Answered step by step

Verified Expert Solution

Question

1 Approved Answer

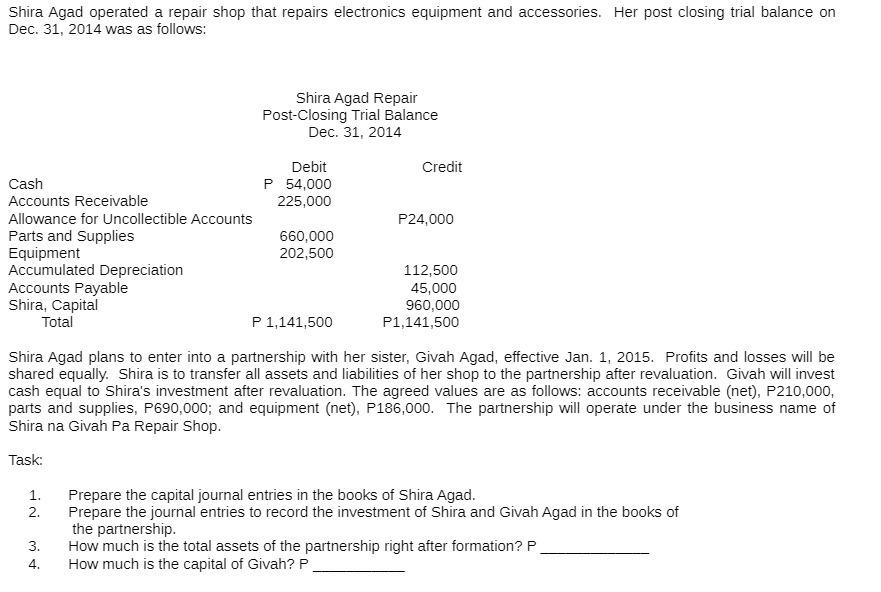

Shira Agad operated a repair shop that repairs electronics equipment and accessories. Her post closing trial balance on Dec. 31, 2014 was as follows:

Shira Agad operated a repair shop that repairs electronics equipment and accessories. Her post closing trial balance on Dec. 31, 2014 was as follows: Cash Accounts Receivable Allowance for Uncollectible Accounts Parts and Supplies Equipment Accumulated Depreciation Accounts Payable Shira, Capital Total 1. 2. Shira Agad Repair Post-Closing Trial Balance Dec. 31, 2014 3. 4. Debit P 54,000 225,000 660,000 202,500 Credit P24,000 P 1,141,500 Shira Agad plans to enter into a partnership with her sister, Givah Agad, effective Jan. 1, 2015. Profits and losses will be shared equally. Shira is to transfer all assets and liabilities of her shop to the partnership after revaluation. Givah will invest cash equal to Shira's investment after revaluation. The agreed values are as follows: accounts receivable (net), P210,000, parts and supplies, P690,000; and equipment (net), P186,000. The partnership will operate under the business name of Shira na Givah Pa Repair Shop. Task: 112,500 45,000 960,000 P1,141,500 Prepare the capital journal entries in the books of Shira Agad. Prepare the journal entries to record the investment of Shira and Givah Agad in the books of the partnership. How much is the total assets of the partnership right after formation? P How much is the capital of Givah? P

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Capital journal entries in the books of Shira Agad 1 Transfer all assets and liabilities t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started