Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Shine Magazine is offering a $120 supermarket cash coupon to attract new subscribers (i.e., acquisition costs incurred to Shine Magazine). The subscription is in

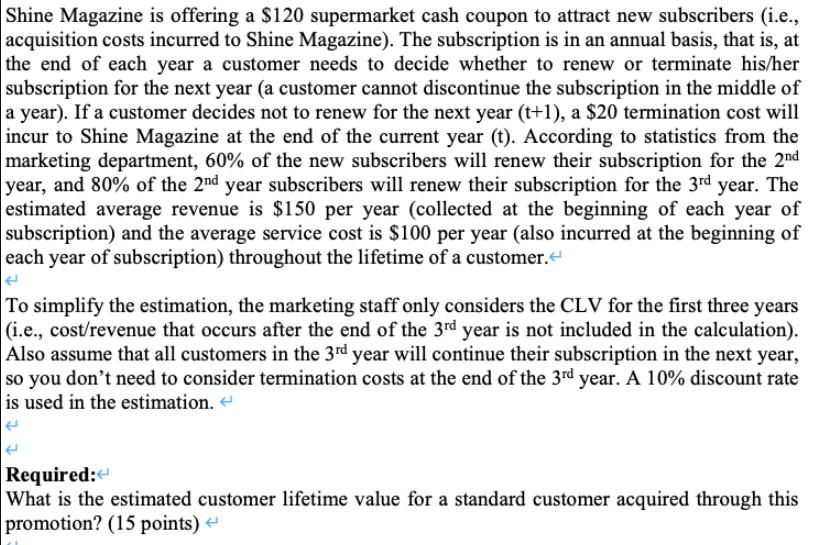

Shine Magazine is offering a $120 supermarket cash coupon to attract new subscribers (i.e., acquisition costs incurred to Shine Magazine). The subscription is in an annual basis, that is, at the end of each year a customer needs to decide whether to renew or terminate his/her subscription for the next year (a customer cannot discontinue the subscription in the middle of a year). If a customer decides not to renew for the next year (t+1), a $20 termination cost will incur to Shine Magazine at the end of the current year (t). According to statistics from the marketing department, 60% of the new subscribers will renew their subscription for the 2nd year, and 80% of the 2nd year subscribers will renew their subscription for the 3rd year. The estimated average revenue is $150 per year (collected at the beginning of each year of subscription) and the average service cost is $100 per year (also incurred at the beginning of each year of subscription) throughout the lifetime of a customer. < To simplify the estimation, the marketing staff only considers the CLV for the first three years (i.e., cost/revenue that occurs after the end of the 3rd year is not included in the calculation). Also assume that all customers in the 3rd year will continue their subscription in the next year, so you don't need to consider termination costs at the end of the 3rd year. A 10% discount rate is used in the estimation. < Required: < What is the estimated customer lifetime value for a standard customer acquired through this promotion? (15 points)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the estimated customer lifetime value CLV for a standard customer acquired through the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

6642779c251c0_980038.pdf

180 KBs PDF File

6642779c251c0_980038.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started