Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Sheridan Company has recently decided to go public and has hired you as an independent CPA. One statement that the enterprise is anxious to have

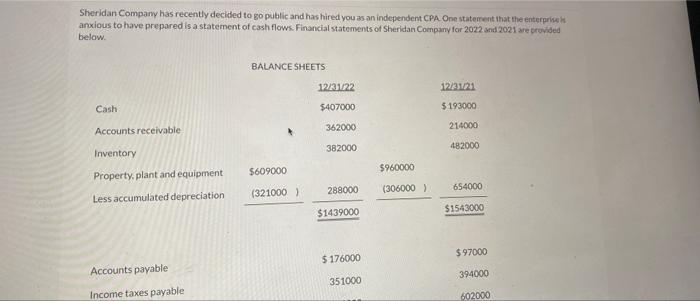

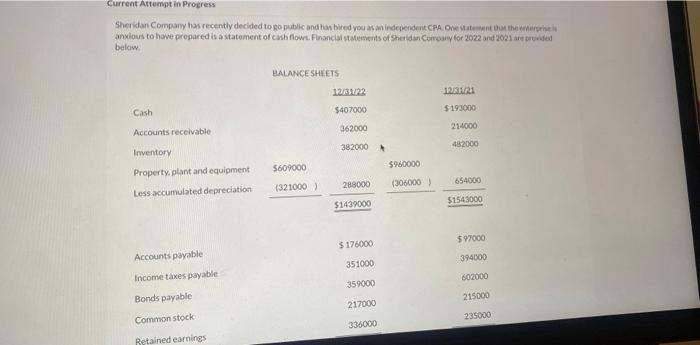

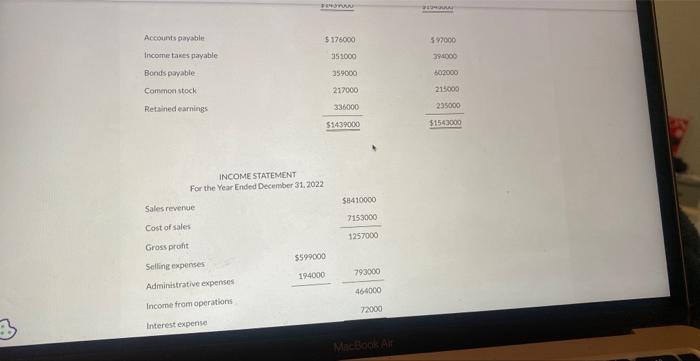

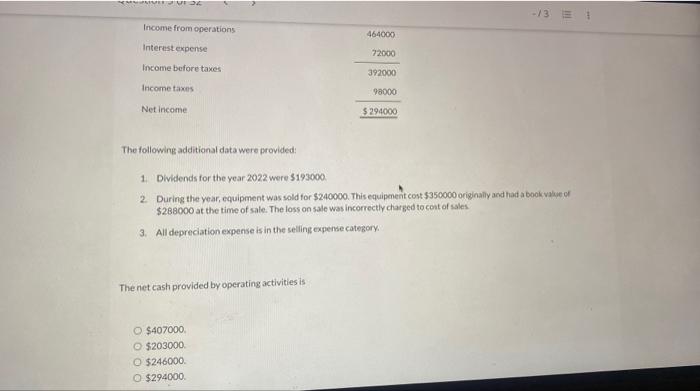

Sheridan Company has recently decided to go public and has hired you as an independent CPA. One statement that the enterprise is anxious to have prepared is a statement of cash flows. Financial statements of Sheridan Company for 2022 and 2021 are provided below. Cash Accounts receivable Inventory Property, plant and equipment Less accumulated depreciation Accounts payable Income taxes payable BALANCE SHEETS $609000 (321000) 12/31/22 $407000 362000 382000 288000 $1439000 $176000 351000 $960000 (306000) 12/31/21 $193000 214000 482000 654000 $1543000 $97000 394000 602000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started