Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Sheridan Incorporated leases a piece of machinery to Concord Company on January 1, 2020, under the following terms. HELP WITH 21-15 Part Level Submission PART

Sheridan Incorporated leases a piece of machinery to Concord Company on January 1, 2020, under the following terms.

HELP WITH 21-15 Part Level Submission PART C: Journal entry for cost of good sold and sales revenue?

| 1. | The lease is to be for 4 years with rental payments of $15,278 to be made at the beginning of each year. | |

| 2. | The machinery has a fair value of $80,086, a book value of $59,760, and an economic life of 10 years. | |

| 3. | At the end of the lease term, both parties expect the machinery to have a residual value of $29,880. To protect against a large loss, Sheridan requests Concord to guarantee $21,160 of the residual value, which Irving agrees to do. | |

| 4. | The lease does not transfer ownership at the end of the lease term, does not have any bargain purchase options, and the asset is not of a specialized nature. | |

| 5. | The implicit rate is 5%, which is known by Concord. | |

| 6. | Collectibility of the payments is probable. |

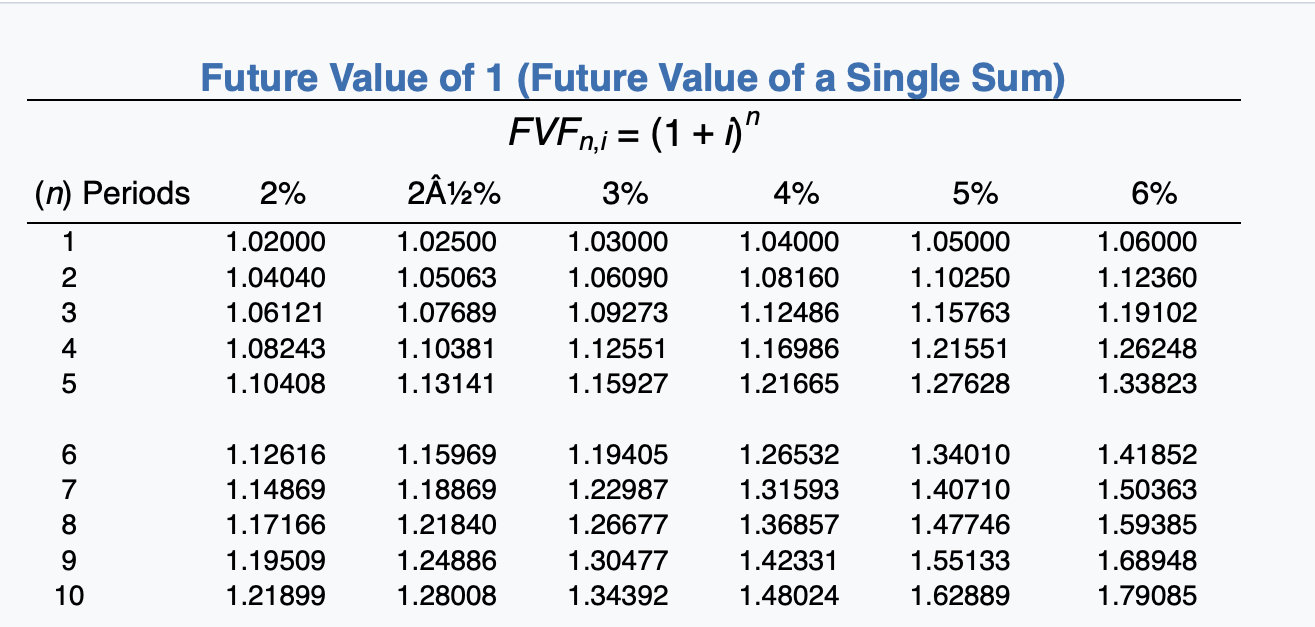

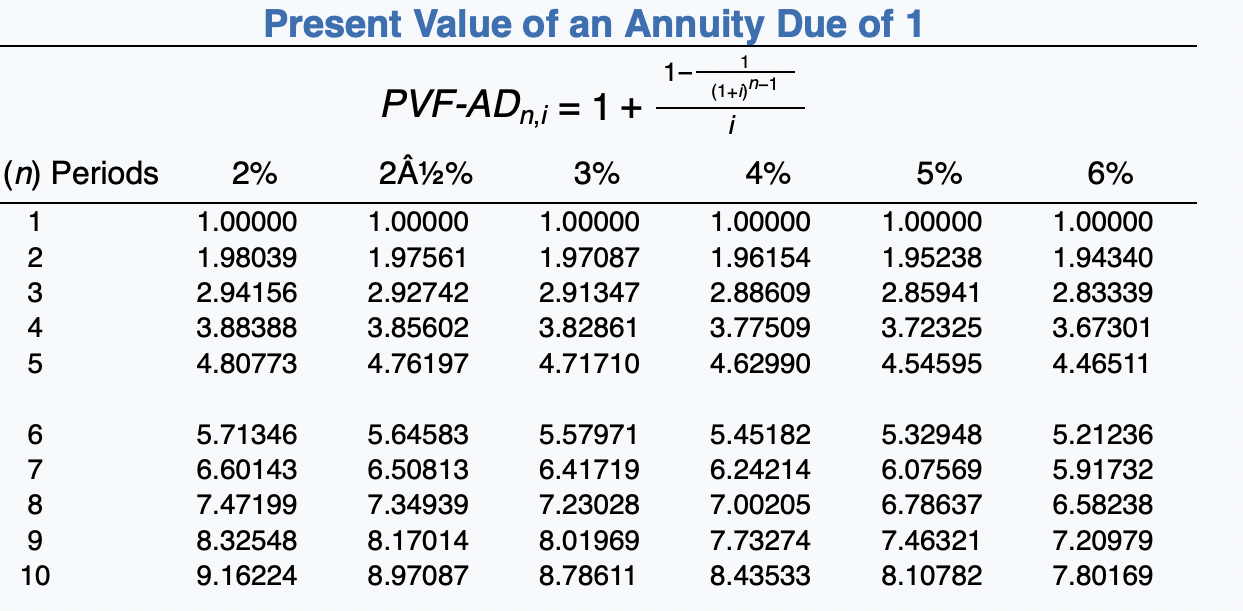

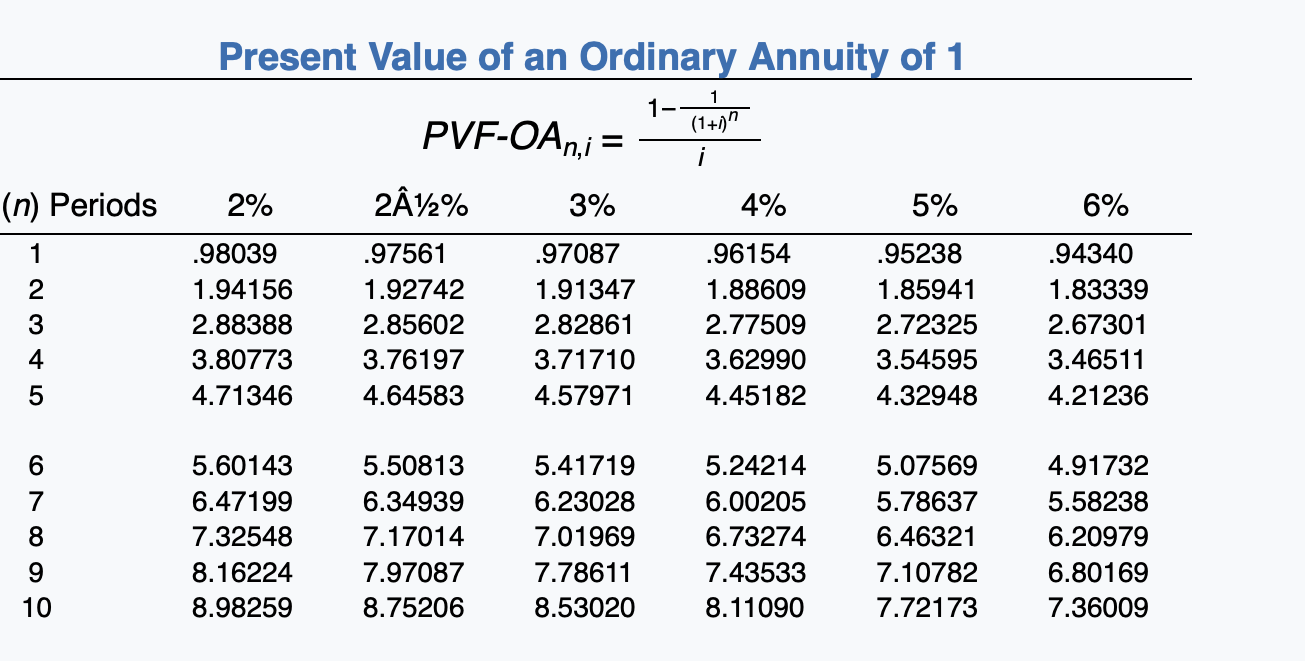

6% Future Value of 1 (Future Value of a Single Sum) FVFn,i = (1 + i)" (n) Periods 2% Z12% 3% 4% 5% 1 1.02000 1.02500 1.03000 1.04000 1.05000 2 1.04040 1.05063 1.06090 1.08160 1.10250 3 1.06121 1.07689 1.09273 1.12486 1.15763 4 1.08243 1.10381 1.12551 1.16986 1.21551 5 1.10408 1.13141 1.15927 1.21665 1.27628 1.06000 1.12360 1.19102 1.26248 1.33823 6 7 8 1.12616 1.14869 1.17166 1.19509 1.21899 1.15969 1.18869 1.21840 1.24886 1.28008 1.19405 1.22987 1.26677 1.30477 1.34392 1.26532 1.31593 1.36857 1.42331 1.48024 1.34010 1.40710 1.47746 1.55133 1.62889 1.41852 1.50363 1.59385 1.68948 1.79085 9 10 Present Value of an Annuity Due of 1 1 1- (1+11-1 i PVF-ADni = 1 + 242% 3% (n) Periods 2% 4% 5% 6% 1 2 3 4 1.00000 1.98039 2.94156 3.88388 4.80773 1.00000 1.97561 2.92742 3.85602 4.76197 1.00000 1.97087 2.91347 3.82861 4.71710 1.00000 1.96154 2.88609 3.77509 4.62990 1.00000 1.95238 2.85941 3.72325 4.54595 1.00000 1.94340 2.83339 3.67301 4.46511 5 6 7 8 5.71346 6.60143 7.47199 8.32548 9.16224 5.64583 6.50813 7.34939 8.17014 8.97087 5.57971 6.41719 7.23028 8.01969 8.78611 5.45182 6.24214 7.00205 7.73274 8.43533 5.32948 6.07569 6.78637 7.46321 8.10782 5.21236 5.91732 6.58238 7.20979 7.80169 9 10 Present Value of an Ordinary Annuity of 1 1 1- PVF-OAni = (177)" i (n) Periods 2% 212% 3% 4% 5% 6% 1 2 3 4 .98039 1.94156 2.88388 3.80773 4.71346 .97561 1.92742 2.85602 3.76197 4.64583 .97087 1.91347 2.82861 3.71710 4.57971 .96154 1.88609 2.77509 3.62990 4.45182 .95238 1.85941 2.72325 3.54595 4.32948 .94340 1.83339 2.67301 3.46511 4.21236 5 6 7 8 5.60143 6.47199 7.32548 8.16224 8.98259 5.50813 6.34939 7.17014 7.97087 8.75206 5.41719 6.23028 7.01969 7.78611 8.53020 5.24214 6.00205 6.73274 7.43533 8.11090 5.07569 5.78637 6.46321 7.10782 7.72173 4.91732 5.58238 6.20979 6.80169 7.36009 9 10 Future Value of an Ordinary Annuity of 1 (1+1)"-1 FVF-OAni = (n) Periods 2% 2A%% 3% 4% 5% 6% 1 2 3 4 5 1.00000 2.02000 3.06040 4.12161 5.20404 1.00000 2.02500 3.07563 4.15252 5.25633 1.00000 2.03000 3.09090 4.18363 5.30914 1.00000 2.04000 3.12160 4.24646 5.41632 1.00000 2.05000 3.15250 4.31013 5.52563 1.00000 2.06000 3.18360 4.37462 5.63709 6 7 8 9 10 6.30812 7.43428 8.58297 9.75463 10.94972 6.38774 7.54743 8.73612 9.95452 11.20338 6.46841 7.66246 8.89234 10.15911 11.46338 6.63298 7.89829 9.21423 10.58280 12.00611 6.80191 8.14201 9.54911 11.02656 12.57789 6.97532 8.39384 9.89747 11.49132 13.18079 PVF 1,1 = Present Value of 1 (Present Value of a Single Sum) 1 = (1 + 1)" (1+1)" (n) Periods 2% 212% 3% 4% 5% 6% 1 .98039 .97561 .97087 .96154 .95238 .94340 2 .96117 .95181 94260 .92456 .90703 .89000 3 .94232 .92860 .91514 .88900 .86384 .83962 4 .92385 .90595 .88849 .85480 .82270 .79209 5 .90573 .88385 .86261 .82193 .78353 .74726 6 7 8 9 10 .88797 .87056 .85349 .83676 .82035 .86230 .84127 .82075 .80073 78120 .83748 .81309 .78941 .76642 .74409 .79031 .75992 .73069 ..70259 .67556 .74622 .71068 .67684 .64461 .61391 .70496 .66506 .62741 .59190 .55839 Your answer is correct. Prepare the journal entries for Concord for the year 2020. (Credit account titles are automatically inde titles and enter o for the amounts. Round present value factor calculations to 5 decimal places, Date Account Titles and Explanation Debit Credit Jan. 1 Right-of-Use Asset 56884 Lease Liability 56884 (To record lease) Jan. 17Lease Liability 15278 Cash 15278 (To records first lease payment) Dec. 31 TInterest Expense 2080 2080 Lease Liability (To record accrued interest) Dec. 31 TAmortization Expense 14221 Right-of-Use Asset 14221 (To record amortization expense) (c) Open calculator Your answer is partially correct. Try again. Prepare the journal entries for Sheridan for the year 2020. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts. Round present value factor calculations to 5 decimal places, e.g. 1.25124 and the final answer to 0 decimal places e.g. 5,275.) Date Account Titles and Explanation Debit Credit Jan. 14 Lease Receivable 80086 Cost of Goods Sold 0 PA Sales Revenue 20326 59760 Inventory (To record lease) Jan. 19 Cash 15278 Lease Receivable 15278 (To record first lease payment) Dec. 314 Lease Receivable 3240 Lease Revenue 3240 (To record lease revenue) Click if vou would like to Show Work for this question: Open Show Work

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started