Answered step by step

Verified Expert Solution

Question

1 Approved Answer

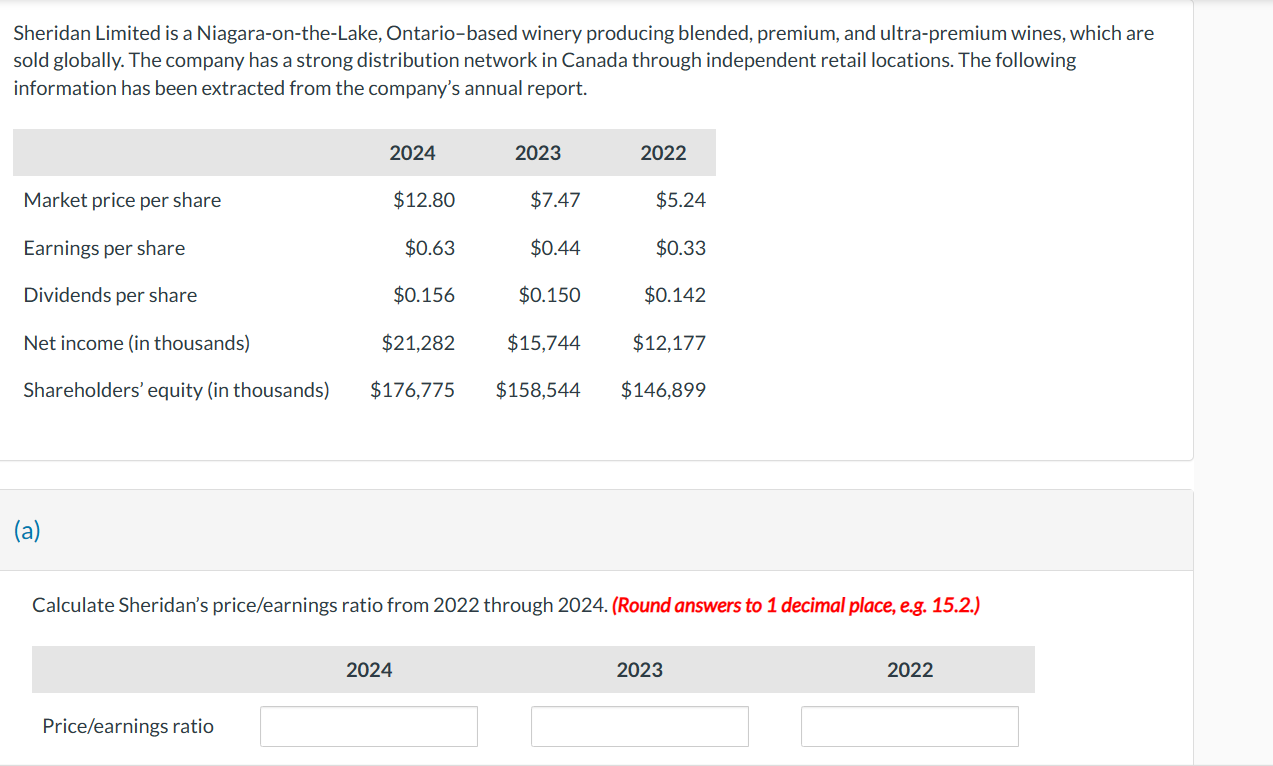

Sheridan Limited is a Niagara-on-the-Lake, Ontario-based winery producing blended, premium, and ultra-premium wines, which are sold globally. The company has a strong distribution network

Sheridan Limited is a Niagara-on-the-Lake, Ontario-based winery producing blended, premium, and ultra-premium wines, which are sold globally. The company has a strong distribution network in Canada through independent retail locations. The following information has been extracted from the company's annual report. 2024 2023 2022 Market price per share $12.80 $7.47 $5.24 Earnings per share $0.63 $0.44 $0.33 Dividends per share $0.156 $0.150 $0.142 Net income (in thousands) $21,282 $15,744 $12.177 Shareholders' equity (in thousands) $176,775 $158,544 $146,899 (a) Calculate Sheridan's price/earnings ratio from 2022 through 2024. (Round answers to 1 decimal place, e.g. 15.2.) Price/earnings ratio 2024 2023 2022

Step by Step Solution

★★★★★

3.31 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

1 2024 Market Price per Share 1280 Earnings per Share 063 PriceEarnings Ratio 1280 063 203 The price...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

66432551a0689_952190.pdf

180 KBs PDF File

66432551a0689_952190.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started