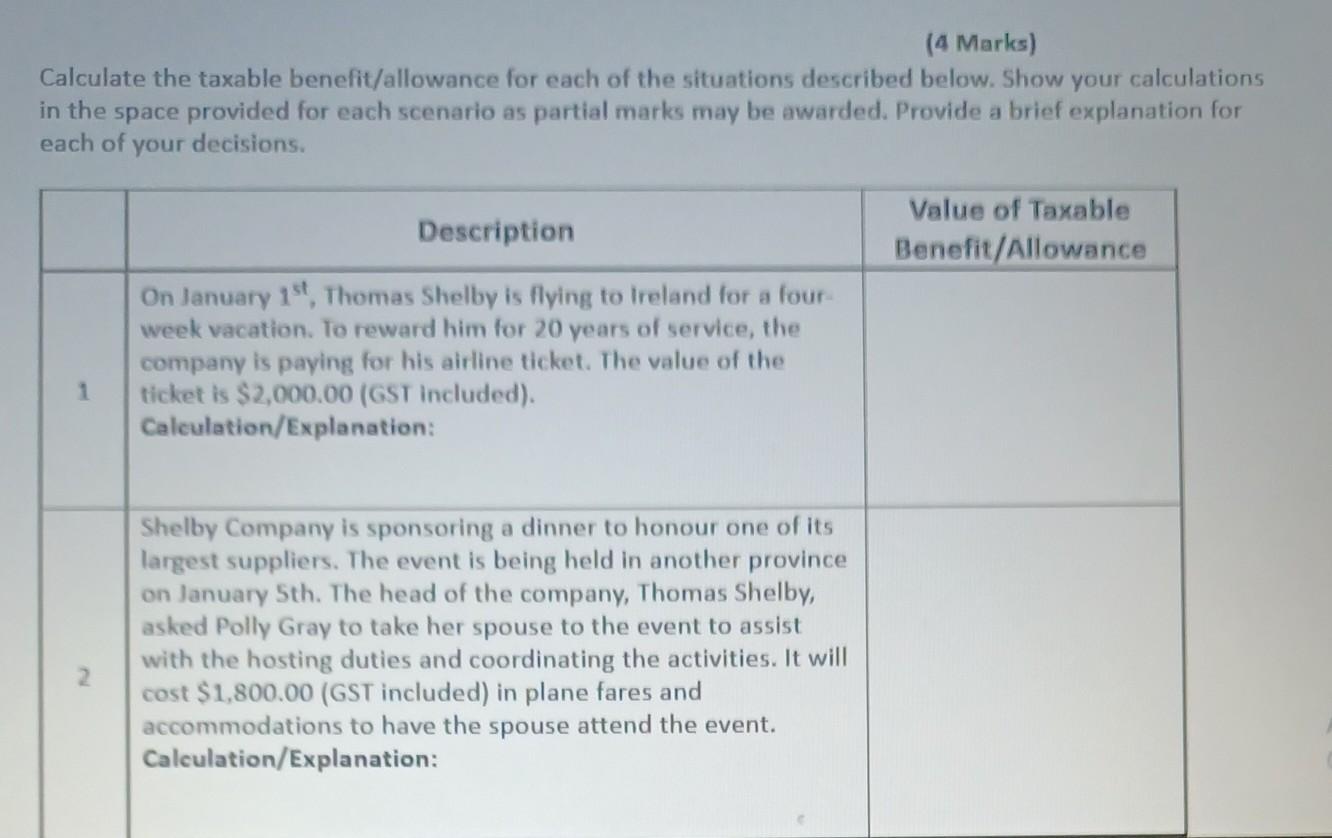

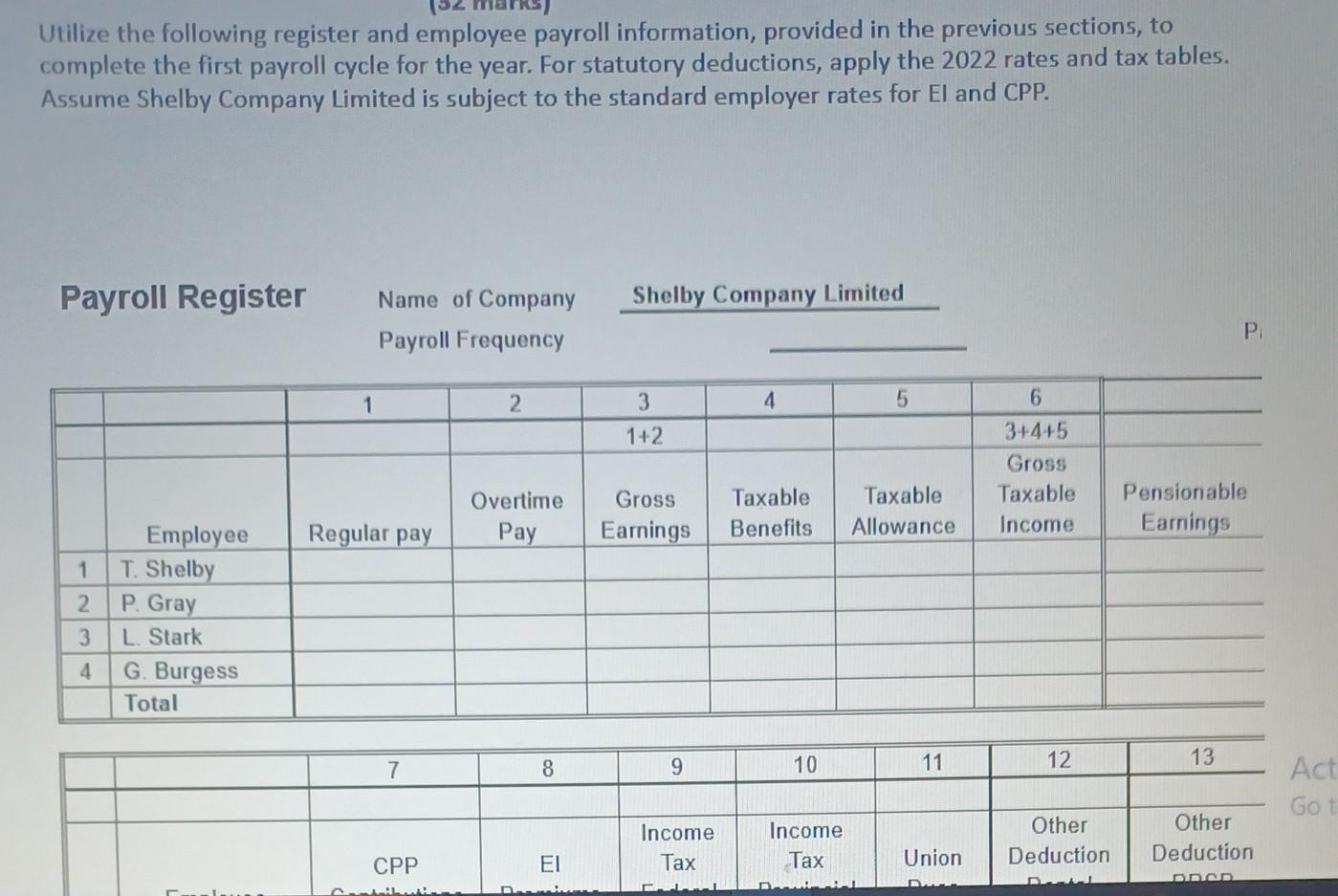

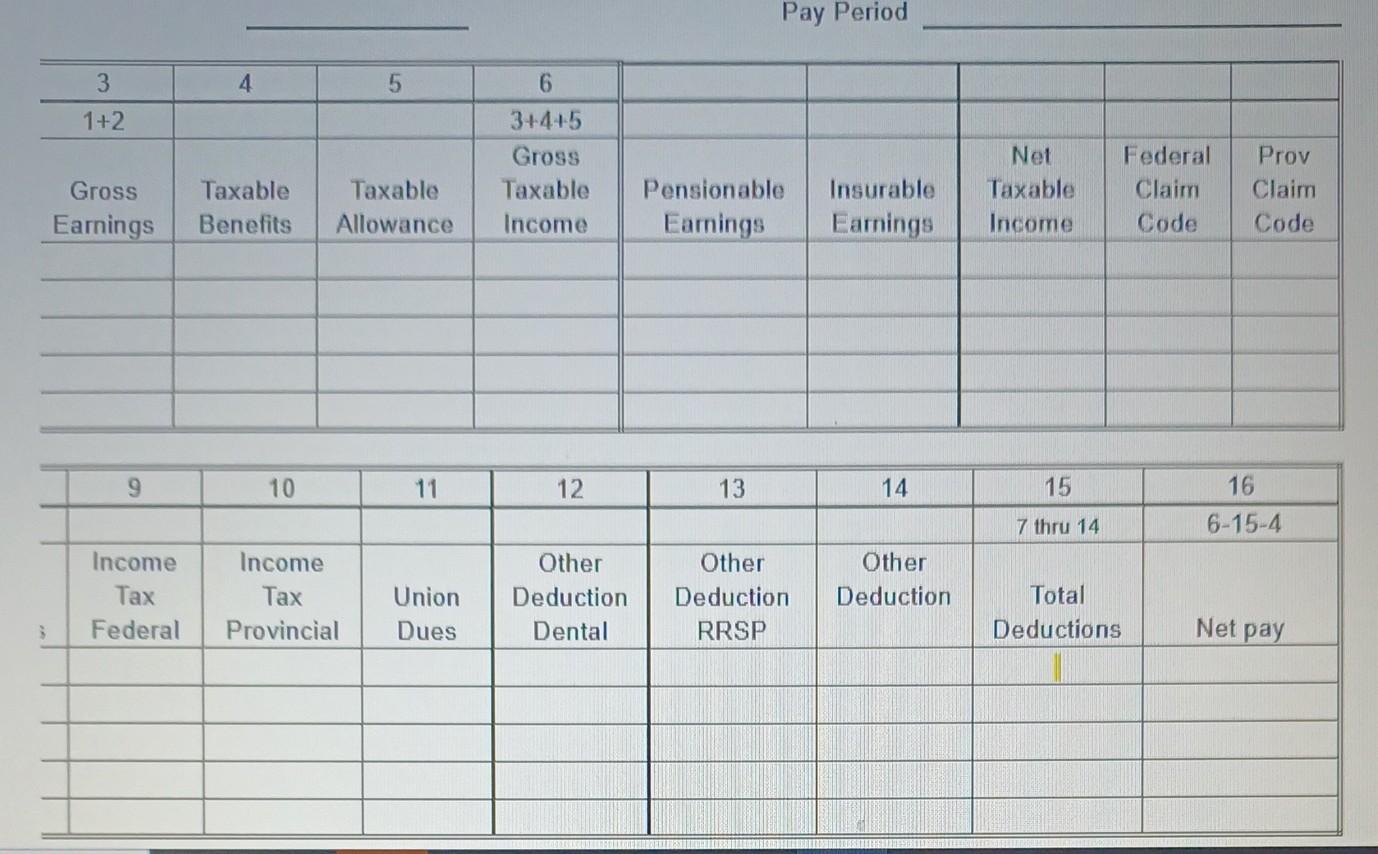

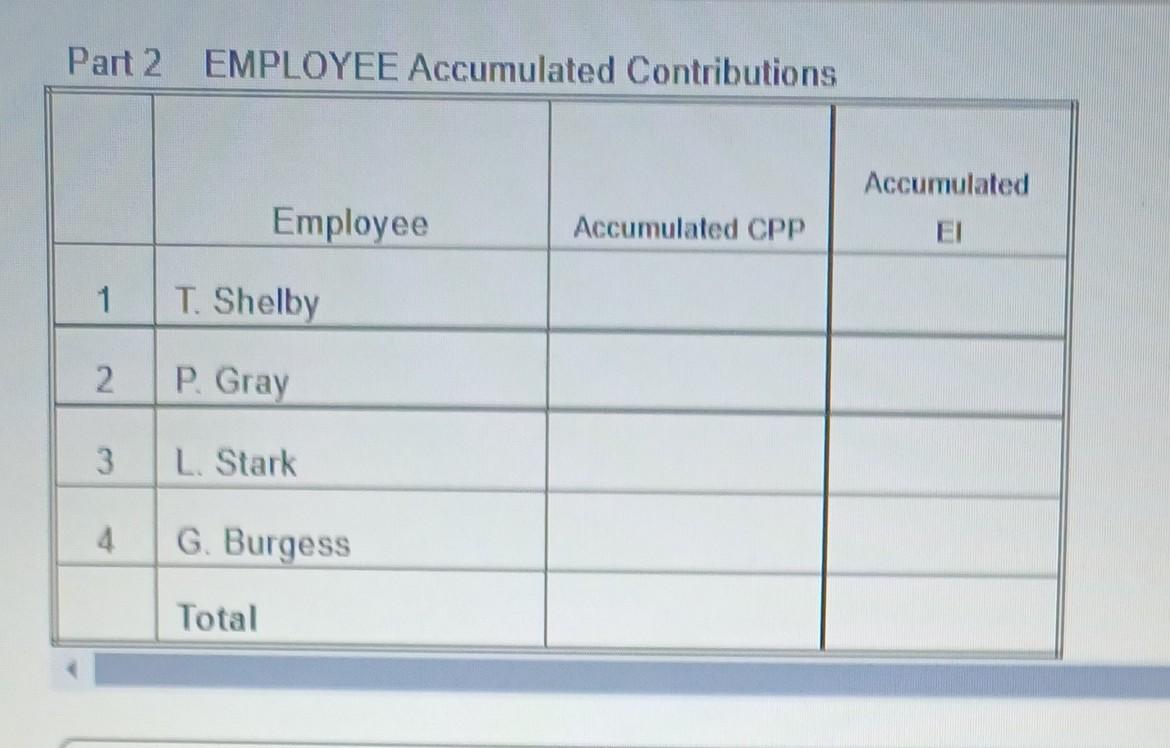

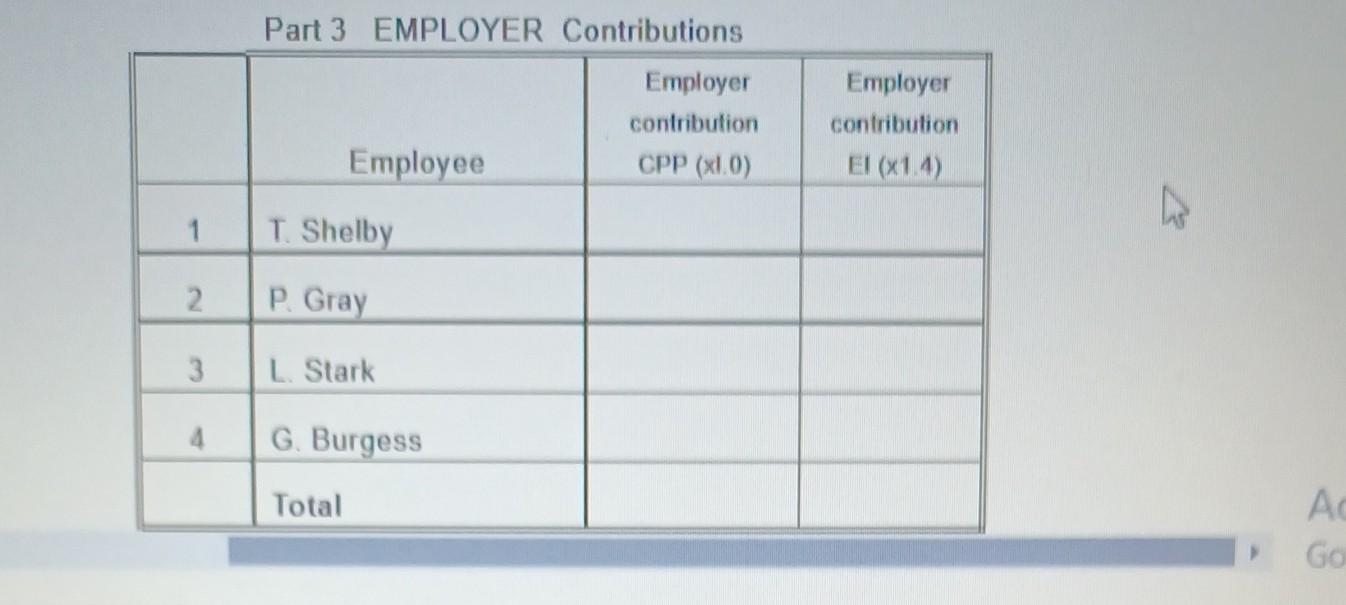

Shelby Company Limited is headquartered in Winnipeg Manitoba and has four employees on its payroll. Shelby Company has a semi-monthly payroll ending every 15th and final day of the month. Employees are gnificant all the necessary paperwork with LKA to document her disability. Lizzie estimates that she will earn $39,000.00 this year. Grace Burgess Grace is 20 years old and works part-time, as she is currently in college. She will be in classes full-time for 8 months during the 2022 year. Grace estimates that she will pay about $2,500 in tuition and about $1,000 for books over the year. She is hoping to make $5,000 from her part-time work over the year. Section 1: (12 marks) Using the fillable forms provided in the Assignment Case #1 section within the Learn course shell, complete the following forms for the Shelby Company employees (see Introduction), taking advantage of all claims allowable to them.: - TD1 2022 Personal Tax Credit Return - TD1-WS 2022 Personal Tax Credit Return Worksheet - TD1MB 2022 Manitoba Personal Tax Credit Return - TD1MB-WS 2022 Manitoba Personal Tax Credits Return Worksheet - for the below individuals taking advantage of all claims allowable to them. (8 Marks) Determine the corresponding 2022 Federal and Manitoba claim codes for the TD1 and TD1-MB totals provided from Section 1. (4 Marks) Calculate the taxable benefit/allowance for each of the situations described below. Show your calculations in the space provided for each scenario as partial marks may be awarded. Provide a brief explanation for each of your decisions. Utilize the following register and employee payroll information, provided in the previous sections, to complete the first payroll cycle for the year. For statutory deductions, apply the 2022 rates and tax tables. Assume Shelby Company Limited is subject to the standard employer rates for EI and CPP. Pay Period Dat 2 Dart 2 EMADI VED Shelby Company Limited is headquartered in Winnipeg Manitoba and has four employees on its payroll. Shelby Company has a semi-monthly payroll ending every 15th and final day of the month. Employees are gnificant all the necessary paperwork with LKA to document her disability. Lizzie estimates that she will earn $39,000.00 this year. Grace Burgess Grace is 20 years old and works part-time, as she is currently in college. She will be in classes full-time for 8 months during the 2022 year. Grace estimates that she will pay about $2,500 in tuition and about $1,000 for books over the year. She is hoping to make $5,000 from her part-time work over the year. Section 1: (12 marks) Using the fillable forms provided in the Assignment Case #1 section within the Learn course shell, complete the following forms for the Shelby Company employees (see Introduction), taking advantage of all claims allowable to them.: - TD1 2022 Personal Tax Credit Return - TD1-WS 2022 Personal Tax Credit Return Worksheet - TD1MB 2022 Manitoba Personal Tax Credit Return - TD1MB-WS 2022 Manitoba Personal Tax Credits Return Worksheet - for the below individuals taking advantage of all claims allowable to them. (8 Marks) Determine the corresponding 2022 Federal and Manitoba claim codes for the TD1 and TD1-MB totals provided from Section 1. (4 Marks) Calculate the taxable benefit/allowance for each of the situations described below. Show your calculations in the space provided for each scenario as partial marks may be awarded. Provide a brief explanation for each of your decisions. Utilize the following register and employee payroll information, provided in the previous sections, to complete the first payroll cycle for the year. For statutory deductions, apply the 2022 rates and tax tables. Assume Shelby Company Limited is subject to the standard employer rates for EI and CPP. Pay Period Dat 2 Dart 2 EMADI VED