Question

Sheldon Cooper is an unmarried man living in Cape Town, South Africa. On the 25th of April 2022, he inherited a house in Parktown, Johannesburg,

Sheldon Cooper is an unmarried man living in Cape Town, South Africa. On the 25th of April 2022, he inherited a house in Parktown, Johannesburg, with a market value of R1,500,000 from his late father, George Cooper. Sheldon works as a scientist at the local university, earning a salary of R500,000 per annum, and has no intention of relocating to Johannesburg. Therefore he decided to rent this house to a couple for R12,000 a month, beginning on the 15th of May 2022. During the year under assessment, he received R60,000 from these tenants. On the 25th of September 2022, having realised that the house had grown in market value, Sheldon decided to sell it for R1,800,000 to his tenants. He then used the to purchase another house of the same value in in Parktown. On the 25th of November 2022, he sold this newly purchased house at its market value of R2,100,000 to an interested buyer.

Additional information:

Required:

Explain to Sheldon which of the amounts received by him would be included in the calculation of his gross income.

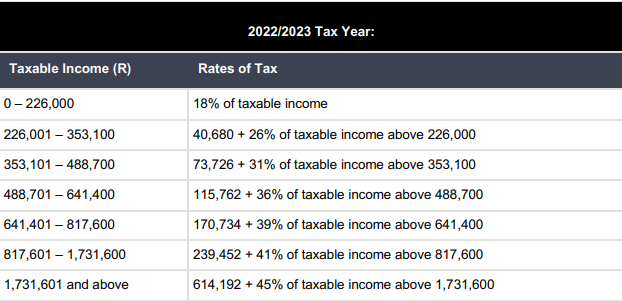

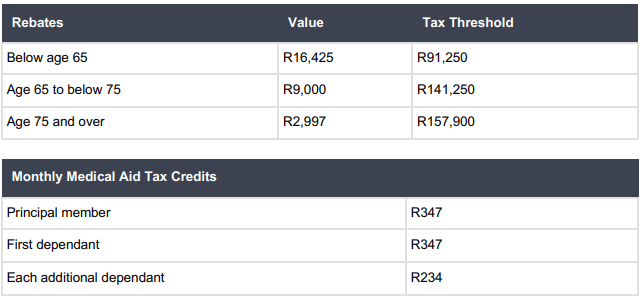

2022/2023 Tax Year: \begin{tabular}{|l|l} \hline Taxable Income (R) & Rates of Tax \\ \hline 0226,000 & 18% of taxable income \\ \hline 226,001353,100 & 40,680+26% of taxable income above 226,000 \\ \hline 353,101488,700 & 73,726+31% of taxable income above 353,100 \\ \hline 488,701641,400 & 115,762+36% of taxable income above 488,700 \\ \hline 641,401817,600 & 170,734+39% of taxable income above 641,400 \\ \hline 817,6011,731,600 & 239,452+41% of taxable income above 817,600 \\ \hline 1,731,601 and above & 614,192+45% of taxable income above 1,731,600 \\ \hline \end{tabular} \begin{tabular}{|l|l|l|} \hline Rebates & Value & Tax Threshold \\ \hline Below age 65 & R16,425 & R91,250 \\ \hline Age 65 to below 75 & R9,000 & R141,250 \\ \hline Age 75 and over & R2,997 & R157,900 \\ \hline \end{tabular} \begin{tabular}{|l|l|} \hline Monthly Medical Aid Tax Credits & \\ \hline Principal member & R347 \\ \hline First dependant & R347 \\ \hline Each additional dependant & R234 \\ \hline \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started