Question

Sheridan Enterprises is a boutique guitar manufacturer. The company produces both acoustic and electric guitars for rising and established professional musicians. Vanessa Aaron, the companys

Sheridan Enterprises is a boutique guitar manufacturer. The company produces both acoustic and electric guitars for rising and established professional musicians. Vanessa Aaron, the companys sales manager, prepared the following sales forecast for 2018. The forecasted sales prices include a 5% increase in the acoustic guitar price and a 10% increase in the electric guitar price, to cover anticipated increases in raw materials prices.

| Sales Price | 1st Quarter | 2nd Quarter | 3rd Quarter | 4th Quarter | ||||||||||||

| Acoustic guitar sales | $1,220 | 200 | 270 | 290 | 350 | |||||||||||

| Electric guitar sales | $2,370 | 400 | 340 | 320 | 370 | |||||||||||

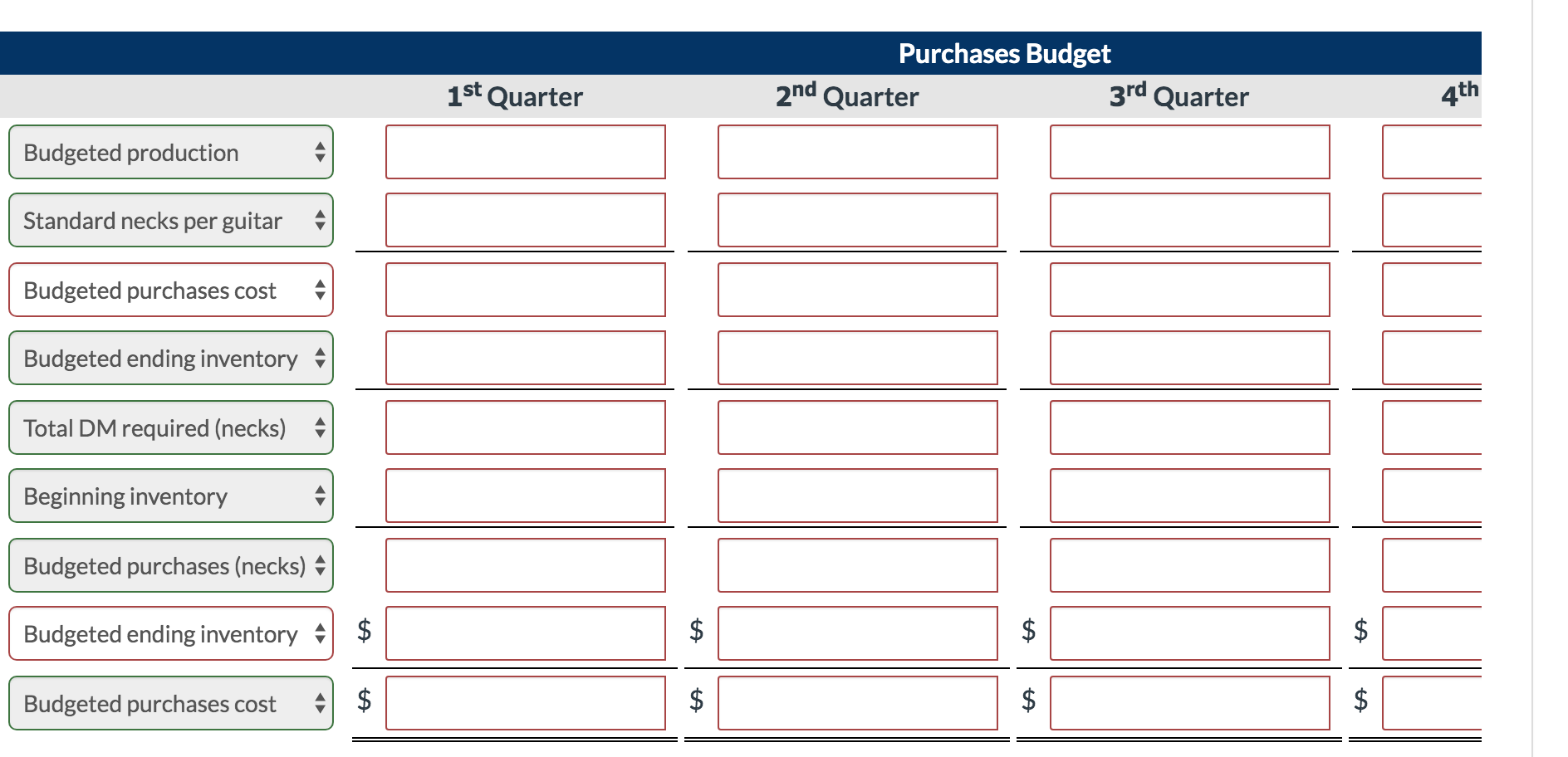

| Each acoustic guitar requires a maple neck blank, which Sheridan purchases for $40. On December 31, 2017, Sheridan had 410 neck blanks in inventory. Spoilage during the production process results in a standard quantity of 1.5 necks per acoustic guitar. Because of recent delivery problems, Sheridan wants to maintain an ending inventory equal to 50% of the following quarters production needs. Since the supplier has assured Sheridan that the delivery issues will be resolved by the end of December, Sheridan wants only 330 neck blanks in inventory on December 31, 2018. Prepare the purchases budget for neck blanks for 2018. (Enter "per guitar" value to 1 decimal place, e.g. 3.1. Round all other answers to 0 decimal places, e.g. 153.)

|

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started