Answered step by step

Verified Expert Solution

Question

1 Approved Answer

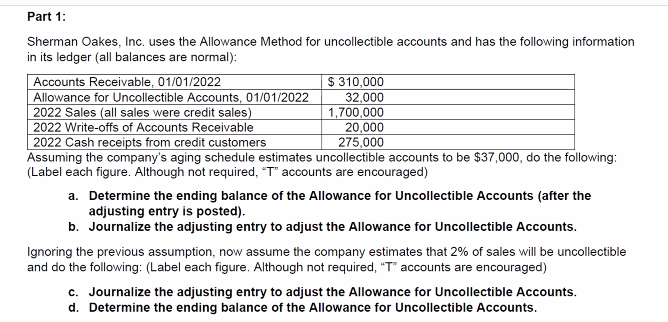

Sherman Oakes, Inc. uses the Allowance Method for uncollectible accounts and has the following information in its ledger (all balances are normal): Assuming the company's

Sherman Oakes, Inc. uses the Allowance Method for uncollectible accounts and has the following information in its ledger (all balances are normal): Assuming the company's aging schedule estimates uncollectible accounts to be $37,000, do the following: (Label each figure. Although not required, " T " accounts are encouraged) a. Determine the ending balance of the Allowance for Uncollectible Accounts (after the adjusting entry is posted). b. Journalize the adjusting entry to adjust the Allowance for Uncollectible Accounts. Ignoring the previous assumption, now assume the company estimates that 2% of sales will be uncollectible and do the following: (Label each figure. Although not required, "T" accounts are encouraged) c. Journalize the adjusting entry to adjust the Allowance for Uncollectible Accounts. d. Determine the ending balance of the Allowance for Uncollectible Accounts

Sherman Oakes, Inc. uses the Allowance Method for uncollectible accounts and has the following information in its ledger (all balances are normal): Assuming the company's aging schedule estimates uncollectible accounts to be $37,000, do the following: (Label each figure. Although not required, " T " accounts are encouraged) a. Determine the ending balance of the Allowance for Uncollectible Accounts (after the adjusting entry is posted). b. Journalize the adjusting entry to adjust the Allowance for Uncollectible Accounts. Ignoring the previous assumption, now assume the company estimates that 2% of sales will be uncollectible and do the following: (Label each figure. Although not required, "T" accounts are encouraged) c. Journalize the adjusting entry to adjust the Allowance for Uncollectible Accounts. d. Determine the ending balance of the Allowance for Uncollectible Accounts Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started