Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Sheldon Daly is district sales manager for a Vancouver-based distribution company He has requested that you help him establish his employment income for tax purposes

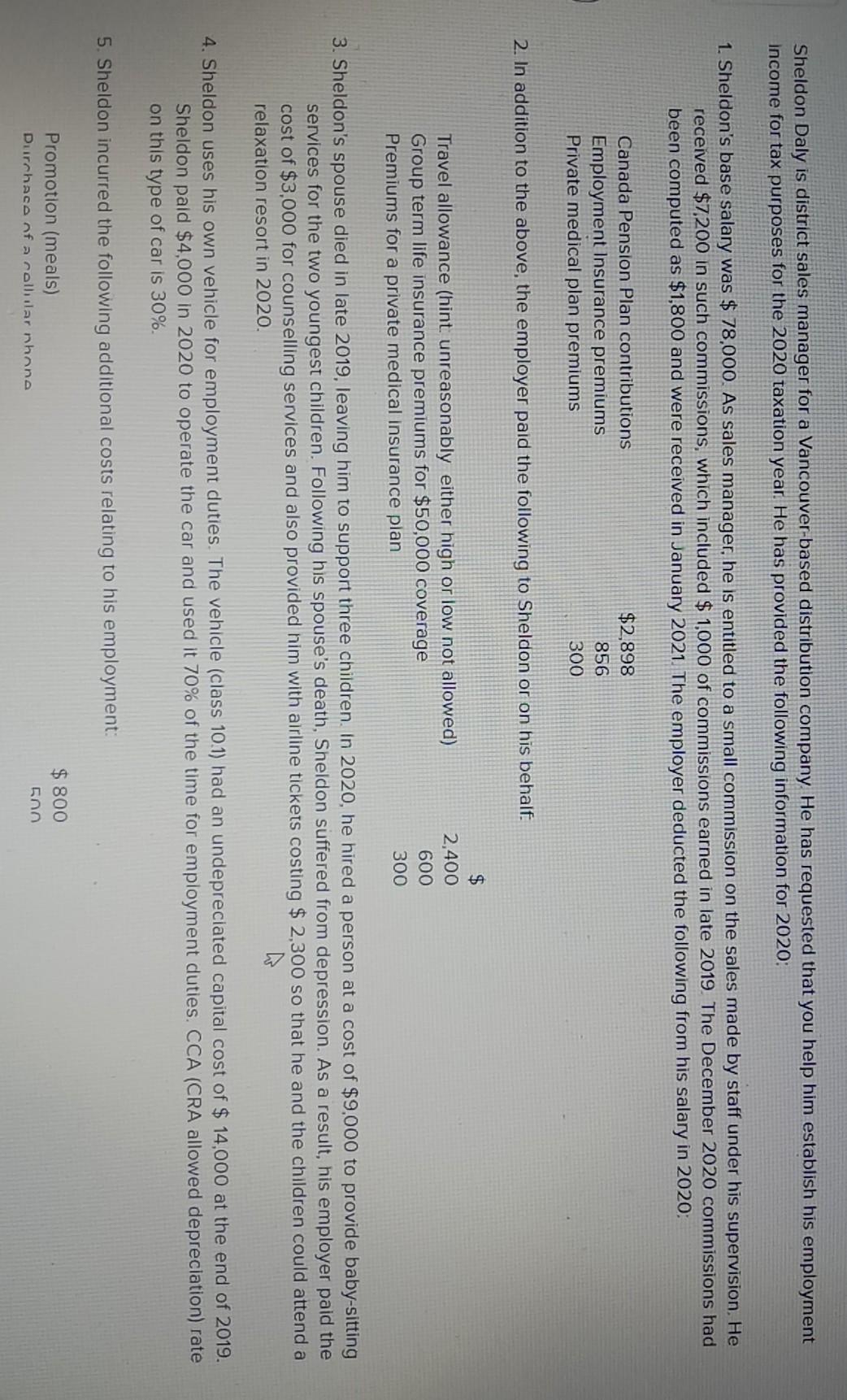

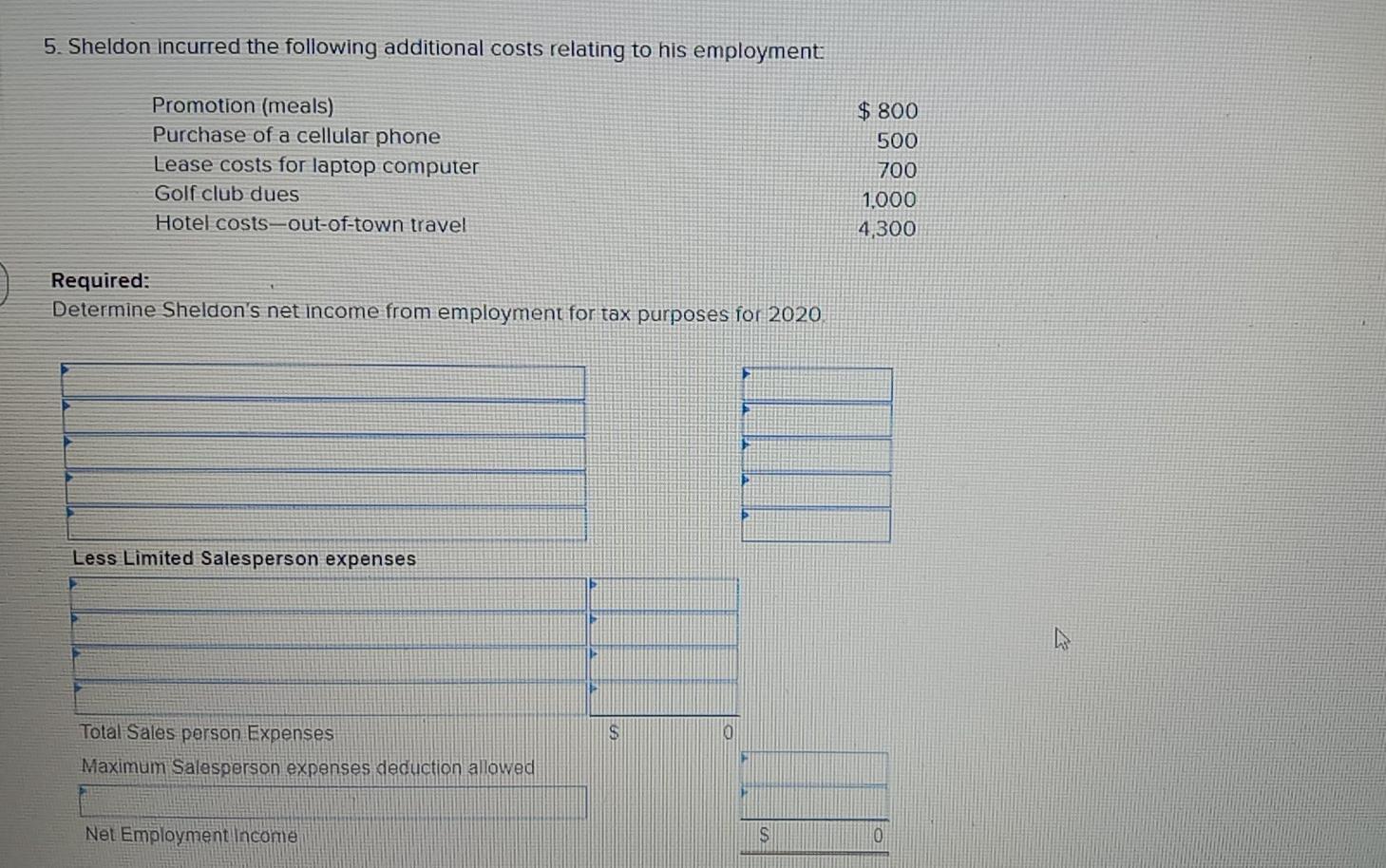

Sheldon Daly is district sales manager for a Vancouver-based distribution company He has requested that you help him establish his employment income for tax purposes for the 2020 taxation year. He has provided the following information for 2020: 1. Sheldon's base salary was $ 78,000. As sales manager, he is entitled to a small commission on the sales made by staff under his supervision. He received $7,200 in such commissions, which included $ 1.000 of commissions earned in late 2019 The December 2020 commissions had been computed as $1,800 and were received in January 2021. The employer deducted the following from his salary in 2020 Canada Pension Plan contributions Employment Insurance premiums Private medical plan premiums $2,898 856 300 2. In addition to the above, the employer paid the following to Sheldon or on his behalf. Travel allowance (hint unreasonably either high or low not allowed) Group term life insurance premiums for $50,000 coverage Premiums for a private medical insurance plan $ 2,400 600 300 3. Sheldon's spouse died in late 2019, leaving him to support three children. In 2020, he hired a person at a cost of $9,000 to provide baby-sitting services for the two youngest children. Following his spouse's death, Sheldon suffered from depression. As a result, his employer paid the cost of $3,000 for counselling services and also provided him with airline tickets costing $ 2,300 so that he and the children could attend a relaxation resort in 2020. 4. Sheldon uses his own vehicle for employment duties. The vehicle (class 10.1) had an undepreciated capital cost of $ 14,000 at the end of 2019. Sheldon paid $4,000 in 2020 to operate the car and used it 70% of the time for employment duties. CCA (CRA allowed depreciation) rate on this type of car is 30%. 5. Sheldon incurred the following additional costs relating to his employment: Promotion (meals) $ 800 Durchase of a collilar nhona 5. Sheldon incurred the following additional costs relating to his employment Promotion (meals) Purchase of a cellular phone Lease costs for laptop computer Golf club dues Hotel costs-out-of-town travel $ 800 500 700 1,000 4,300 Required: Determine Sheldon's net income from employment for tax purposes for 2020 b Less Limited Salesperson expenses S 0 Total Sales person Expenses Maximum Salesperson expenses deduction allowed Net Employment Income $ 0 Sheldon Daly is district sales manager for a Vancouver-based distribution company He has requested that you help him establish his employment income for tax purposes for the 2020 taxation year. He has provided the following information for 2020: 1. Sheldon's base salary was $ 78,000. As sales manager, he is entitled to a small commission on the sales made by staff under his supervision. He received $7,200 in such commissions, which included $ 1.000 of commissions earned in late 2019 The December 2020 commissions had been computed as $1,800 and were received in January 2021. The employer deducted the following from his salary in 2020 Canada Pension Plan contributions Employment Insurance premiums Private medical plan premiums $2,898 856 300 2. In addition to the above, the employer paid the following to Sheldon or on his behalf. Travel allowance (hint unreasonably either high or low not allowed) Group term life insurance premiums for $50,000 coverage Premiums for a private medical insurance plan $ 2,400 600 300 3. Sheldon's spouse died in late 2019, leaving him to support three children. In 2020, he hired a person at a cost of $9,000 to provide baby-sitting services for the two youngest children. Following his spouse's death, Sheldon suffered from depression. As a result, his employer paid the cost of $3,000 for counselling services and also provided him with airline tickets costing $ 2,300 so that he and the children could attend a relaxation resort in 2020. 4. Sheldon uses his own vehicle for employment duties. The vehicle (class 10.1) had an undepreciated capital cost of $ 14,000 at the end of 2019. Sheldon paid $4,000 in 2020 to operate the car and used it 70% of the time for employment duties. CCA (CRA allowed depreciation) rate on this type of car is 30%. 5. Sheldon incurred the following additional costs relating to his employment: Promotion (meals) $ 800 Durchase of a collilar nhona 5. Sheldon incurred the following additional costs relating to his employment Promotion (meals) Purchase of a cellular phone Lease costs for laptop computer Golf club dues Hotel costs-out-of-town travel $ 800 500 700 1,000 4,300 Required: Determine Sheldon's net income from employment for tax purposes for 2020 b Less Limited Salesperson expenses S 0 Total Sales person Expenses Maximum Salesperson expenses deduction allowed Net Employment Income $ 0

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started