Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Shiraz Ltd is a company that manufactures equipment used in the wine making process. Pinot Ltd is a wholesaler of wine and buys directly

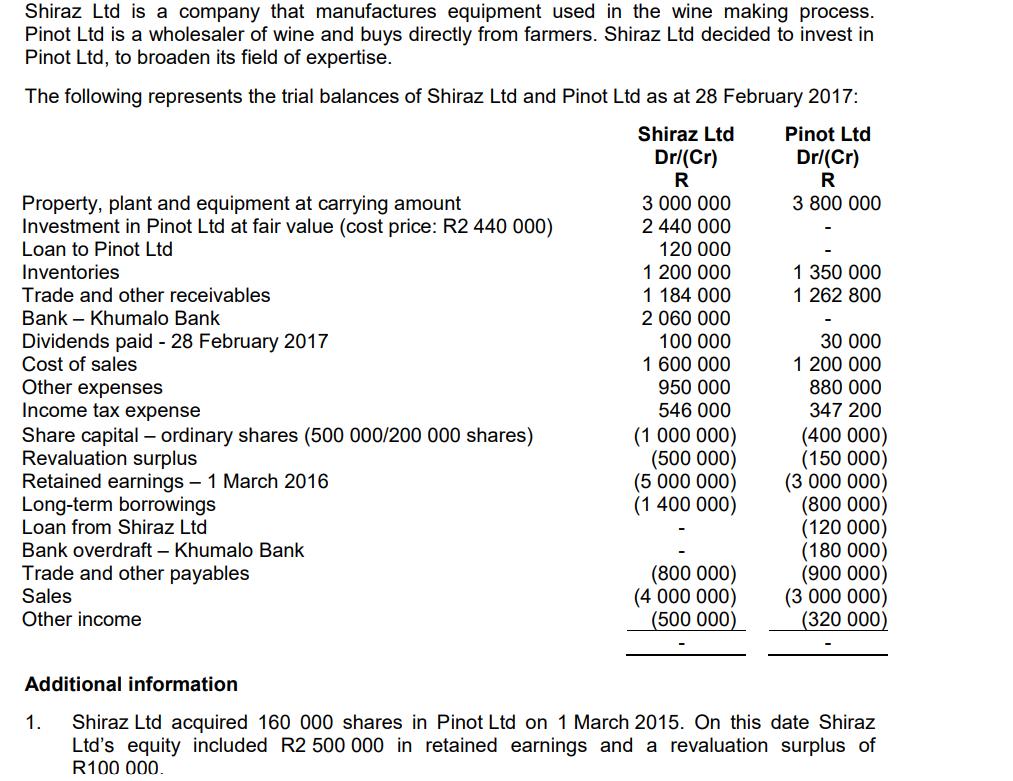

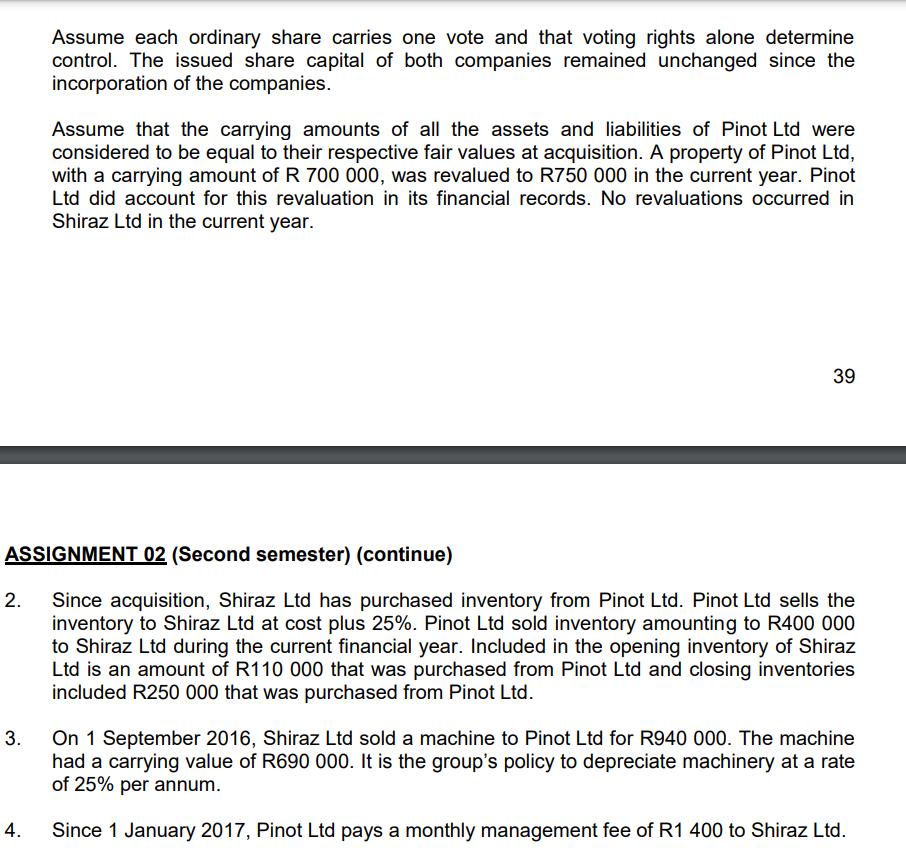

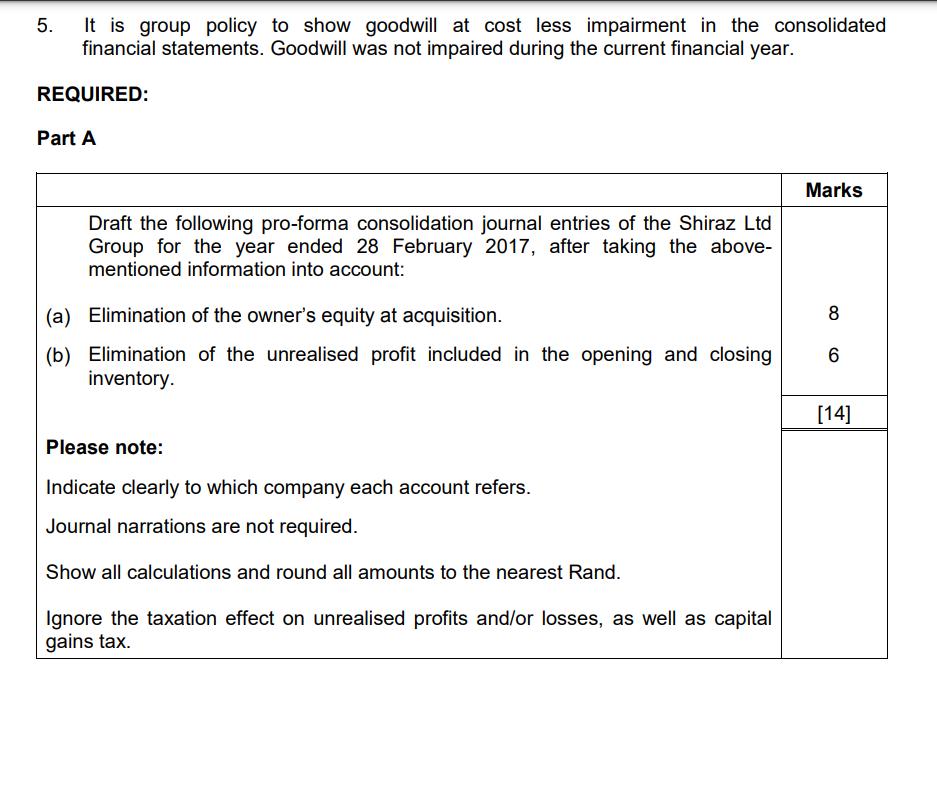

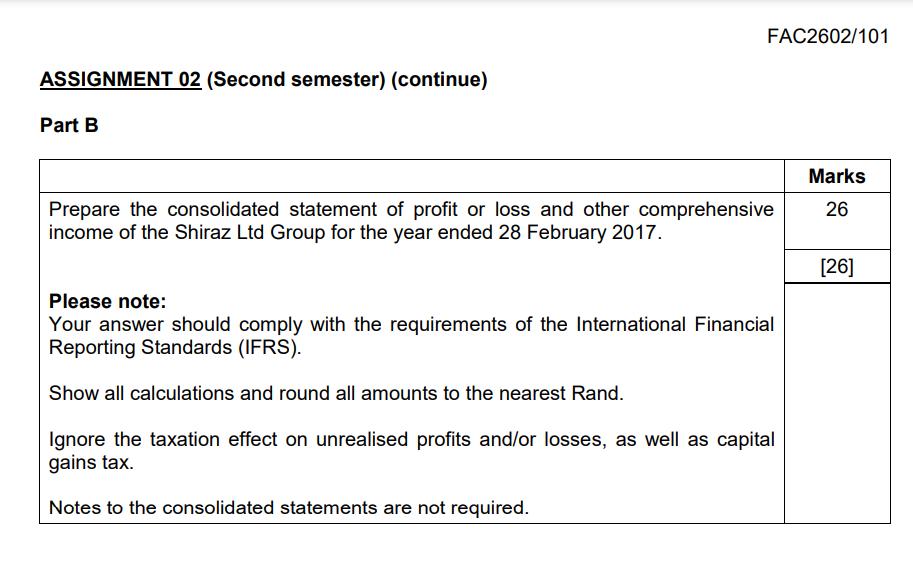

Shiraz Ltd is a company that manufactures equipment used in the wine making process. Pinot Ltd is a wholesaler of wine and buys directly from farmers. Shiraz Ltd decided to invest in Pinot Ltd, to broaden its field of expertise. The following represents the trial balances of Shiraz Ltd and Pinot Ltd as at 28 February 2017: Shiraz Ltd Dr/(Cr) R 3 000 000 2 440 000 120 000 1 200 000 1 184 000 2 060 000 100 000 1 600 000 950 000 546 000 (1 000 000) (500 000) (5 000 000) (1 400 000) Property, plant and equipment at carrying amount Investment in Pinot Ltd at fair value (cost price: R2 440 000) Loan to Pinot Ltd Inventories Trade and other receivables Bank - Khumalo Bank Dividends paid - 28 February 2017 Cost of sales Other expenses Income tax expense Share capital - ordinary shares (500 000/200 000 shares) Revaluation surplus Retained earnings - 1 March 2016 Long-term borrowings Loan from Shiraz Ltd Bank overdraft - Khumalo Bank Trade and other payables Sales Other income Additional information 1. (800 000) (4 000 000) (500 000) Pinot Ltd Dr/(Cr) R 3 800 000 1 350 000 1 262 800 30 000 1 200 000 880 000 347 200 (400 000) (150 000) (3 000 000) (800 000) (120 000) (180 000) (900 000) (3 000 000) (320 000) Shiraz Ltd acquired 160 000 shares in Pinot Ltd on 1 March 2015. On this date Shiraz Ltd's equity included R2 500 000 in retained earnings and a revaluation surplus of R100 000. 2. 3. Assume each ordinary share carries one vote and that voting rights alone determine control. The issued share capital of both companies remained unchanged since the incorporation of the companies. ASSIGNMENT 02 (Second semester) (continue) Since acquisition, Shiraz Ltd has purchased inventory from Pinot Ltd. Pinot Ltd sells the inventory to Shiraz Ltd at cost plus 25%. Pinot Ltd sold inventory amounting to R400 000 to Shiraz Ltd during the current financial year. Included in the opening inventory of Shiraz Ltd is an amount of R110 000 that was purchased from Pinot Ltd and closing inventories included R250 000 that was purchased from Pinot Ltd. 4. Assume that the carrying amounts of all the assets and liabilities of Pinot Ltd were considered to be equal to their respective fair values at acquisition. A property of Pinot Ltd, with a carrying amount of R 700 000, was revalued to R750 000 in the current year. Pinot Ltd did account for this revaluation in its financial records. No revaluations occurred in Shiraz Ltd in the current year. 39 On 1 September 2016, Shiraz Ltd sold a machine to Pinot Ltd for R940 000. The machine had a carrying value of R690 000. It is the group's policy to depreciate machinery at a rate of 25% per annum. Since 1 January 2017, Pinot Ltd pays a monthly management fee of R1 400 to Shiraz Ltd. 5. It is group policy to show goodwill at cost less impairment in the consolidated financial statements. Goodwill was not impaired during the current financial year. REQUIRED: Part A Draft the following pro-forma consolidation journal entries of the Shiraz Ltd Group for the year ended 28 February 2017, after taking the above- mentioned information into account: (a) Elimination of the owner's equity at acquisition. (b) Elimination of the unrealised profit included in the opening and closing inventory. Please note: Indicate clearly to which company each account refers. Journal narrations are not required. Show all calculations and round all amounts to the nearest Rand. Ignore the taxation effect on unrealised profits and/or losses, as well as capital gains tax. Marks 8 6 [14] ASSIGNMENT 02 (Second semester) (continue) Part B FAC2602/101 Prepare the consolidated statement of profit or loss and other comprehensive income of the Shiraz Ltd Group for the year ended 28 February 2017. Please note: Your answer should comply with the requirements of the International Financial Reporting Standards (IFRS). Show all calculations and round all amounts to the nearest Rand. Ignore the taxation effect on unrealised profits and/or losses, as well as capital gains tax. Notes to the consolidated statements are not required. Marks 26 [26]

Step by Step Solution

★★★★★

3.36 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Part a Elimination of owners equity at acquisition Debit Share Capital Pinot Ltd R400000 Debit Retained earnings Pinot Ltd R 2500000 Debit Revaluation ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started