Question

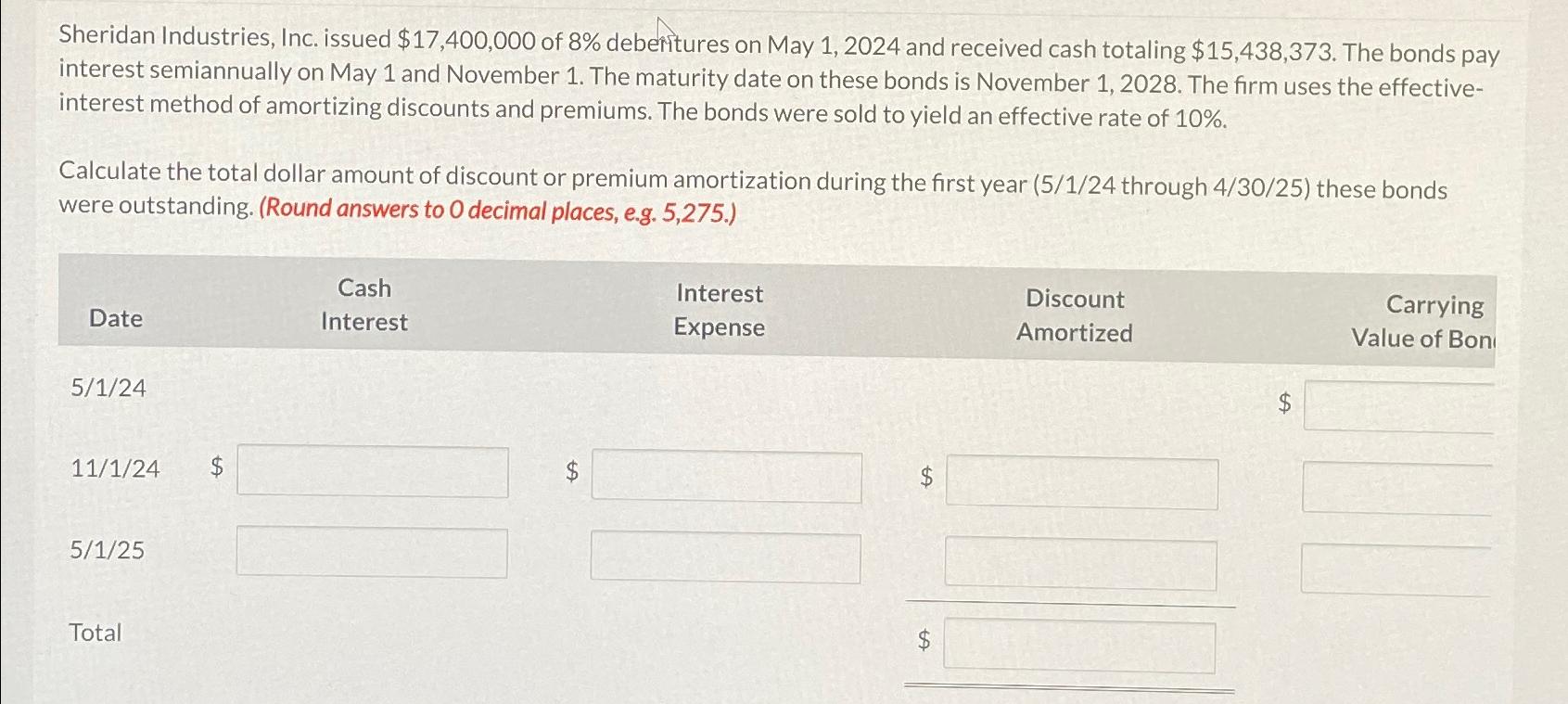

Sheridan Industries, Inc. issued $17,400,000 of 8% deberitures on May 1,2024 and received cash totaling $15,438,373 . The bonds pay interest semiannually on May 1

Sheridan Industries, Inc. issued

$17,400,000of

8%deberitures on May 1,2024 and received cash totaling

$15,438,373. The bonds pay interest semiannually on May 1 and November 1. The maturity date on these bonds is November 1,2028. The firm uses the effectiveinterest method of amortizing discounts and premiums. The bonds were sold to yield an effective rate of

10%.\ Calculate the total dollar amount of discount or premium amortization during the first year (5/1/24 through 4/30/25) these bonds were outstanding. (Round answers to 0 decimal places, e.g. 5,275.)\ \\\\table[[Date,\\\\table[[Cash],[Interest]],\\\\table[[Interest],[Expense]],\\\\table[[Discount],[Amortized]],\\\\table[[Carrying],[Value of Bon]]],[

(5)/(1)/24,

$,

$,,],[

(11)/(1)/24,,,,],[Total,,,,]]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started