Question

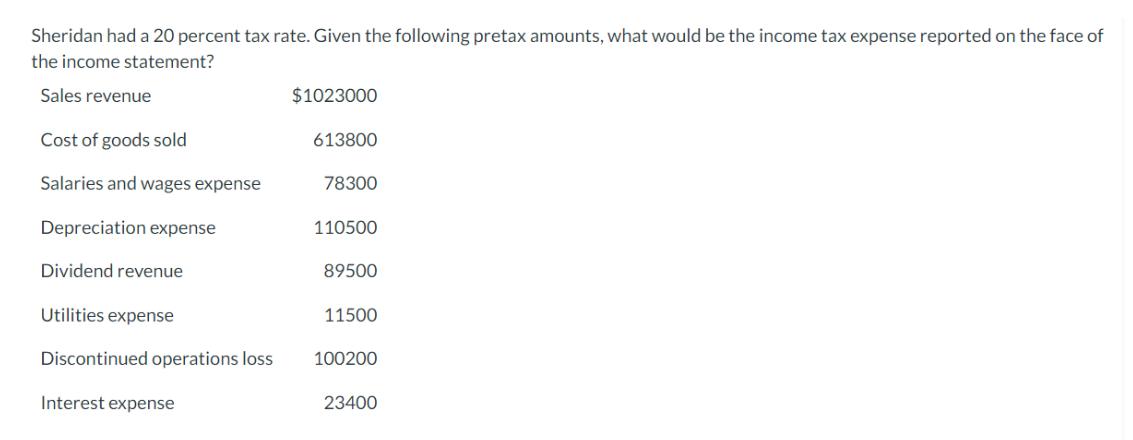

Sheridan had a 20 percent tax rate. Given the following pretax amounts, what would be the income tax expense reported on the face of

Sheridan had a 20 percent tax rate. Given the following pretax amounts, what would be the income tax expense reported on the face of the income statement? Sales revenue Cost of goods sold Salaries and wages expense Depreciation expense Dividend revenue Utilities expense Discontinued operations loss Interest expense $1023000 613800 78300 110500 89500 11500 100200 23400

Step by Step Solution

3.32 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the income tax expense we need to determine the taxable i...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Accounting and Reporting a Global Perspective

Authors: Michel Lebas, Herve Stolowy, Yuan Ding

4th edition

978-1408066621, 1408066629, 1408076861, 978-1408076866

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App