Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Sheridan Company leases equipment from Cheyenne Inc. for five years starting on January 1, 2025. The lease is properly classified as a finance/sales-type lease.

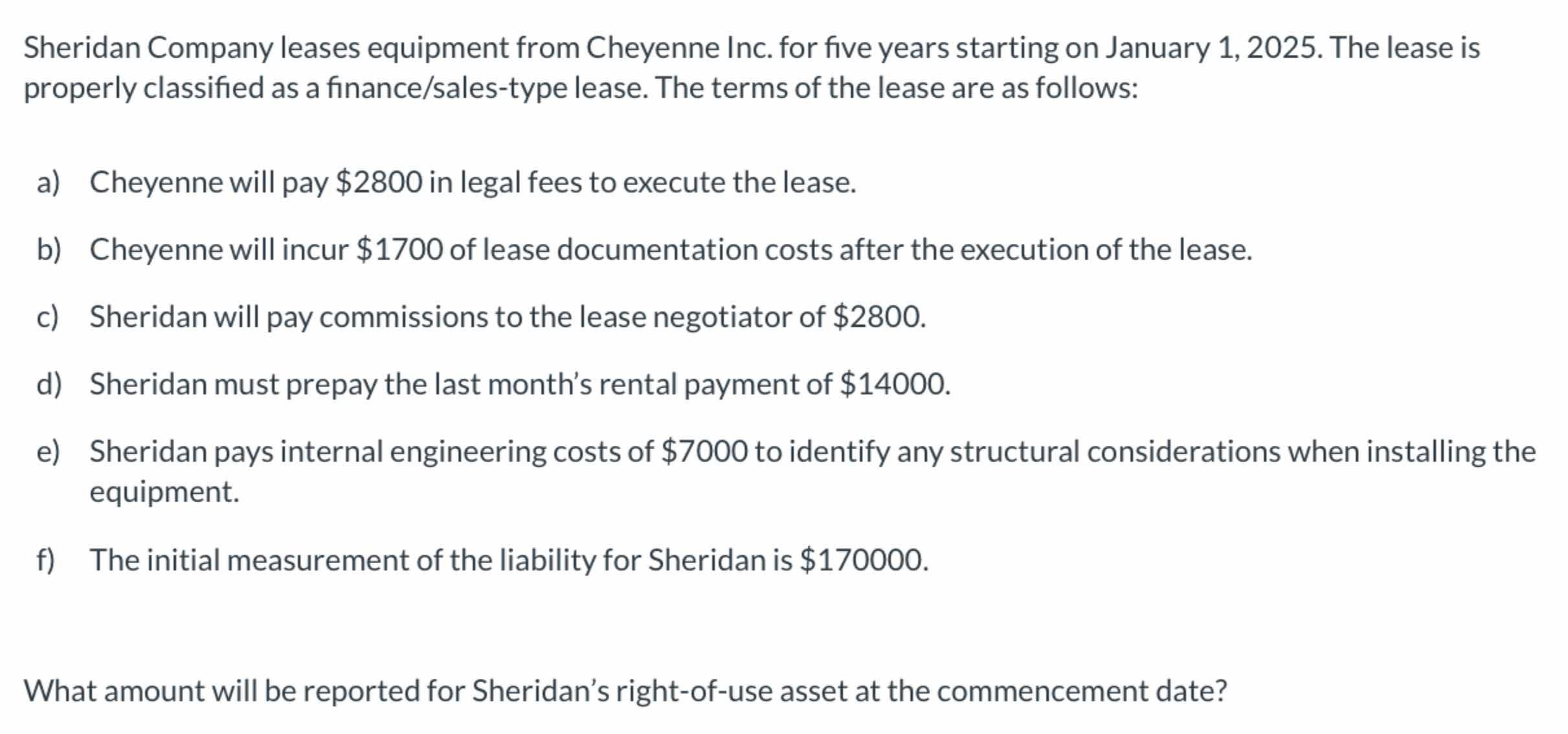

Sheridan Company leases equipment from Cheyenne Inc. for five years starting on January 1, 2025. The lease is properly classified as a finance/sales-type lease. The terms of the lease are as follows: a) Cheyenne will pay $2800 in legal fees to execute the lease. b) Cheyenne will incur $1700 of lease documentation costs after the execution of the lease. c) Sheridan will pay commissions to the lease negotiator of $2800. d) Sheridan must prepay the last month's rental payment of $14000. e) Sheridan pays internal engineering costs of $7000 to identify any structural considerations when installing the equipment. f) The initial measurement of the liability for Sheridan is $170000. What amount will be reported for Sheridan's right-of-use asset at the commencement date?

Step by Step Solution

★★★★★

3.46 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

Based on the image the amount reported for Sheridans rightofuse asset at the commencement date will be 194500 This is calculated by adding the initial measurement of the liability for Sheridan 170000 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started