Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Shim Amon owns a small business that manufactures and sells freezers. He manufactures one standard freezer available for sale and he also manufactures custom

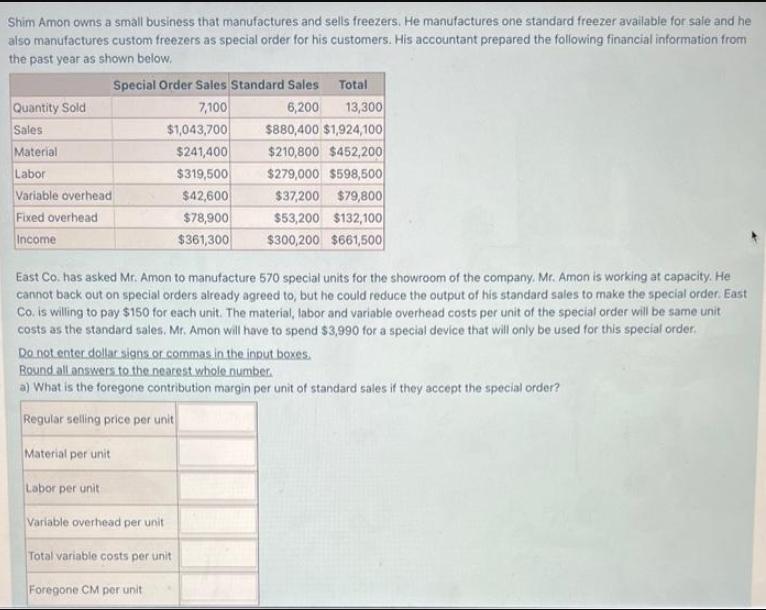

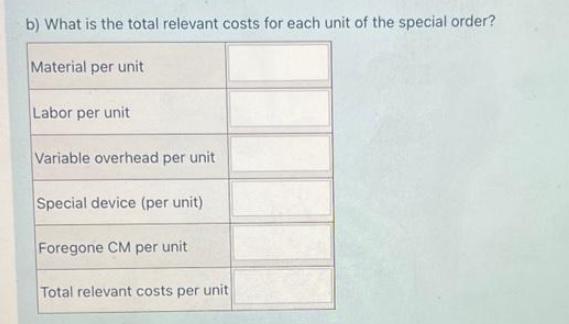

Shim Amon owns a small business that manufactures and sells freezers. He manufactures one standard freezer available for sale and he also manufactures custom freezers as special order for his customers. His accountant prepared the following financial information from the past year as shown below. Quantity Sold Sales Material Labor Variable overhead Fixed overhead Income Special Order Sales Standard Sales 7,100 6,200 13,300 $880,400 $1,924,100 $210,800 $452,200 $279,000 $598,500 $37,200 $79,800 $53,200 $132,100 $300,200 $661,500 Material per unit $1,043,700 $241,400 $319,500 $42,600 $78,900 $361,300 East Co. has asked Mr. Amon to manufacture 570 special units for the showroom of the company. Mr. Amon is working at capacity. He cannot back out on special orders already agreed to, but he could reduce the output of his standard sales to make the special order. East Co. is willing to pay $150 for each unit. The material, labor and variable overhead costs per unit of the special order will be same unit costs as the standard sales. Mr. Amon will have to spend $3,990 for a special device that will only be used for this special order, Labor per unit Do not enter dollar signs or commas in the input boxes. Round all answers to the nearest whole number. a) What is the foregone contribution margin per unit of standard sales if they accept the special order? Regular selling price per unit Total Variable overhead per unit Total variable costs per unit Foregone CM per unit b) What is the total relevant costs for each unit of the special order? Material per unit Labor per unit Variable overhead per unit Special device (per unit) Foregone CM per unit Total relevant costs per unit

Step by Step Solution

★★★★★

3.48 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

a Regular selling price per unit 10437007100 147 Material per unit 2414007100 34 Labor per unit 31...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started