Answered step by step

Verified Expert Solution

Question

1 Approved Answer

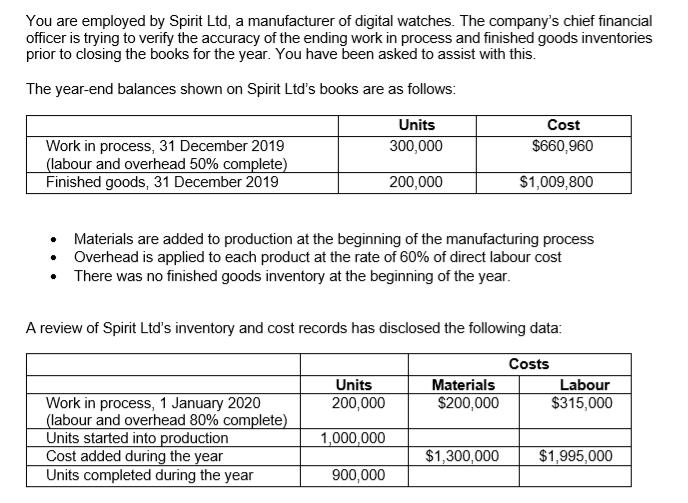

You are employed by Spirit Ltd, a manufacturer of digital watches. The company's chief financial officer is trying to verify the accuracy of the

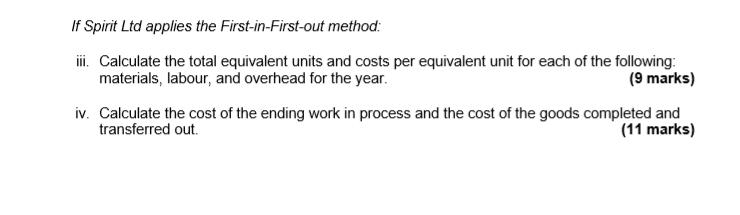

You are employed by Spirit Ltd, a manufacturer of digital watches. The company's chief financial officer is trying to verify the accuracy of the ending work in process and finished goods inventories prior to closing the books for the year. You have been asked to assist with this. The year-end balances shown on Spirit Ltd's books are as follows: Work in process, 31 December 2019 (labour and overhead 50% complete) Finished goods, 31 December 2019 Materials are added to production at the beginning of the manufacturing process Overhead is applied to each product at the rate of 60% of direct labour cost There was no finished goods inventory at the beginning of the year. Work in process, 1 January 2020 (labour and overhead 80% complete) Units started into production Units 300,000 200,000 A review of Spirit Ltd's inventory and cost records has disclosed the following data: Costs Cost added during the year Units completed during the year Units 200,000 1,000,000 900,000 Cost $660,960 $1,009,800 Materials $200,000 $1,300,000 Labour $315,000 $1,995,000 If Spirit Ltd applies the First-in-First-out method: iii. Calculate the total equivalent units and costs per equivalent unit for each of the following: materials, labour, and overhead for the year. (9 marks) iv. Calculate the cost of the ending work in process and the cost of the goods completed and transferred out. (11 marks)

Step by Step Solution

★★★★★

3.43 Rating (172 Votes )

There are 3 Steps involved in it

Step: 1

The answer has been fresented in the supporting she sheet Spirit Lts Units completed Inventosey in p...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started