Answered step by step

Verified Expert Solution

Question

1 Approved Answer

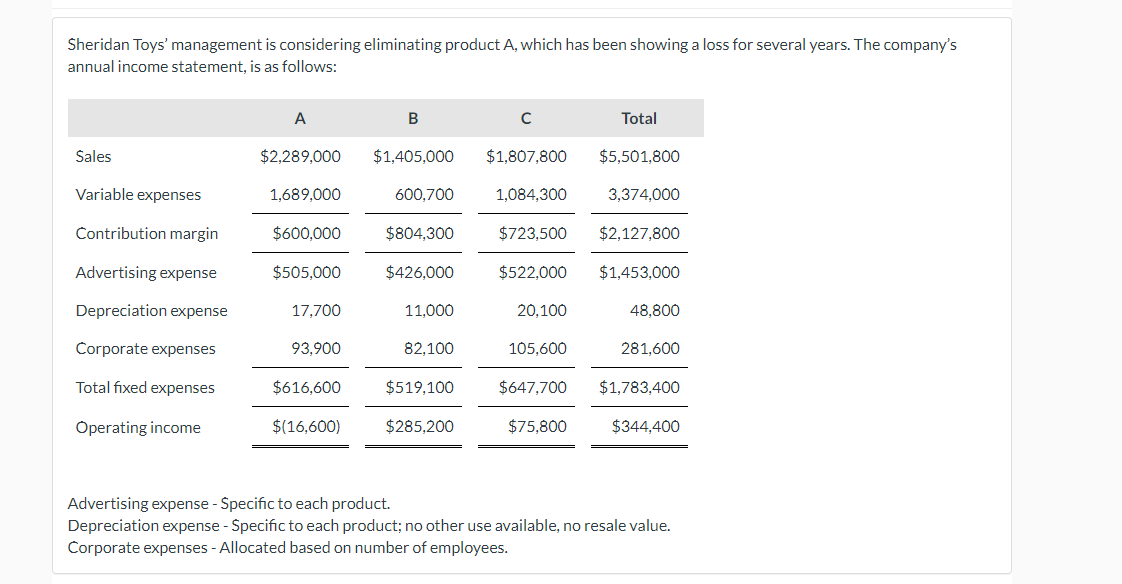

Sheridan Toys' management is considering eliminating product A, which has been showing a loss for several years. The company's annual income statement, is as

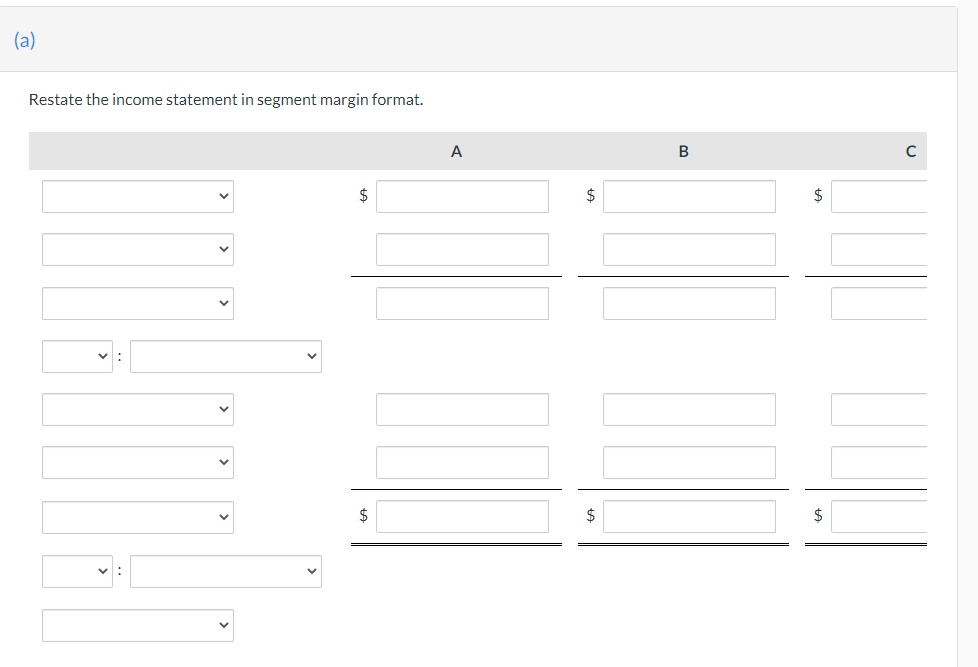

Sheridan Toys' management is considering eliminating product A, which has been showing a loss for several years. The company's annual income statement, is as follows: A B C Total Sales $2,289,000 $1,405,000 $1,807,800 $5,501,800 Variable expenses 1,689,000 600,700 1,084,300 3,374,000 Contribution margin $600,000 $804,300 $723,500 $2,127,800 Advertising expense $505,000 $426,000 $522,000 $1,453,000 Depreciation expense 17,700 11,000 20,100 48,800 Corporate expenses 93,900 82,100 105,600 281,600 Total fixed expenses $616,600 $519,100 $647,700 $1,783,400 Operating income $(16,600) $285,200 $75,800 $344,400 Advertising expense - Specific to each product. Depreciation expense - Specific to each product; no other use available, no resale value. Corporate expenses - Allocated based on number of employees. (a) Restate the income statement in segment margin format. $ A $ B $ $ $ (b) What would be the effect on income if product A were dropped? Net income would by $ (c) Management is considering making a new product using product A's equipment. If the new product's selling price per unit were $10, its variable costs were $5, and its advertising costs were the same as for product A, how many units of the new product would the company have to sell to make the switch from product A to the new product worthwhile? Units

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started