Answered step by step

Verified Expert Solution

Question

1 Approved Answer

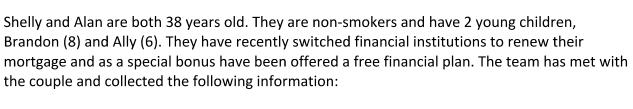

Shelly and Alan are both 38 years old. They are non-smokers and have 2 young children, Brandon (8) and Ally (6). They have recently

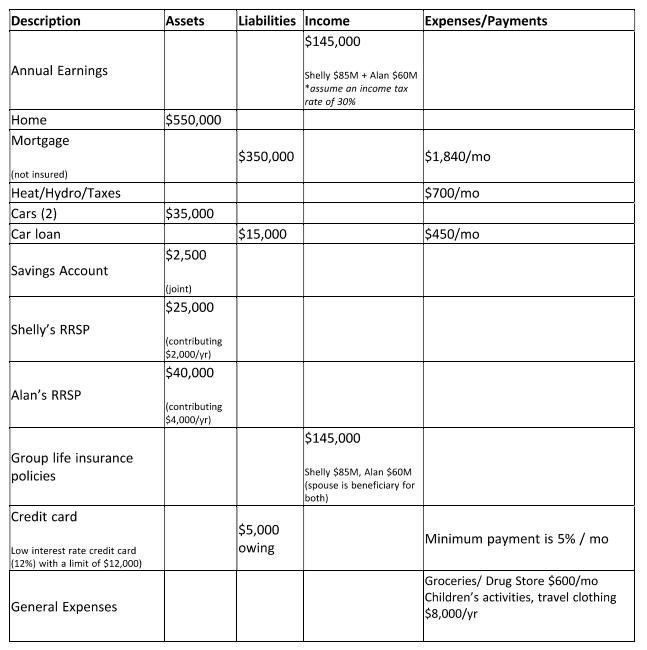

Shelly and Alan are both 38 years old. They are non-smokers and have 2 young children, Brandon (8) and Ally (6). They have recently switched financial institutions to renew their mortgage and as a special bonus have been offered a free financial plan. The team has met with the couple and collected the following information: Description Annual Earnings Home Mortgage (not insured) Heat/Hydro/Taxes Cars (2) Car loan Savings Account Shelly's RRSP Alan's RRSP Group life insurance policies Credit card Low interest rate credit card (12%) with a limit of $12,000) General Expenses Assets Liabilities Income $145,000 $550,000 $35,000 $2,500 (joint) $25,000 (contributing $2,000/yr) $40,000 (contributing $4,000/yr) $350,000 $15,000 $5,000 owing Shelly $85M+ Alan $60M *assume an income tax rate of 30% $145,000 Shelly $85M, Alan $60M (spouse is beneficiary for both) Expenses/Payments $1,840/mo $700/mo $450/mo Minimum payment is 5% / mo Groceries/ Drug Store $600/mo Children's activities, travel clothing $8,000/yr Question #1 Identify Shelly and Alan's life cycle stage and based on their stage assess strengths, weaknesses, opportunities and threats of their current financial situation using all applicable financial ratios and formulas. Question #2 Shelly and Alan have recently lost a close friend in a car accident. They feel so sad to see their friend's wife left struggling to raise and provide for her 2 children all alone. Shelly and Alan have given some thought to the family's financial affairs should an unexpected tragedy occur. Their wishes include: family remains in the home, $140,000 is available for the children's education, if one spouse passed away the other would need supplemental income equivalent to 50% of the other spouse's gross income until Ally completed a post secondary degree at 22. If they both passed away Alan's sister would take care of the children and would require income of $20,000 each until Ally completed a post secondary degree at 22. Shelly and Alan would like the team to assess the amount of life insurance they would need if: 1) Shelly passed away 2) Alan passed away and 3) both pass away. 4)They also want to know if there is a rider that would provide protection for both their children until they are adults. 5) Shelly and Alan are also concerned about getting sick or being in an accident and not being able to provide for their family. They ask you what steps they could take to protect against illnesses or injuries in case they are unable to work for 6 month - 1 year. . .05 discount rate make and state any other assumptions and ignore estate taxes Question #3 Provide 2 options of how Shelly & Alan could use their monthly surplus cash to address any of the weaknesses, opportunities or threats identified. Provide rationale for each option and how it addresses a gap or capitalizes on an opportunity, state any information/questions you may have of the clients and clarify next steps.

Step by Step Solution

★★★★★

3.49 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Question 1 Life Cycle Stage Shelly and Alan are in the Expanding Family life cycle stage This stage is characterized by the following Two wage earners Young children Increasing expenses Need for longt...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started